Liberal Party’s funding challenges

Former Victorian Liberal Party director Damien Mantach has been sentenced to five years in prison for defrauding the party of $1.5 million.

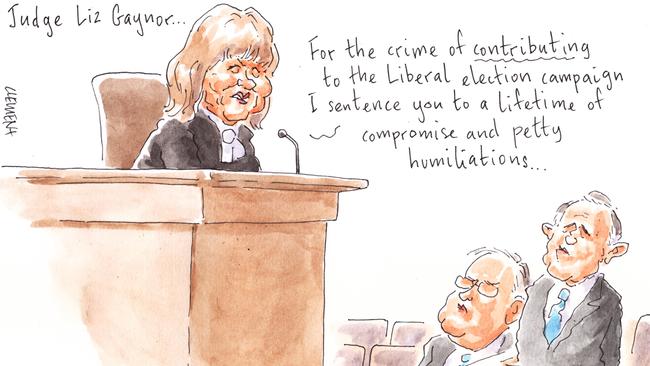

The strength of the sentence handed down by judge Liz Gaynor surprised judicial and political observers.

The sentence for Mantach, who pleaded guilty to fraud offences, includes a non-parole period of two years and eight months, so he faces at least another two years behind bars.

Not surprisingly, Mantach’s crime was not well received by Liberal donors.

It is one of a series of events in the broad church’s recent past that resulted in Malcolm Turnbull putting his hand into his well-tailored suit to fish out more than $2m to help fund the federal Coalition’s re-election.

The withholding of $4.3m in public funding to the Liberals’ NSW division because of a failure to properly disclose donations was another reason Mr Harbourside Mansion had to fund himself.

With a party machine with that series of multi-million-dollar blunders on its CV, is it any wonder that federal director Tony Nutt and pollster and strategist Mark Textor had trouble navigating a bigger win?

Frankly, with the party organisation in its current frayed condition — cash-strapped, with a piddly, shrinking and ageing membership — it’s quite an achievement they are in government at all.

A bob each way

At the very moment that the Prime Minister was unveiling his new, expansive ministry, NSW Premier Mike Baird was receiving US Vice-President Joe Biden.

Barack Obama’s well-preserved 73-year-old deputy was yesterday afternoon the star guest at a business event at Nicholas Moore’s Sydney Opera House.

Business Council of Australia chief executive Jennifer Westacott helped run the event for our American overlord.

Also in the House — presumably, like us, wondering if the wrinkle-free Biden really has had Botox — were CHAMP private equity co-chair Bill Ferris and Australia’s second-richest person Anthony Pratt ($10.35 billion and growing) who — after his disappointment with the tardy Turnbull at the Sofitel Wentworth on election night — made the most of an excellent Instagram opportunity.

The Visy billionaire’s Instagram pic with Biden makes the perfect Democratic complement to his weekend post of himself touring a recycled paper mill in Indiana with Governor Mike Pence, the running mate of would-be Republican president Donald Trump. Both bases covered then.

Spotted at Spotlight

Moving down the rich list a few notches to the rejigged corporate ranks of a couple of our most private billionaires.

Nick Palmer, the group managing director at billionaire Morry Fraid’s Spotlight Group, looks to have recently left the company’s South Melbourne headquarters. A filing with the corporate regulator reveals Palmer, who had been in the top job since 2013, stepped down as a director last Friday.

The whisper is he’s been replaced by James Garde, who filings show joined the Spotlight board on the same day.

Garde was formerly a managing director at PwC, where he focused on corporate finance, M&A and rich private clients — that is, people like Fraid. Garde had been with the accounting giant for 30 years.

Spotlight Group owns the Spotlight retail chain, the nation’s largest craft, fabric and home interior superstore. It’s also a great place to buy shoelaces.

The group also owns Anaconda, Australia’s largest outdoor adventure and sporting superstore, and has operations in New Zealand, Singapore and Malaysia.

The business empire is jointly owned by Morry Fraid and Zac Fried, the son of Morry’s late brother Ruben.

The Fraid and Fried families were valued at $1.22bn on this year’s BRWRich List. Billionaire historians record that their different surnames result from a teacher’s spelling mistake.

Sinclair’s in sync

Meanwhile over at the South Yarra offices of fellow low-key billionaire Ruffy Geminder, Kerri Lee Sinclair has emerged as a so-called “private investor’’ at Geminder’s new family office, known as Kin Group.

Kin Group was established late last year to manage Geminder’s growing suite of assets that span packaging (he’s chair of the booming Pact Group), property and education. His wealth was last put at $1.22bn.

Sinclair was only in her previous role as the CEO of data analysis group QSR International for four months before she left in February.

The former McKinsey consultant has also held senior positions at Telstra and construction and infrastructure group Aconex.

Family man McInnes

Evidently it’s a transformative experience to work for fellow Melbourne-based billionaire Solomon Lew.

Just look at family man Mark McInnes.

Long gone is the 2010 claim of sexual harassment from 25-year-old marketing staffer Kristy Fraser-Kirk, which saw McInnes resign as head of David Jones and flee the country. These days the retail mogul is all about hearth and home.

That’s according to the HR boss at Lew’s Just Group, where McInnes these days hangs his shingle as head of retail, in charge of household names including Just Jeans, Portmans and Smiggle.

News of McInnes’s uxorious existence arises in proceedings brought by Just against former CFO Nicole Peck, who has upset the Lew empire by decamping to the Cotton On group run by rival richies Nigel Austin and Ashley Hardwick.

According to an affidavit filed with the Victorian Supreme Court, where the Lew side is attempting to stymie the defection, Peck phoned Just HR boss Rosemarie Phillips in late April, worried that McInnes didn’t like her flexible hours “and the fact I leave early”.

“Just talk to him,” Phillips allegedly replied. “You need to find out what (McInnes) meant by ‘presence’. He’s family-focused.”

What a departure from the $35m lawsuit launched by KFK, in which Fraser-Kirk alleged McInnes twice made “unwelcome sexual advances” towards her, tried to kiss her and put his hand under her clothes. The case never made it to court.

Elliott’s knees-up

Some welcome news for those ANZ shareholders worried about the swarm of litigation the bank is fighting.

It seems the Kiwi running the place, Shayne Elliott, is as resilient as All Blacks legend Richie McCaw.

Just over a fortnight ago Elliott had knee surgery, which he paid for with Android Pay.

The next day, Elliott was back at ANZ’s Docklands headquarters.

The day after that, he’d thrown away the crutches — in a performance that recalled McCaw’s busted foot heroics against France in the 2011 World Cup final.

No extended convalescence for Elliott, who is understood to share the same pants size as fellow health-conscious gym junkee Greg Medcraft.

Chairman Medcraft’s corporate regulator ASIC is one of ANZ’s many current litigants, along with fellow vegetarians the Oswals and former Bell Potter broker Angus Aitken, who — despite laudable shrinking efforts — is still a few rounds of golf away from being Elliott-slim.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout