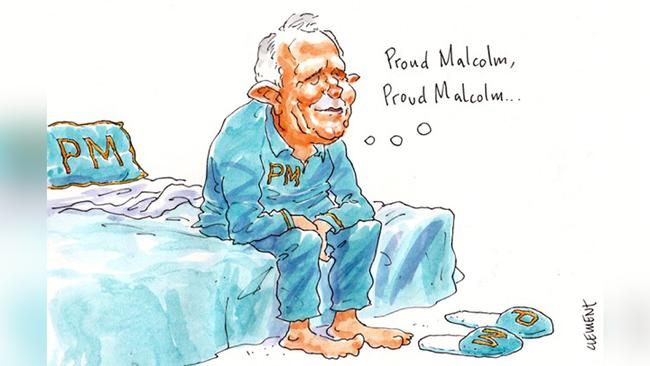

Malcolm Turnbull a prime minister by any other name

No wonder Angela Merkel and her G20 peers are having trouble remembering Australia’s prime minister.

Not only is Scott Morrison just over three months into the job, further confusing things is the prime ministerial approach his predecessor Malcolm Turnbull is taking to life as an ex-prime minister.

Have a look at our 29th prime minister yesterday. He began with an interview with Radio National breakfast host Fran Kelly, stirring up more well-earned grief for Craig Kelly.

Hours later, Turnbull’s fledgling yet industrious post-prime ministerial office had prepared a transcript of the breakfast interview, which was published on Turnbull’s shiny, rejigged personal website, malcolmturnbull.com.au.

Then Turnbull set off with his former PMO adviser Daniel Meers to 1 Bligh Street, where the commonwealth government — including the prime minister — has its Sydney CBD offices. It’s as if August was just a bad dream.

Some of Turnbull’s former Coalition colleagues will be relieved to know that’s a temporary arrangement.

He’ll be off to a new, permanent post-prime ministerial office in the Sydney CBD shortly.

Towering inferno

Not only is the new headquarters of the Peter Coleman-led oil and gas outfit Woodside Petroleum in Perth one of the most technologically advanced buildings in the country — it also doubles as a monument to the dangers of solar power.

The curved glass exterior of the 32-storey tower — which Woodside moved into a few months ago — appears to be acting as a giant magnifying glass, reflecting sunshine on to cars parked along Mount Street.

So extreme was the concentrated heat that one black BMW parked outside last month began smoking and its dashboard started to melt.

And that was before the West Australian summer began.

The building’s owner AAIG Nominees, has since brought in a team of experts to investigate the giant car-melting heat ray/commercial office.

Meanwhile Woodside, merely a tenant in the death ray, is working with the building owner, the building manager CBRE and the expert consultants to, said a spokeswoman, “understand and determine the appropriate remedy to the potential risk on Mount Street”.

Visitors, beware.

Shepherd’s flock

It’s amazing how little we know about Long-term Asset Partners, the mysterious new outfit Tony Shepherd is using to launch a $2.4 billion takeover of GrainCorp.

That makes life interesting for Graham Bradley — one of Shepherd’s predecessors as president of the Business Council of Australia — as he and his GrainCorp board consider the bid.

After their harrowing experience with American giant Archer Daniels Midland, whose $3.4bn bid was quashed by then treasurer Joe Hockey back in 2013, GrainCorp is understandably keen for the new bidder to further reveal itself.

Company paperwork shows Shepherd created Long-term Asset Partners in March 2016 with fellow founding directors Christopher Craddock (a finance guy once at Deutsche) and Andrea Staines (a logistics-focused company director).

Former Aurizon boss Lance Hockridge joined the board in June this year, two months after Margin Call spotted the foursome scurrying into a private room at Sydney power lunch spot Rockpool.

Now we know why they looked so shifty.

The quartet are equal shareholders of Long-Term Alpha One, one of two parent companies that control Long-Term Asset Partners.

How much of a stake that paperwork will deliver the four in their proposed structure for GrainCorp is as clear as one of their target’s grain silos.

The other company that owns Long-Term Asset Partners is called Long-Term Asset Partners Nominees. Shepherd is its only director.

So who is Shepherd a nominee for? That is, who is the money behind the bid?

For now, neither Shepherd nor his advisers Goldman Sachs will say.

It’s not like him to be so shy.

Time catches us all

Four weeks on from the trackside glitz and glamour at Flemington’s Melbourne Cup Carnival, here’s hoping that Victoria Racing Club chair Amanda Elliott’s debt collectors remain vigilant in their duties.

News emerged last week that one of the racing cup carnival’s major sponsors, the Kennedy Luxury Group, was in a spot of financial bother, with an arm of executive chairman James Kennedy’s outfit thrust into administration.

That’s only a month after his new wife Jaimee Belle Kennedy, 25, helped him host the watch retailer’s opulent marquee in Flemington’s Birdcage, where their guests included former foreign minister Julie Bishop and her partner David Panton.

Administrators from Ferrier Hodgson were last Thursday called in to Kennedy’s EGI Audio Visual (Retail), which until September sold Bang & Olufsen equipment.

Creditors will meet later this week.

B&O says the Kennedy vehicle owes it $6 million. Watch brand Patek Phillippe and fashion brand Kenzo have also walked away from Kennedy.

By Margin Call’s count, Kennedy, 39, who has talked of ambitions to build a luxury conglomerate from the watch shop his late father started in Sydney’s Double Bay, is a director of almost 30 corporate vehicles, with several new entities created in the weeks leading up to EGI AV (Retail) being placed into Ferrier Hodgson’s hands.

So has the Victoria Racing Club, which has partnered with Kennedy since last year in a deal that runs to mid-2023, got its dosh?

“While the terms of the agreement are commercial in confidence, VRC can confirm that all current obligations from both parties are being met,” VRC boss Neil Wilson told us yesterday.

Want to take a punt on how long that will last?