Joe Hockey’s Bondi Partners joins forces with Ellerston Capital

As a nation we didn’t have much choice but to trust Joe Hockey withthe nation’s purse strings as federal treasurer for two years in Tony Abbott’s coalition government.

But will corporate Australia and our wealthiest citizens be as willing to hand over money to the former pollie and ambassador to Washington as he rolls out a new strategy for his advisory firm Bondi Partners to enter the lucrative world of funds management?

Margin Call can reveal that Hockey and his team are joining forces with long-established and successful investment manager Ellerston Capital, led by former right hand man to the billionaire Packer family Ashok Jacob.

It’s early days for the tie-up, but we hear that Hockey’s financial services executive wife Melissa Babbage, who is also Bondi Partner’s chief financial and operating officer, is playing a key role in the initiative.

The union has already been several months in the making, with the pair establishing 1941 Capital Pty Ltd at the end of April as a 50-50 venture.

Ellerston and Bondi Partners in July went on to form 1941 GP Pty Ltd, which is owned by the original 1941 vehicle.

To date Bondi Partners has acted as an advisory firm in North America and Australia, assisting clients to navigate geopolitical and economic landscapes, while Ellerston Capital, which was originally established with financial backing from James Packer, is a specialist investment manager with funds based around various investment strategies.

Hockey’s firm and Ellerston each have two representatives on the new funds management vehicles. From Bondi Partners that comprises Babbage and the firm’s Australian chief executive Anthony Lazzoppina.

From Ellerston, directors comprise exec Brian O’Sullivan and head of private investments, advisory and distribution Stuart Robertson. Plans for a public launch of the funds management alliance are believed not to be far away.

–

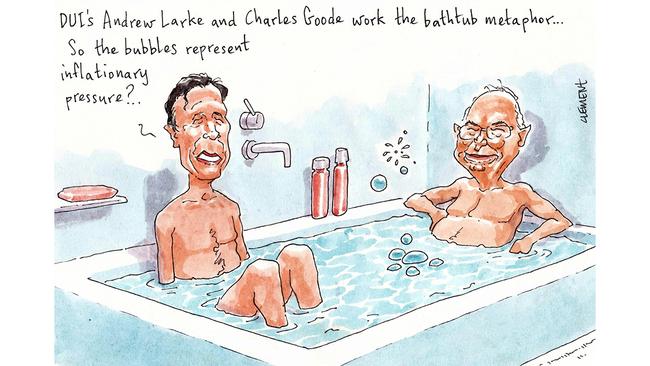

The Goode stuff

After 40-odd years in capital markets, Collins St veteran Charles Goode sure knows a thing or two about investment. And after all that hard work it seems he may just have some insights in how to take a load off too.

Shareholders in his Diversified United Investment were treated to what may just be a hint at Goode’s bathtime regimen during the group’s AGM on Thursday, with one of the more drawn-out metaphors these columnists have seen in some time.

Following a comprehensive update on the fund’s performance, the latest dividends and a short run down of DUI’s latest holdings, Goode proceeded to paint a picture of the market outlook, comparing it to a bathtub of warm water, saying “it is pleasant and the level is rising”.

How good.

If that wasn’t enough to inspire a rather odd mental picture and extending the metaphor, 83-year-old Goode further referenced “taps” such as quantitative easing and government expenditure, but also “plugs” such as left field or the partially opened international investments.

Activity on the surface of Goode’s tub included “soap cakes called public investors” and little boats sailing around called hedge funds and mergers and acquisitions.

All the sharemarket veteran seems to be missing is a rubber duck.

“Looking around the bathroom, there is really nowhere else to go so we lie comfortably and complacently in the rising warm water and we won’t mind greatly if the water overflows,” the chairman noted in summary.

“However, at some stage some of the taps will be turned off and some of the plugs will be lifted and the water will drain out … On balance, the water may cool and the level may stay steady or rise only a little.”

All that is to say the group is holding a steady course, its incumbent directors Tony Burgess (also advisory outfit Flagstaff Partners chair) and Andrew Larke (also a director of Dulux) too being re-elected without a hitch.

Where they fit in when it comes to the bath time, we’d rather not know.

–

The great divide

Forget Labor or Liberal, there’s a new political divide emerging, spearheaded by the nation’s wealthiest names asking Aussies to choose between Andrew ‘‘Twiggy’’ Forrest and his fellow WA mining magnate Gina Rinehart.

Forrest has been hard to miss in his charm offensive along the east coast, smiling alongside Queensland Premier Annastacia Palaszczuk in Gladstone on Monday before moving down the coast to have a beer with deputy PM Barnaby Joyce in Tamworth, then another green hydrogen announcement with new NSW Premier Dominic Perrottet on Wednesday.

If he wasn’t sick of the media by Thursday, it was off to the offices of Bloomberg at Barangaroo, followed by an near-hour-long address to the National Press Club beamed from the ABC’s headquarters at Ultimo.

Forget the Emerald City, he told reporters, Sydney would be the first major green city, powered by hydrogen, a plan that his Fortescue Future Industries, which counts Malcolm Turnbull as chair, would be a key stakeholder in.

Twiggy called out “hysterical politicians” and their “running cries of deception” which he said stopped the country from “getting our energy sovereignty back”.

Not one to be upstaged, billionaire Rinehart took to the pages of NewsCorp mastheads just hours earlier, warning that rushing to reduce emissions could be a strain on taxpayers and family farmers, among others.

Her views are, of course, no surprise. The Hancock Prospecting boss recently used a speech to her alma mater St Hildas to warn students of climate change propaganda, urging them to be careful of “information spread on emotional basis, or tied to money, or egos, or power-seekers”.

As the nation’s largest, and most vocal, mining identities this is hardly the first time the two have come out in opposition but perhaps one thing they can agree on at least is their mutual frustration with WA Premier Mark McGowan.

Twiggy told journalists the move to back the east coast hydrogen projects had been against his usual west coast-first strategy but described the process of getting through to his home state’s pollies as “knocking my head against a brick wall”.

And when quizzed as to how his vast fortunes amassed off the back of the rising iron ore price sat with his more recent clean and green image?

“People who don’t produce a lot of carbon might feel great about themselves, but in the global warming battle they aren’t really that interesting,” he said, adding he would give them a “slow clap”.

It was heavy industry stakeholders, like his own Fortescue, that needed to go green because they were the largest emitters, he said.

“You can give them (heavy industry) a hard time, and say they are hypocrites. But remember, global warming comes from them and a solution is with them.”

Rinehart might need some more convincing.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout