Not such a great investment since it’s gone up just $50,000 in the past five years, but investment banker Lorraine Tarabay, wife of Nick Langley, co-founder of the fund Rare Infrastructure, has finally sold Rocca Bella, their oceanfront Whale Beach retreat.

It was listed after the Point Piper-based couple decided not to proceed with their ambitious new weekender building plans.

They secured $6.95m for the Rayner Road estate that was long owned by the late Dame Joan Sutherland. Back in 2015 the cul-de-sac clifftop estate sold for $6.9m, five years after the death of the soprano.

Rocca Bella was relisted in 2018 with $8m hopes, then returned to the market with revised $7.5m hopes in February through LJ Hooker Palm Beach’s David Edwards.

On the peninsula’s largest oceanfront estate of 3300sq m, the three-storey house remains in a 1950s time warp with an overrun tennis court.

It had been bought by Dame Sutherland in 1977 for $167,000, but was seldom used by La Stupenda and her widower, conductor Richard Bonynge, who mostly called Montreux, Switzerland, home, along with a bolt hole in Potts Point.

There are approved $3.6m Campbell Architecture plans available for the buyer.

“The property held such enormous potential that it was somewhat overwhelming or simply ‘too much work’ for most buyers, so it waited, romantically, like Sleeping Beauty waiting to be kissed, until the perfect buyer emerged with the vision and enthusiasm to own this breathtaking land and invest in the potential,” Edwards advised.

Board renewal

Lorraine Tarabay, the incoming chair of the Museum of Contemporary Art, is overseeing the Sydney institution’s board transition given the pending departure of its longtime chair Simon Mordant.

Two of the board’s longest serving members, company director Scott Perkins and fund manager Ari Droga, have decided to pass the baton to a younger generation. Likewise, artist Patricia Piccinini, who hasdecided to depart.

Perkins, who sits on the boards of Woolworths, Brambles and Origin Energy, had been on the MCA board since 2011, as had Droga, a partner at Global Infrastructure Partners.

Their departures paved the way for Bridget Grant Pirrie and Danie Mellor, the winner of the 2009 National Aboriginal & Torres Strait Islander Art Award. Property developer Anthony Medich also joined the board. His family foundation, established by his father Roy, recently donated $1m to target the museum’s social impact through art programs.

Mordant has been its chair for the past decade.

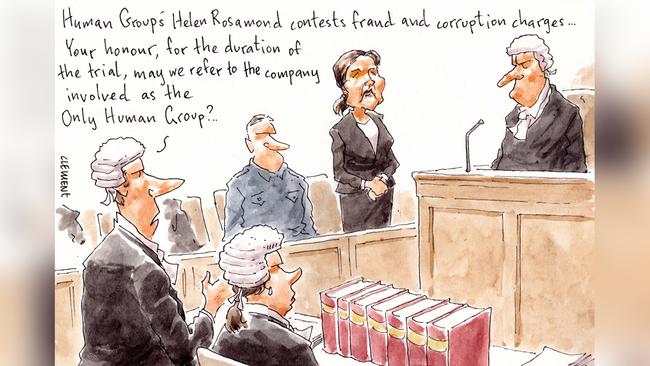

Court date set

There is now an arraignment date set for the former National Australia Bank contractor, Helen Rosamond, as she contests fraud and corruption offences.

The Lancashire-born Rosamond, who pleaded not guilty in April, will attend Sydney’s Downing Centre on July 24 before judge Dina Yehia.

Margin Call imagines her legal team, headed by Panetta Lawyers and barrister Matthew Breeze, from Garfield Barwick Chambers, are still going through three compact discs that contained 1000 telephone calls and text messages that were recently given to them by the Department of Public Prosecutions as part of their evidence brief.

Rosamond, the Edgecliff-based director of the Human Group, was allegedly behind an arrangement that saw Andrew Thorburn’s former chief of staff Rosemary Rogers allegedly receive dozens of secret commissions over several years until a whistleblower informed the bank.

Meanwhile, Rosamond’s events and human resources company faces separate legal action in the Supreme Court. At the time of her March 2019 arrest, forensic accountants valued its contracts with NAB at more than $40m over five years.

Departmental delays

Despite the diplomatic rhetoric, there appears to be a pause in our important relationship with India under the stewardship of Foreign Affairs Minister Marise Payne.

The Australia-India Council currently has five board vacancies, with just four council members on deck. That’s the minimum number for it to be validly constituted.

The Australia-India Council, which works to broaden the relationship between Australia and India, sees Neema Premji, from Premji Board Consultancy and Management Services, as its acting chair.

While COVID-19 has been an almighty distraction, excessive delays by the Foreign Affairs department making appointments will impact on deals with our significant trading partner, with two-way investment recently valued at $30bn. Far be it for Margin Call to advise minister Payne, but getting Ashok Jacob, executive chairman of Ellerston Capital, back on the board as chairman would seem a worthy first step.

He is the most eminent of Australian businessmen with Indo-Pacific links, including directorship of MRF, one of India’s largest tyre companies, based in Chennai.

He is a former director of Malayala Manorama, one of India’s largest media companies.

While he secured his MBA in 1984 from the Wharton School, University of Pennsylvania, Jacob picked up his Bachelor of Science from St Joseph’s College in Bangalore.

The former NSW premier Barry O’Farrell, was the council’s deputy, but is now our high commissioner in New Delhi.

So getting the former Victorian premier Ted Baillieu onto the council would seem worthy step.

Of course, the Foreign Affairs department dysfunction is not limited to our relationship with the world’s largest democracy. The National Foundation for Australia-China Relations has also been in recent upheaval, although Pru Bennett took the helm last month. Until recently Bennett was managing director for the Asia-Pacific region for BlackRock.

Virgin headwinds

Virgin’s Deloitte administrator Vaughan Strawbridge may have the hardest part of his job ahead of him after he made the decision to allow the Bain bid to proceed.

These pesky Virgin bondholders have elevated their demands for recompense in court proceedings, creditors meetings and with the Takeovers Panel.

No sign of retired investment banker Nicholas Moore, who has been engaged by the federal government to oversee the Virgin Australia sale transition.

But at two recent creditors meetings, including one in early July following Bain’s confirmed successful bid, the federal Attorney-General Christian Por ter had his key departmental officer Henry Carr listen in as Strawbridge chaired the meetings.

Virgin’s bondholders lost their case against Deloitte in the Federal Court on Friday, contesting the airline sale to Bain, and demanding information on the precise terms of the deal. Justice John Middleton urged the parties to communicate, leaving that up to the “good sense” of the parties.

Lobbyist success

Former NSW Labor premier Morris Iemma and his business partner, the former Camden Liberal MP Chris Patterson, have taken their lobbyist firm into the federal arena.

The political duo founded Iemma Patterson Premier Advisory (IPPA) just over a year ago when Patterson, the state government whip until March last year, quit Macquarie Street.

The two former MPs became friends during their involvement with the Campbelltown-Camden Ghosts Cricket Club.

While Iemma Patterson Premier Advisory was registered as a business just three days later, and they have now eight clients, they’ve only just formalised their first federal clients.

One was an easy pick as IPPA represents the boutique construction company Roberts Pizzarotti, where Iemma is on the advisory board. The national law firm Sparke Helmore also now sits among their client book.

The pair have former Nationals staffer Anthea Savage as the state manager.

Since departing Macquarie Street in 2008, Iemma has taken up numerous positions including at TAFE NSW, the Greyhound Industry Reform Panel and as a commissioner on the Greater Sydney Commission.