When celebrated chef Maggie Beer sold her business to the ASX-listed food group Longtable for $25m, part of the deal was a $500,000 convertible note, which has now been redeemed.

She pocketed $100,000, but advanced Longtable $400,000 to help it get through the COVID-19 pandemic.

While an unsecured generous act from Beer, it’s likely a financially astute move. It sees her earn 1.7 per cent interest on the loan, better than most banks, with deposit interest rates at record lows.

Unless extended, the loan will be repaid by next July.

The convertible note was part of the deal that saw Longtable take full control last year, buying the remaining 52 per cent of the company Beer founded with her husband Colin on their farm in the Barossa.

Beer and her family hold 6.3 million shares in the company, worth around $700,000 at its latest 11c a share price.

There is a $24.8m market capitalisation, with $8m in cash and undrawn debt facilities.

Last month, Margin Call reported that Beer had bought 1.4 million shares, costing $98,000, while shares were trading at 7c.

Beer’s been busy in the kitchen too, racking up an extra 20,000 followers in the past month to 246,000. She’s also had 1.8 million Facebook views, showing fans how to cook simple recipes with fresh ingredients from her kitchen. The latest was an enticing pumpkin and goat’s cheese tart. There will be five new Beer-branded cheese lines in Woolworths from June.

Stellar Stanley

So what next for Lawrence Ho? Margin Call reckons his attention will be on the home front.

His dad Stanley, known as the King of Gambling, turns 99 in November, around the time the world will hopefully want to party.

Maybe his mate and “brother-from-another-mother” James Packer might turn up at any Macau festivities. Not sure who’ll be the singing star of the bash, now that Mariah is not around, nor how many of the former rat pack will turn up.

Ho, the now departed Crown Resorts shareholder, of course, was there in the heyday when Packer was transfixed by the Hollywood actors Leonardo DiCaprio, Robert De Niro and Martin Scorsese when Packer was Australia’s richest person.

Retiring from his own casinos only two year ago, family patriarch Stanley Ho is rarely seen, with reports of ill-health quashed in recent times. His 17 children are no doubt making their dad comfortable amid their warring ways.

Born in the year of the rooster, 1921, Ho’s known familial links to Australia saw a property play on the Kirribilli harbour front. It was with his fourth wife, Angela Leong, the billionaire businesswoman, who developed the Kirribilli Grande with the Waterhouse bookmaking family in the mid-1990s.

Leong, who met Ho when she was his ballroom dance teacher, retains two late 1990s apartments in Pyrmont, above the Star Casino.

The family still owns Palm Meadows, the Gold Coast golf course, just a 10-minute drive from Jupiters Casino. There’s an associated company with 10 per cent stakes held by each of her children Sabrina, Mario, Alice and Arnaldo.

The family retain a waterfront Southern Cross Drive, Surfers Paradise home which cost $940,000 in 1994, with KPMG’s Aaron Street running their local affairs.

Lawrence, the son of Stanley’s second wife, Lucina Laam, never took a bolthole in Australia.

Earlier this year he reportedly spent $US65m on a condominium in 432 Park Avenue, New York’s tallest residential skyscraper.

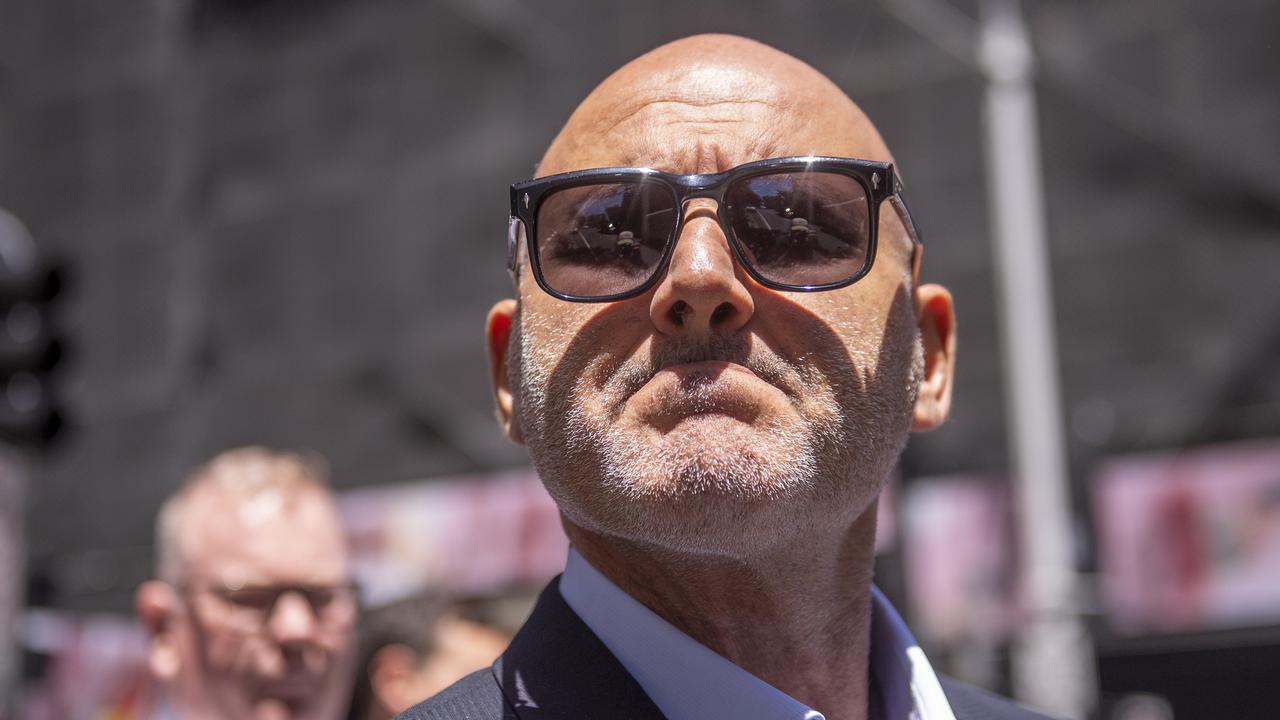

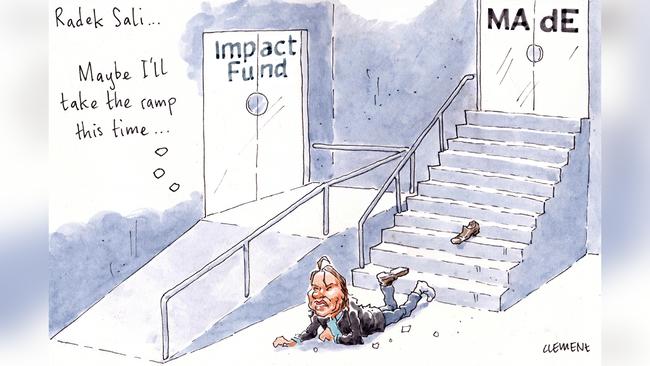

Relief for Radek

The latest note to investors in the relatively new Radek Sali-led social impact venture, The Impact Fund, which invests in social housing and disability accommodation, allows the entrepreneur a momentary sigh of relief.

The fund’s chief investment officer, former Goldman Sachs banker Matthew Tominc, writes that the fund’s performance was down only 3 per cent net over the March 2020 quarter, an impressive performance compared to the double-digit declines in other asset classes such as equities, real estate and infrastructure.

During the quarter the fund invested in two specialist disability accommodation apartment investments, acquiring a line of one-bedroom apartments scattered through new high-rise apartment buildings.

It is also doing due diligence on another opportunity in the space, which will be offered as a co-investment opportunity for investors in the fund.

“Importantly, we want to emphasise that The Impact Fund makes long-term investments and hasn’t realised any losses,” Tominc stressed.

“We think it’s important to make timely revaluations to assets to accurately reflect the world we’re living in, and communicate this to you — our investors.

“The best and most transparent superannuation funds have recently conducted a similar exercise on their portfolios. As the world improves, we expect the carrying value of these investments to increase.”

And there’s more good news for Sali in the note — the fund will be paying a quarterly distribution of 1.2 per cent to investors in the coming weeks from its cash balance, based on its policy of fully distributing cash income received during the quarter.

But then Tominc adds: “In an uncertain world, we’re still working through what this dividend looks like for next quarter.”

Sali will surely be grateful for any cash crumbs he can get, especially after his MAdE Establishment restaurant investment implosion.

Coles recruit

Coles has again gone overseas to recruit their latest key executive.

They’ve nabbed American supermarket giant Walmart’s Ben Hassing to be the chief executive of e-commerce.

It is a newly created role reporting directly to group chief executive Steven Cain.

Hassing had been at Walmart for 16 years, most recently their senior vice-president of global cross border trade. Between 2015 and 2019 he was working with Walmart in China.

“E-commerce has a very important role to play in our purpose of sustainably feeding all Australians to help them lead healthier, happier lives,” Cain told Margin Call.

Coles is hoping for a May start date at the Tooronga, Melbourne HQ for Hassing, presumably with his wife and three children likely further delayed at their San Francisco home. Cain could steer them towards bayside Melbourne, having bought in Brighton last year.

Overseas recruits in recent times include its liquor division chief executive Darren Blackhurst and its chief people officer, Kris Webb.

Winning the race

Horseracing has provided one bright spot in the sports and broadcast world. So successful has it been that word is that the James Warburton-led Seven West Media is going to simulcast its Racing.com network on its main channel from this Saturday onwards.

The move means South Australian and Victorian racing, with a bit more of a focus on the former, will get some rare main channel coverage during what would ordinarily be a big time for the footy codes.

It comes at an intriguing time for the industry, with rumour of rival Tabcorp’s Sky Thoroughbred Racing channel potentially also soon to get a free-to-air partner — likely Ten Network, maybe the Nine Network.

How that would work given Seven has the free-to-air rights for Brisbane’s upcoming winter carnival every Saturday is another matter. But it leaves open the prospect of racing on two free broadcasters, plus about four channels on pay-TV.

Racing in Australia may well be the most over-broadcast sport in the world.