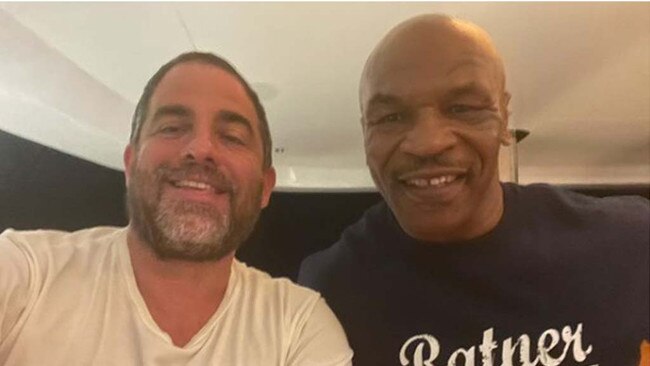

James Packer, Mike Tyson and ‘one of the greatest vacations ever’

The levels of luxury on board James Packer’s floating palace IJE are so much, even Hollywood types can’t help but brag about their visits on social media.

Maybe they are human after all.

Packer’s latest guests? None other than his on-again-off-again mate and film producer Brett Ratner — the man at the centre of a Hollywood sex-for-roles scandal — and former boxer Mike Tyson, whose latest project is an interview series called Hotboxin’ with Mike.

The two selfie enthusiasts uploaded a number of pictures to Instagram over the past week, documenting their trip — from hazmat suits at the airport, swimming with Hungarian model Livia Pillman, through to afternoon naps on the superyacht’s couches.

Packer doesn’t make a cameo in the snaps, however, only in a final post from Ratner, who writes, “the end of one of the greatest vacations ever! Thanks to #JamesPacker and the crew of the #M. Y. IJE”.

Ratner should have plenty to celebrate.

Word on the street is Ratner was a beneficiary of Packer’s generosity with Zillow shares when Packer first established a major stake into the real estate stock in 2013.

While it has been a wild ride on the market over the past eight years, Ratner’s (along with fellow Zillow investor Gretel Packer — to whom James sold his stake to help settle their father’s estate — and Caledonia’s Will Vicars) holdings are now well and truly in the green as the Nasdaq-listed shares trade at $US139.

Maybe enough for Ratner to buy his own superyacht.

Magpies in summer go-slow

There’s nothing like a deep dive into boardroom culture and policy to add to your summer reading list — at least, that looks to have been the case for Eddie McGuire’s board at Collingwood.

After the report, including allegations of systemic racism, was leaked on Monday, Mr Everywhere and chief executive Mark Anderson conceded that the findings of a review into the club’s culture had been provided to its board before breaking for the holidays in December.

That would have given high-profile directors such as billionaire investor Alex Waislitz, insolvency expert Mark Korda and entrepreneur Peter Murphy plenty of time to get to the crux of the issues over the summer.

Even Christine Holgate surely would have had a minute to ponder its recommendations between putting out fires at her former employer Australia Post and lobbying for any new chief role with Nine Entertainment or Toll Holdings.

With no skiing holidays on the cards, it is not like the directors had much else to do but sink their teeth into the 35-page report.

Still, McGuire told the media the break hadn’t been long enough for the board to consider the way forward, noting that a second meeting on the topic had been scheduled for later this week.

The board, of course, is a key point of reflection for the authors, University of Technology Sydney’s chair of Indigenous research Larissa Behrendt and professor of Indigenous policy Lindon Coombes, who put forward a “board audit” as the second most urgent recommendation to the club, behind establishing an “expert group on anti-racism”.

Within six months, each of the board members — also including Jodie Sizer and Collingwood great Paul Licuria to those named above — are to be probed to make sure, “through their behaviour and beliefs”, they reflect the club’s diversity goals and embrace anti-racism and inclusion principles”.

While McGuire described the release as a “landmark day” and “proud day”, there’s no doubt it adds another dimension to the hunt for his replacement, especially as his opponents call for him to stand down immediately, describing his post as “untenable”.

When pressed on the subject at Monday’s presser, McGuire insisted he wouldn’t step down because he wanted to see the reforms through.

“This is something I’ve been very passionate about, not just today but for the 22 years that I’ve been president of the Collingwood Football Club,” he said.

“I have no doubt whatsoever and with the support of the board and the members, to be able to do this job.”

Anderson added that the Collingwood’s long-term sponsors, Emirates and CGU, were standing by the club through the growth period.

Big wigs splash out

Cardboard box king Anthony Pratt may have got all the headlines for his political donations, but there was no shortage of corporate big wigs through the depths of the national transparency register.

At the top of the rich list, Gina Rinehart’s Hancock Prospecting dolled out $22,000 to the Liberal Party — the first donation from the miner since 2005 — while tech investor and Seek founder Paul Bassat and wife Sharon donated $20,000, too.

Theme park operator Village Roadshow and its founding Kirby family, despite fending off takeover attempts through the year, managed to donate $25,000 to ScoMo’s camp, but just under $3000 to the Labor Party.

Crown Resorts, meanwhile, donated across the board — $68,000 to Labor and $77,000 to various arms of the Liberal Party, mostly the WA division.

Josh Frydenberg’s Kooyong 200 Club, meanwhile, had its donations curbed — contributing just $43,000 to Liberal coffers for the year, compared with $265,000 in the year prior, no doubt as a result of functions being curtailed during the COVID lockdowns.

Shayne Elliott’s ANZ tipped in $110,000 to the Labor Party, eclipsing Commonwealth Bank’s $60,000 donation.

A rich CSL stay

Pascal Soriot may have only been on CSL’s board for a hot minute, but his final director’s interest notice shows it wasn’t without its perks.

The 61-year-old, also chief executive of AstraZeneca, resigned from his post last week, in a bid to avoid any future conflict of strategic interest between the two companies as the London-based pharma group acquires Alexion, a key competitor to CSL.

His final day was Monday — completing six months on the Brian McNamee-led board.

In a filing to the market, CSL said Soriot was leaving with the 1000 ordinary shares he bought at the beginning of his tenure — worth roughly $277,000 at Monday’s prices - as well as 139 share rights held as part of the director’s rights plan.

As part of CSL’s non executive director fee policy, directors must hold CSL shares equal to 100 per cent of their board base fee for the first five years of their tenure, but can sacrifice fees in exchange for share rights to vest after a nominated restricted period.

Soriot’s exit does leave a few holes in the biotech group’s board — after Christine O’Reilly’s exit in October, to free up time in her schedule for her most recent appointment to Ken MacKenzie’s board at BHP.

CSL’s board charter dictates that the board should ideally be made up of about eight to 10 directors — with the make-up currently on the lower end of the spectrum.

Succession planning will no doubt be on the brain for McNamee as Marie McDonald, also a director at Nanosonics and Nufarm, comes up to her final year on the board, too.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout