Lord Gold’s digging for local class actions

Lord David Gold, dubbed the King of Litigation, could be expected to fly down to Australia from Britain now that his litigation firm has the funds to push seriously ahead with running class actions in Australia.

The London-based Balance Legal Capital has undertaken a $150m capital raising that will trigger a boost in its class actions given the Australian appetite for dispute finance.

Gold’s highest-profile disputes saw him advising the entertainment industry manager John Reid in his disputes with Sir Elton John and Michael Flatley of Riverdance fame.

Russian oligarch Roman Abramovich had Gold on his side in his dispute with Boris Berezovsky, ditto Lev Leviev in his African diamond mining dispute with Arkady Gaydamak.

Lord Gold, the former global senior partner of Herbert Smith, is BLG’s investment committee chairman.

Fraser Shepherd, the former litigation partner at Gilbert + Tobin, Sydney who has worked in New Zealand, London and Russia, is a senior adviser to the investment committee.

Set up in 2015, BLG is a founder member of the Association of Litigation Funders of Australia (ALFA), with three class actions currently under way, including one on behalf of 120 Queensland and NSW sorghum growers in the so-called shattercane class action trial.

Lord Gold, who was appointed to the House of Lords in 2011, is not likely to rush down to Australia in case he’s quarantined or to avoid the risk of infection.

His firm has advised that Balance has not been asked to, and has no intention of, funding any class actions relating to COVID-19.

The recently raised funds come from Balance’s anchor investor and seven global institutional investors, located across Britain, the US, Switzerland and Australia.

Phone call answered

The hunt for the missing BlackBerry of the late class action lawyer and funder Mark Elliott is over. Now the phone has been found by his lawyers, Arnold Bloch Leibler, it will be examined by the IT experts.

Victorian Supreme Court judge John Dixon had been told the contents of the phone could be crucial because Elliott was in the habit of deleting his computer emails.

The phone could contain crucial information for the court case Elliott was fighting before his death, in which it was alleged he and other lawyers in the Banksia Securities class action unfairly charged clients $22m in legal fees and commissions.

Elliott died last month in a vehicle accident on his farm at Flinders on Victoria’s Mornington Peninsula.

Elliott had a 76 per cent share in litigation funder Australian Funding Partners, which helped finance the Banksia debenture holders class action that reached a $64m settlement with the trustee in 2018.

Elliott had denied the allegations including backdating invoices and providing false information to a costs expert. The case will be returning for a hearing later this year.

Owners bereft

Paul Lacy, the co-founder of stationery firm kikki. K, and wife Kristina Karlsson, have advised creditors that they were “shattered” by the company’s collapse.

The pair fronted the first creditors meeting, which ended positively after just 38 minutes.

Even before advertisements were published for the sale of the business, the meeting was advised there’d been 25 expressions of interest.

Secured creditors, who are owed about $20m, appointed Barry Wight and Bruno Secatore, of Cor Cordis, as receivers and managers, while the directors appointed Jim Downey of JP Downey & Co the voluntary administrator. Cor Cordis were too busy to turn up to last week’s meeting.

There were high hopes a Chinese listed stationery business, tipped to be Shanghai M&G, would make an offer since they’d been in talks with Karlsson and Lacy, who own 40 per cent, for more than a year.

Kikki. K has $70m annual sales from a network of 65 stores in Australia, New Zealand, Singapore, Hong Kong and Britain.

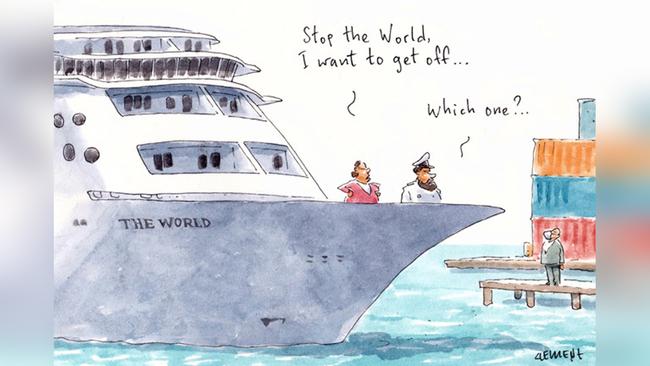

End of The World

The Noah’s ark for the filthy rich is anchored empty off Fremantle, in part because it doesn’t want to be infected by the odium surrounding cruise ships and COVID-19.

Australian billionaire Gina Rinehart, along with Gutbuster founders Richard and Heather Penn, property developer Bob and Margaret Rose, publishing matriarch Ros Packer and Rothschild chairman Trevor Rowe rank among The World’s luxury residence owners who are now unable to endlessly cruise.

Pamela Conover, chief executive of The World, informed the 165 apartment owners it would be out of service until at least June.

“The risk of contagion coming on board is present now and every day forward that the vessel remains in operation until the spread of this disease abates,” she said.

The ship had been set to sail from Fremantle to the Kimberley, then on to Italy.

“We strongly believe it is far better to voluntarily take the ship out of service now while we can still practically do so to mitigate these risks as well as the potential damage that would ensue to the reputation of the ship and The World brand globally.”

Conover noted passenger ships continue to be “at the forefront of news media as high-risk environments” for the spread of the disease and “we are seeing daily increases to the number of ports and countries around the world restricting access for passenger ships”.

Residents have been told that the ship could head down to Cape Town, South Africa. Margin Call had spotted the super-disinfected squillionaires while it was moored off Port Douglas last month, and then when it berthed on Sydney Harbour for a few days.

The ship — where the penthouse is for sale at $20m — had 140 passengers when it arrived at Fremantle from Adelaide. It has been sailing the world since 2002.

Missing middleman

The moratorium announced Sunday night by Prime Minister Scott Morrison on evictions OF residential and commercial tenants during the coronavirus pandemic overlooked an entire industry. Leasing agents didn’t get a mention when the Prime Minister announced a six-month moratorium on evicting tenants.

“Landlords and renters are encouraged to talk about short-term agreements,” the official update advised. At one point the PM sought “co-operative activity, between banks, between tenants and between landlords”, but still no leasing agents.

The president of the Real Estate Institute of Australia, Adrian Kelly, was super quick to issue a press release saying that while it was very supportive of the government’s efforts, the REIA was “disappointed with the simplistic approach” of the Prime Minister’s message.

He pointed out the PM’s message ignored “the tenancy arrangement”.

“Real estate agents are the middle persons who facilitate the agreement between landlords and tenants and manage it as well as the property.

“There are some 70,000 property managers, principals, real estate agents and representatives across Australia.

“Tenants don’t negotiate with landlords,” he snapped.

Jigsaw jokes

Prime Minister Scott Morrison has urged Australian to stay indoors and only shop for essentials, you know, like jigsaw puzzles.

Our PM advocated the pastime when announcing he wanted more of us to stay at home as public places get shut down.

When quizzed on what he meant by leaving the home only for what you need, Mr Morrison replied: “Our kids are at home now, as are most kids, and Jenny went out yesterday and bought them a whole bunch of jigsaw puzzles. I can assure you over the next few months, we’re going to consider those jigsaw puzzles absolutely essential,” the PM said.

Morrison’s heartfelt comments on his household’s simple, pre-technology predilection triggered some humorous tweets.

“This new guidance from the government that says jigsaws can only have a maximum of 2 pieces seems a bit over the top,” one tweet advised, with respondents adding that the pieces must remain 1.5m apart.

“If the jigsaw is getting married in a food court while getting its hair cut, it can have 10 pieces.”

Margin Call wonders just what the hardworking PM will grab when he returns home to the Shire for Easter.

No doubt chocolate eggs, and some free range perhaps, plus a Canberra national capital jigsaw, or even one with his face.

They are priced at $49 by the mediastorehouse website in collaboration with Australian Associated Press (AAP), but no sign of a panic buying sellout.