Mark Cutifani gives Drayton mine a third ‘sheikh’

It is a truth universally acknowledged that, despite his billions, Sheikh Mohammed bin Rashid Al Maktoum’s Godolphin horse empire just can’t win the Melbourne Cup.

The Sheikh has spent a reported $1 billion on the effort. This year his best placed horse, Hartnell, came third. His Godolphin empire had another four runners in the field.

Unperturbed, the Sheikh has made it clear that he’ll be back for another, exorbitantly funded crack next year.

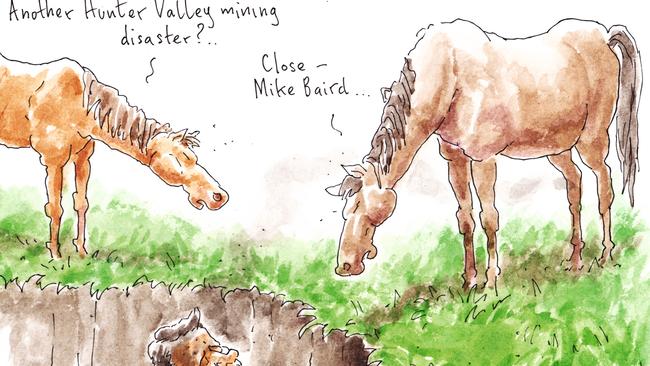

A similarly tenacious spirit is shared by the London-headquartered Anglo American. Now on its fourth attempt, Mark Cutifani’s miner is having another go at getting an approval for a three times rejected mine development at Drayton South, in the NSW Hunter Valley, just over the way from Godolphin’s Darley operations and the neighbouring thoroughbred farm Coolmore Australia.

Anglo American’s 30-year-old Drayton mine, adjacent to the Drayton South patch, shut down last week, just as the Spring Racing Carnival was beginning in Melbourne.

Thanks to a German billionaire Hans Mende, it’s possible some its 500-odd workers will end up back in the coal business. The New York-based Mende is backing Malabar Coal’s bid for Anglo American’s assets. But for Mende, “the Godfather of black coal”, to spread the soot and jobs, he will need the NSW Planning Assessment Commission to finally give approval.

NSW Premier Mike Baird might well hope that doesn’t happen.

The word around Flemington this week was that the stud owners are gearing up for a legal challenge and campaign to tell Baird, again, that the mine’s approval would risk the departure from the state of two of the world’s biggest studs.

With that gloomy backdrop, it was interesting to learn that there is a rival group in the mix for Anglo’s Hunter Valley assets.

We understand a private consortium has spoken to Coolmore and Godolphin about a plan to buy and rehabilitate Drayton with a large-scale solar farm, which would plug into the existing electricity infrastructure. They have other apparently horse-friendly plans for Drayton South.

If it could stack up, it might just be the sunny resolution Baird needs.

After the greyhound saga, the last thing he wants is another showdown with racing-mad broadcaster Alan Jones.

Horsing around

Westpac’s chairman Lindsay Maxsted is also a member of the Coolmore Australia advisory board.

It’s a handy corporate connection for the illustrious horse stud and not unhelpful for Maxsted as he looks for new opportunities to join his horse Inference, who placed third in this week’s Victoria Derby (nudging the three-year-old colt’s career prize money north of $240,000).

The Coolmore advisory position sits on Maxsted’s CV alongside his role as a director at BHP, where he’s the most likely replacement for outgoing chairman Jac “The Knife” Nasser (unless fellow director Carolyn Hewson decides she’s up for it).

Coal is one of the four “pillars” of the mining giant, as Coolmore’s unhappy neighbours Anglo American are well aware.

After a four-year stoush with the powerful studs, Maxsted’s speculated elevation to the BHP chairmanship was not the coal-horse “coexistence” they were hoping for.

Shep’s best seats

The effervescent Tony Shepherd has won the trifecta. Following a meeting of Baird’s NSW cabinet on Thursday, Shep has been appointed to the board of Racing NSW.

That makes for three plum sporting gigs. He’s already the chairman of the Sydney Cricket Ground & Sports Ground Trust and AFL upstart GWS Giants. With access to that array of tickets, no wonder he’s one of Australia’s most popular businessmen.

Also joining the Racing NSW board is Simon Tuxen from Frank Lowy’s Westfield Corporation. The pair will get about $60,000 each for their work — and a lot less heartburn than Shepherd’s previous role as chairman of the huge road delivery outfit WestConnex.

On the way out at RNSW is chairman John Messara, 69, who retires next month. A farewell party will be held at Randwick racecourse next Sunday for the long-serving Messara, who, along with RNSW CEO Peter Vlandys, leaves a tidy legacy. Together they helped to create The Championships at Randwick and secure tax parity with Victoria (forecast to deliver the industry up to $100 million a year).

The remaining RNSW vacancy is expected to be filled by the reappointment of high-profile director Tony Hodgson of Ferrier Hodgson fame.

Waislitz on the tear

Thorney Investments billionaire Alex Waislitz is expected to be on the tear at Flemington today, following in the footsteps of his brother-in-law Anthony Pratt and partner Claudine Revere, who returned to the Birdcage this week.

With an eclectic bunch of buddies that include comedian Nick Giannopoulos, Toorak plastic surgeon Chris Moss and Melbourne pub owner Carlos Sala, Waislitz will host a marquee at the epicentre of the trackside party zone adjacent to Lexus and Mumm.

Be on the lookout for Fairfax’s Domain boss Antony Catalano, who was along on Cup Day, and is one of Waislitz’s buddies and sometime co-investor.

Waislitz has been one of the most outspoken Fairfax shareholders, urging CEO

Greg Hywood to shut down the weekday print editions of the group’s metro mastheads and embrace a future as an online property classifieds business — the sort of thing The Cat could run.

Twiggy’s beef play

There are more than shiny new computers on display at Fortescue’s new remote operations centre in the Perth CBD.

#HarveyBeef is proud to present Harvey Beef Jerky made with 100% premium West Aussie beef! #GWFS #buywesteatbest pic.twitter.com/rGKeK2AUTZ

— Harvey Beef (@harveybeefwa) July 8, 2016

Prominently displayed around Fortescue HQ were boxes of Harvey Beef Jerky, what appears to be a new product line from the historic West Australian beef company bought by Fortescue founder Andrew Forrest back in 2014.

It’s been a bloody good year for Forrest: his fortune has grown by more than $4 billion as Fortescue shares surged from less than $1.50 each to more than $5.50, thanks in no small part to the hard slog of its workforce in getting its production costs down.

But the magnate, who last month collected a $120m dividend cheque from Fortescue, isn’t about to do anything silly like give the jerky away.

Instead, those Fortescue staffers keen to try Twiggy’s finest dried meat are asked to leave $6 per packet in the accompanying honesty box.

Leading by example, Fortescue yesterday announced that Forrest had topped up his stake in the miner by another 1.3 million shares, worth about $7m, or more than one million packets of his jerky.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout