Former Seven Network chief executive Tim Worner wasn’t the only high-profile departure from Seven West Group over the past financial year.

Jeff Kennett’s consulting agreement with Kerry Stokes’ media group came to an end in April. The former Victorian premier pocketed $165,000 in its final year.

The arrangement saw Kennett perform as an on-air political commentator, independent of course of his duties as a non-executive director with Seven West Media.

He was also happy to engage in a Twitter spat with former Seven employee Amber Harrison in 2017.

Kennett joined the board in June 2015 and departed in November last year.

His consultancy income peaked at $220,000, having kicked off at $200,000 in 2015.

His annual director fees typically were $132,000.

Worner pocketed more than $3m in the 2020 financial year, which was earnt while partly on gardening leave. Worner received a $2.57m termination payment following his surprise departure last August after six years as CEO, plus fixed and other remuneration totalling $448,453, according to Seven’s 2020 annual report.

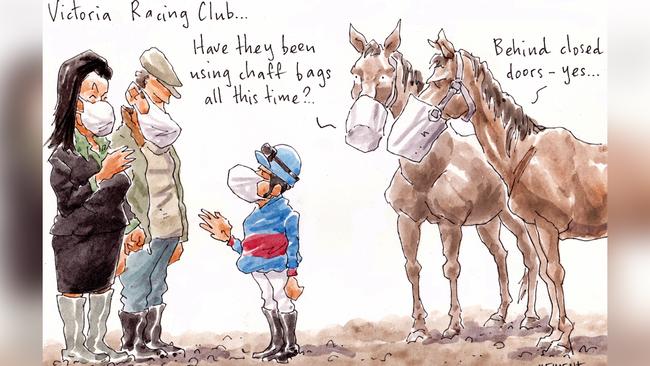

Cup hopes live on

The board at Amanda Elliott’s Victoria Racing Club is still hoping it can get up a memorable, and hopefully world-class, Melbourne Cup Carnival.

Despite suggestions to the contrary, they have their team working on an “innovative Birdcage”. And also ensuring there’s the Myer Fashions on the Field competition.

The club has been planning for a number of different scenarios, including the possibility of having reduced or no crowds for the spring carnival.

They are lucky enough to have expansive grounds at Flemington with over 127ha, Margin Call gleans, so they’ll being exploring just how to best use the space to ensure social distancing requirements come carnival time.

This year’s television, radio and digital broadcasts, along with the print and online coverage, will take on even greater significance.

They aren’t the only Victorian sporting body dealing with getting things done.

Gill McLachlan’s AFL is still tossing up where to hold the grand final on either Saturday, October 17, or the following Saturday.

Margin Call reckons the chances of Western Australia hosting the grand final are slim for several reasons, not the least being that Telstra, as a major partner of the AFL final, isn’t going to be keen to see it held at Optus Stadium.

Telstra chief Andy Penn took a dig at the stadium two years ago, saying while it was named Optus, it was powered by Telstra. He was referring in part to its 1400 Telstra connectivity points of Wi-Fi distribution.

JPMorgan floored

Some staff at JPMorgan’s Sydney office were told not to come into work on Tuesday given a whole floor needed a coronavirus-related deep clean. It was one of the 10 floors the bank occupies in the Castlereagh Street tower.

The floor told to stay at home all have a home work station with their preparation dating back to March, when JPMorgan country head Rob Bedwell decided to split the firm into smaller segregated teams.

JPMorgan, which recently secured the $121m block trade sale in poultry producer Inghams for global buyout giant TPG, has also fired up its back-up trading bunker

Broker’s $34m call

Morgans stockbroker Robert Fiani is the whispered buyer of the priciest house to sell during the pandemic across Australia. It sold for about $34m.

It came as several buyers vied for the Vaucluse home of 90-year-old Vass Electrical Industries founder Nicholas Vass and wife Marion. The Coolong Road residence sold through Christie’s International.

The Vass family paid $3.7m in 1986, when it was bought from the late hotelier Cyril Maloney. The seven-bedroom 1920s residence on 1800sq m comes with pool, jetty, slipway, boathouse and a tennis court that Vass installed.

It is set between banker Ron Malek and the Lewis property development family. The Coolong Road sale ranks as the highest house sale this year, followed by the historic Elizabeth Bay residence Berthong that the retired car dealer Laurie Sutton secured on Tuesday for $33m.

Berthong sold through Double Bay agent Alison Coopes after being listed through Christie’s agent Ken Jacobs for the Ziegler family.

Wilson’s dividend

Stock-picking dividend defender Geoff Wilson has delivered a steady dividend for investors in the listed Wilson Asset Management Capital.

WAM has paid a fully franked dividend of 7.75c a share, taking the full-year dividend to 15.5c a share. Same as for last year.

But Wilson, remembered for inciting pensioners to march in the streets over Bill Shorten’s dividend imputation policy, was challenged on delivering a profit. Indeed, WAM Capital tumbled to a $47.2m loss before tax, down from a $6m profit in the prior year, and $166m profit in FY2018. The losses were “mainly due to the decline in the investment portfolio”.

Its operating loss of $26.7m was buffered by a $20.5m income tax benefit, primarily received on franking credit dividend income from investee companies.

Bags let loose

It appears Sydney property developer Gary Baker didn’t want to be stuck with the handbags of his partner of 37 years, Karin Upton Baker. Following the couple’s recent split, many of her Hermes handbags and other items were sold off on Tuesday under his name at below estimate.

The Shapiro online auction showpiece was a bright red Hermes Birkin Crocodile bag, which had $40,000-$60,000 hopes, but secured $36,000. There was a $3000 sale of a Kelly Pochette handbag listed with $6000-$8000 hopes. Hermes boots sold underwhelmingly too at $350.

A Balenciage frock with $300 hopes fetched $120. Upton Baker is the highly successful MD of French luxury brand Hermes’ Australian operation.

Renouf portrait sells

The portrait of the late Lady Susan Renouf also sold on Tuesday through Leonard Joel as part of the collection of the late John Schaeffer, founder of the Tempo Cleaning Services company. It fetched $8000, plus buyer’s commission. It had been tipped to sell for between $4000 and $6000. There seemed to be competitive bidding between art dealer doyen Denis Savill and a Bermuda-based Kiwi property developer.

But the other Nigel Thomson painting, of Thelma Clune, which was also done in 1984, failed to find a buyer. It was one of two Clune portraits that were entered that year in the Archibald Prize.

There was one surprise auction result when a door mat for the former Schaeffer home, Rona, fetched $2600. The named coir door mat had been estimated to fetch $500. It was bundled up with a Neville Gruzman conservation report and an aerial heritage photograph of the grand mansions of Bellevue Hill including Elaine and Winston.

Margin Call presumes the buyer was most likely Richard Scheinberg, from the property and cattle family, and wife Jacqui, who bought Rona, the Victorian Rustic Gothic Revival for $58m in 2018 through Bart Doff of Laing + Simmons Double Bay and Ben Collier of The Agency. Rona was built in 1883 by G.A Morell for Edward Knox, son of Sir Edward Knox, the founder of sugar giant CSR.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout