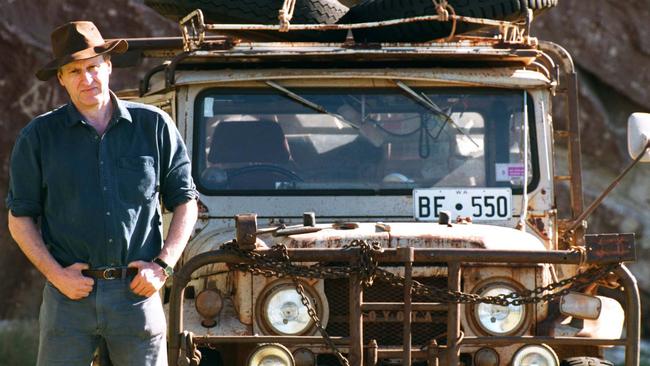

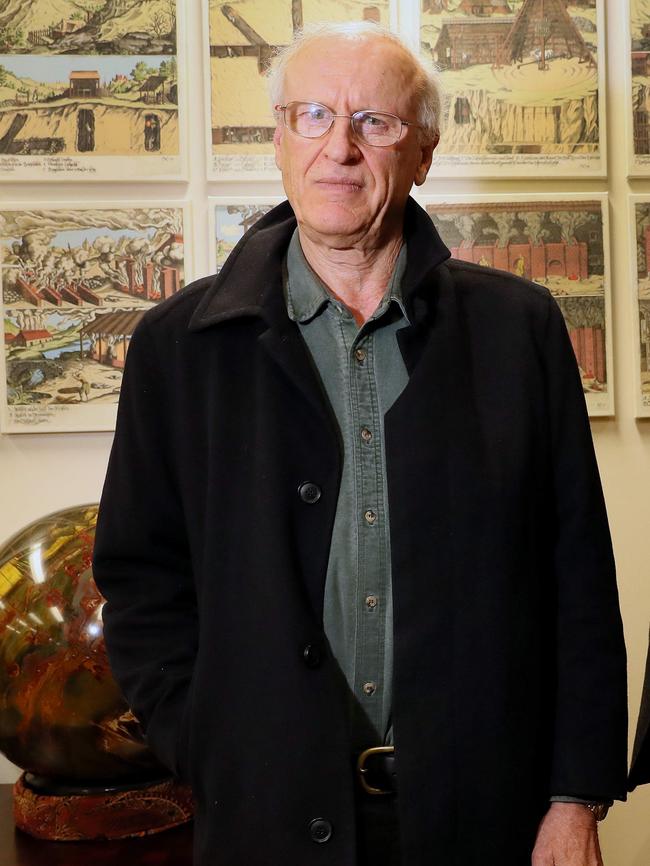

Legendary prospector Mark Creasy gets his own gold mine

Legendary prospector Mark Creasy celebrates his 80th birthday next week – and what better way to mark the occasion than to drop $140m buying himself a gold mine as a present.

That’s if he can wrest control of collapsed miner Calidus Resources from its creditors.

Creasy dropped an absolute bomb in July to buy its debt from Macquarie after the bank put the company into receivership.

Creditors will hold a vote on Friday and the expectation is that Creasy will end up owning the business, even as he faces an 11th-hour bid from Petra Capital to recapitalise the miner and pay him to go away.

But why shouldn’t he have his own mining operation?

The guy has spent a lifetime building a fortune ($1.4bn, according to The Australian’s annual rich list) out of squinting at spots in the desert and selling the treasure underneath to the highest bidder.

And while, yes, it’s fun playing finders-keepers – and retaining a stake in whatever is sold, as Creasy does, most famously with a set of gold deposits sold to Joseph “Diamond Joe” Gutnick in the 1990s – the irony is that he’s never sunk his hands into the messy business of running an actual gold project.

If we’re right about this (and we are) any deal with Calidus should mark the first time his companies have actually owned a working gold mine. Notoriously private, Creasy wouldn’t respond when we asked.

And it isn’t the only late-life change for the legendary digger.

As we reported two years ago, he and partner Annie Guo welcomed a baby, which, arriving now at the age of tantrums and bitter defiance, should make running a remote mine in the kiln of WA’s northwest seem like a refreshing vacation.

Overpriced Libs

Prices are clearly booming on the rubber-chicken circuit.

We’re at a loss to explain why, but the expense of attending a Liberal Party fundraiser is getting way out of hand.

A private dinner scheduled with John Howard for October 15 was originally priced at $10,000 a pop – that was halved two weeks later, presumably because the expense was exorbitant. The same event (on Lygon Street, Melbourne) is now being offered for 20 people, instead of 10, at a cost of $5000. Cheaper, but hardly a steal.

Dinner with Peter Dutton isn’t much more affordable. He’s down for an event in Canberra next month where tickets are selling for $10,000, or roughly double what Anthony Albanese and members of his cabinet charge. Dutton has a second event in the offing, also $10,000, to be held in Melbourne around the same time.

Are we to take this jacked-up pricing as a signal of Liberal confidence in their own polling numbers?

For an example of just how inflated this fundraising bubble has become, take a look at Liberal hopeful Tim Wilson.

He’s not even a member of parliament (anymore) yet he’s charging $10,000 “per plate” for a lunch with New Zealand’s Regulation Minister David Seymour, someone who, according to Wilson, “is coming to Melbourne to do one lunch in support of my campaign to take back Goldstein”.

Unexpected, too, that a conservative-minded Seymour, leader of the right-wing ACT Party, would be embraced so wholly by a moderate like Wilson, whose invitation says: “It will truly be a wonderful lunch with robust and enlivening discussion.”

No doubt. But for ten large?

The market for bloviating is definitely due for a correction.

Taking a stand

A low-hanging morsel from Fortescue’s continuing beef with Element Zero and its co-founders Michael Masterman, Bjorn Winther-Jensen and Bart Kolodziejczyk, all of whom stand accused of stealing intellectual property to start their rival green iron business.

A veritable library of affidavits have been lodged with the Federal Court, from both sides, but one previously-redacted number demands renewed attention.

Rat-holed inside 691 pages filed by Adrian Huber, Fortescue’s senior legal counsel, are details of a confidential investigation that had been run into Kolodziejczyk. He held the role of chief technology officer at Fortescue Future Industries from late 2019 until his resignation in October 2021, at which time “concerns” were raised over his qualifications and experience “as represented on his resume”.

That much has been reported. The short version of the story is that Fortescue alleged Kolodziejczyk – coldly referred to by the investigation as “the Subject” – misrepresented his CV and the former chief scientist, in his own affidavit, denied ever doing so.

Lesser known until now is that Fortescue was sufficiently miffed about these “numerous gaps” that it hit up recruitment firm Gerard Daniels – two years after it recommended Kolodziejczyk for the job – asking for its money back.

Gerard Daniels, it said, had “admitted in writing that they had failed to manage the reference check process properly”, resulting in a Fortescue claim for $67,000. “The employee due diligence had effectively been outsourced by FMG (Fortescue Metals) to Gerard Daniels,” the report said.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout