Today Show co-host Karl Stefanovic has made another shock return. He’s bought back in Queensland.

The Nine Network Sydney presenter and wife Jasmine spent $3.6m on the Sunshine Coast, their first home together. The 2009-built hillside home, overlooking Sunshine Beach, some 200m from the water, was on the market for 420 days before the couple swooped last month.

This time last year, the house, where all four bedrooms have ocean views, was for sale at $4m.

The television presenter last owned in Queensland 15 years ago, when he sold his two-bedroom home to make the move south from Paddington, the trendy Brisbane suburb, to Sydney. It sold for $371,500, having been co-owned with Cassandra Thorburn.

The expectant couple recently moved their Sydney abode to rent on Sydney Harbour.

Beer’s new shout

Beloved Barossa Valley-based celebrity chef Maggie Beer is keeping us all busy with her cooking. Her caramelised onions with Persian feta preparation was watched across the nation.

And in the meantime she has enhanced her shareholding investment in the company that owns her brand name.

While cooking up a storm in her home kitchen for her social media followers, the cooking doyenne quietly amassed further shares in ASX-listed food company Longtable.

Beer recently acquired 1.4 million shares, costing $98,000.

With shares trading at about 7c, the recent acquisition now gives her 4,895,000 shares, making her the biggest private shareholder, with 2.25 per cent of the company.

It was 2016 when Longtable, now led by Chantal Millard after the departure of Laura McBain, acquired a 48 per cent stake of Maggie Beer for $15m. Longtable took full control last year, buying the remaining 52 per cent of the company Beer founded with her husband Colin on their farm in the Barossa for a further $10m.

It all began as a shop, where the couple made wine and farmed pheasants.

Beer was quickly installed as a director at Longtable after the full acquisition.

Last month, food and drinks veteran Reg Weine, the former managing director at fruit processor SPC, was named Longtable’s chairman.

Beer’s Cooking with Maggie has 226,000 Instagram followers getting inspiration on how to cook simple meals using ingredients often sourced from the garden.

She is still appearing on our screens on The Great Australian Bake Off.

Her fellow Bake Off judge, Matt Moran, has likewise taken to social media to show his 147,000 Instagram followers how to cook his master stock poach chicken.

“It will be the first of many,” Moran said given his many venues are closed for the coronavirus shutdown.

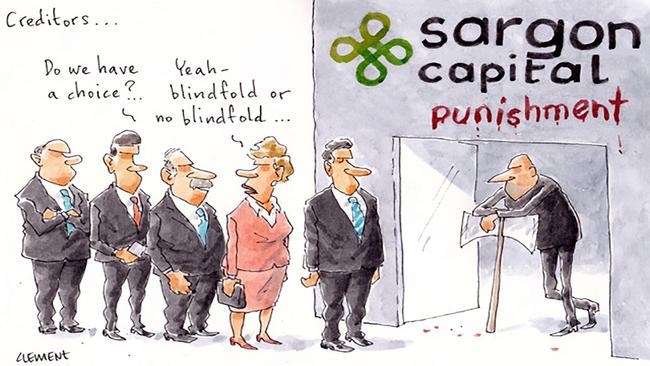

Sargon D-Day

Unsecured creditors in the collapse of Sargon Capital will be wiser on Wednesday on just how little they will be getting back.

There’s not much hope given the amount owed to secured creditors, along with a large proportion of Sargon’s assets being invested in the sharemarket.

Initial estimates by voluntary administrator Andrew McCabe of the sharemarket assets of Sargon have been downgraded in the weeks since its February collapse. And by none other than company director Stephen Conroy in an unusual scribbled notation on the document that has been lodged.

The documentation put some $134m of Sargon’s $145m net assets in the sharemarket.

But Conroy subsequently scribbled onto the formal paperwork to acknowledge the share valuations “may be optimistic”.

Wexted Advisors accountants Joseph Hayes and Andrew McCabe expect so many creditors will ring into the meeting by phone on Wednesday that they have advised of potential congestions on the phone network.

Stefan Renold, the former UBS trader who is now in Hong Kong running his LMR hedge fund, is owed $5m.

KPMG is owned $545,000, King & Wood Mallesons is owned $1.3m, Emma Needham, who runs her own corporate affairs consultancy firm, is owed $69,000 for her work for Sargon’s founder and chief executive Phillip Kingston, who is claiming $10.4m.

The main secured creditor, Taiping Trustees, is claiming $99m from Sargon and the Trimatium entities.

Former company star chairman Rob Rankin, who stepped down on January 23, is owed nothing.

Margin Call previously reported whispers that the expatriate investment banker had been looking to sell his former Woollahra abode, the 1870s colonial mansion Woodlands, which was bought with wife Paula in 2003 for $6,825,000.

Artwork a hit

A Tom Roberts painting was the top-priced item when the Goulburn manor house contents of the former Oxford Street fashion retailer Graeme Webb went to weekend online auction.

Nothing like Roberts’ iconic shearing shed, bushrangers or Sydney Harbour vista paintings.

Indeed, it was Study of a Dead Canary, a 1902 oil on board just 12.5cm x 20cm that sold for $15,000 plus 25 per cent buyers’ commission.

It had last sold at $5000 in boom time 1988, when bought by Graeme Webb and late wife Janet Alstergren.

One flawed artwork did exceptionally well.

It was the tortured 1975 “comedown” self portrait by Brett Whiteley who had destroyed the work after completion, finding it too confronting. But he then gifted it to the Webbs, who had the ink image on torn paper reassembled. It went for $11,500.

There was a $10,000 sale of a portrait of artist George Lambert’s eldest son, Maurice. Its provenance included ownership by Sir Keith Murdoch with it sold in his 1953 deceased estate Toorak house contents auction.

The Webbs’ 1850s Regency clock purchased from the pokey shop of the late Queen Street antiques dealer, Bill Bradshaw, fetched $3000, at the low end of its estimate, suggesting Regency clock devotees are few and far these days.

The Shapiro Auctioneers sale followed the sale of historic Wollogorang, the 1840s Breadalbane home.

Auctioneer Andrew Shapiro advised that there were 716 online bidders. “The sale ran smoothly, though at a much slower pace than if it were in the rooms,” he said.

“Instead of 80-100 lots an hour we were at 30-50 lots an hour as the internet was having to keep up with the incredible number of bidders. It indicated that the taste for traditional furnishings has returned via tech-savvy movers and shakers.”

Making a dent

Doomsday forecaster Harry Dent is making a pitch to Australian investors with plans to set up a fund.

“I’m announcing a unique new mutual fund only for Australians, called the Dent Strategic Sector Fund,” he told Margin Call.

It is being headed by Andrew Stewart at the Stonehouse Group with hopes for $10m initially and $1bn under management within a few years.

He says Australian investors were the most receptive to his long held outlook.

He certainly isn’t counting on our wealthiest seeking him out to look after their wealth.

“The stupidest people I talk to today are not the everyday person — it’s the richest people I talk to,” Dent said.

“Rich people have benefited the most from this bubble.

“They think they are invulnerable — don’t confuse brains with a bull market and frankly a lot of people have done that.

“The richest people are buying the most overvalued real estate, the biggest richest companies are buying their own stocks at the highest valuations in history thinking it will work out well, like the shoeshine boys did in the late 20s.

“They are the new dumb money.”

Dent reckons US stocks were in a “final orgasmic rally from late 2019”.

“Don’t confuse the virus with the real problem,” he says.

Dent always maintained that China was the biggest problem for the world, although he didn’t really see the trigger being a coronavirus.

He points out that others missed it, too.

Dent will be sharing his insights in a webinar for his Australian devotees tomorrow.

He says the world has been in a super bubble created totally by “the magicians and academic douchebags at the central banks”.

“I love the coronavirus because it’s one thing money printing can’t stop,” Dent adds.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout