Margin Call: early act sows seeds of bank discontent

MELBOURNE’S Convention Centre played host to two middle-aged men yesterday, although it’s doubtful anyone will confuse them.

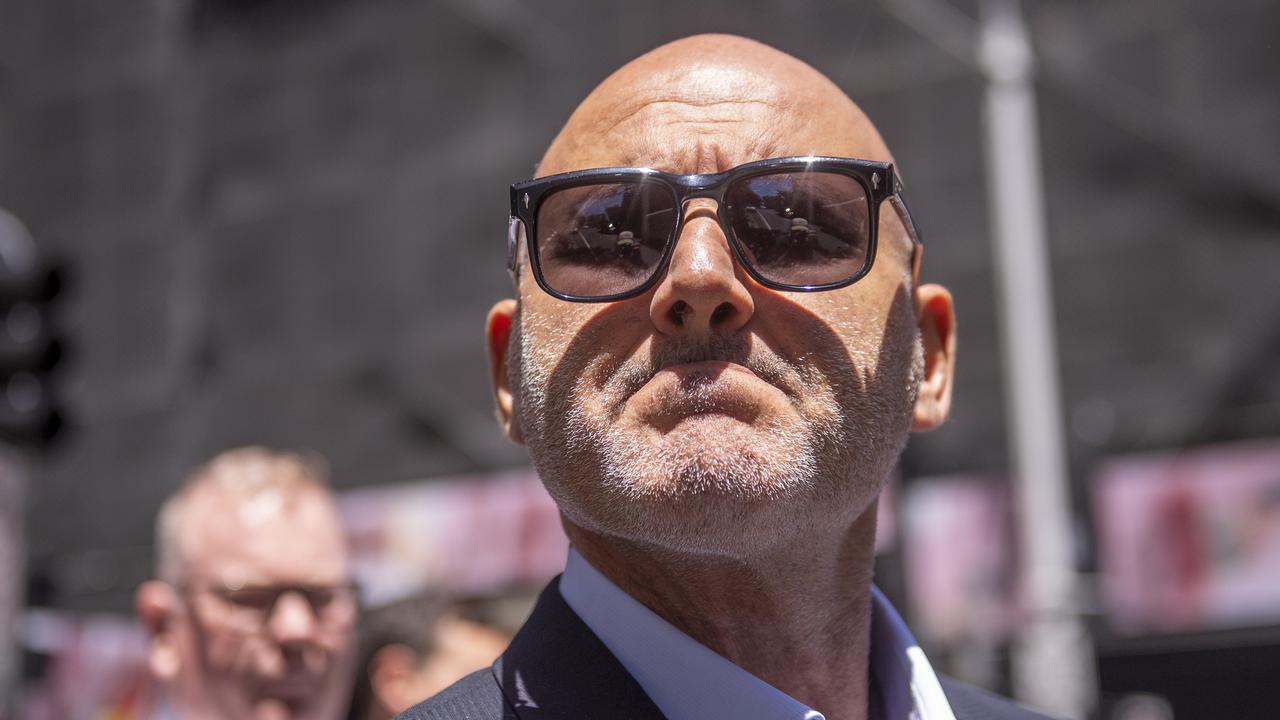

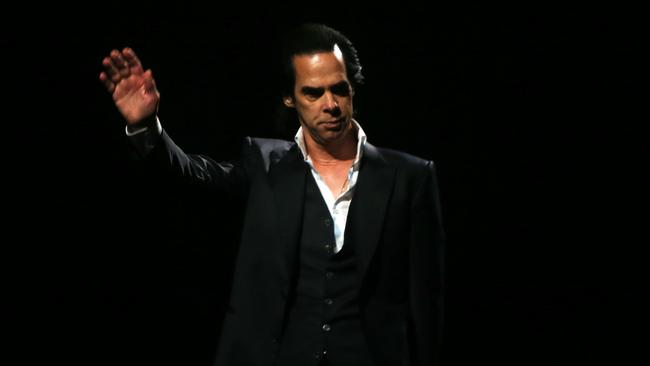

First up was the bad seed of banking, ANZ’s Mike Smith, hosting the bank’s annual shareholder get-together, followed during the night by suburban Australia’s favourite ex-punk, balding balladeer Nick Cave.

While Cave once proudly claimed his title as “Nick the Stripper”, Smith defended himself against claims ANZ has stripped bare investors in doomed forestry scheme Timbercorp who borrowed from the bank to buy their tree lots.

Investors released the bats, accusing the bank of behaving like Stagger Lee after the trees failed to produce the promised return.

And chairman David Gonski had a testy exchange with Finance Sector Union national secretary Fiona Jordan, with whom the bank is locked in a protracted dispute. A case of from her to eternity?

In her weeping song, Jordan complained of a lack of respect from the bank, which wants to cut conditions and penalty rates.

After a while Gonski looked ready for the mercy seat, but insisted the bank does too love its staff and would keep talking.

Tuning in to Nine

HOW much does Nine Entertainment chairman David Haslingden love the company? Almost three times as much as when it floated a year ago.

Haslingden has been buying shares on market since October, increasing the number he holds from about 110,000 at the date of the float to about 310,000 now.

This includes a parcel of 50,000 shares he bought on Wednesday for just over $1.85 each. Of course, Nine’s recent slide means the shares have become cheaper and cheaper since he waded into the market — he paid $2.02 for the first tranche on October 7 and 8.

Nonetheless, all up Haslingden has laid out more than $390,000 for the stake.

While institutional investors often put pressure on directors to have more “skin in the game”, Margin Call can’t find any evidence that’s the case here.

Perhaps he just really really likes hit show The Block?

PS: The October share purchase came just a few weeks before Nine admitted it was in talks to buy outdoor ad company oOh! Media. Margin Call is sure the two events are unrelated and in the end Nine passed on the opportunity anyway — which looks like a bullet dodged.

The billboard business floated on Wednesday and immediately sank below its offer price.

Bid goes to pot

DON’T forget to declare your illegal earnings as a drug dealer to the taxman. Robert Upson, a Queensland man who in 2010 was jailed for eight years after being found guilty of trafficking in cannabis, has lost his bid to stop the ATO charging him tax, penalties and interest on the money he reaped from the trade.

While the criminal court found he got $1.3 million from dealing pot, Upson told the ATO he made his money from a business retrieving golf balls.

Administrative Appeals Tribunal deputy president Philip Hack found the argument unconvincing, saying the evidence of Upson and wife Beryl was “inherently implausible and unreliable”.

Hack also wasn’t happy with the lack of explanation as to why the happy couple made cash deposits into their bank and share trading accounts, “invariably just under $10,000 and frequently on more than one occasion in a single day”.

They’ve been ordered to pay the bill.

Evoworld still busy

MORE on corporate raider Evoworld’s attack on Perth cashbox Neon Energy (Margin Call, Wednesday). Evoworld has called a meeting of shareholders for January 14, in a bid to get rid of incumbent directors in favour of its own men.

Yesterday Neon said it reckons Evoworld’s notice of meeting is defective and the meeting will be put off until later.

Oh, and it’s received a better offer from Evoworld, which might be better than an existing proposal to merge with explorer MEO.

butlerb@theaustralian.com.au