James Packer lieutenants step off Ellerston Capital board; Sam Reinhardt steps up at Treasury

It’s been more than a decade since Ashok Jacob helmed Consolidated Press Holdings for billionaire James Packer.

But the ties that bind Packer to his long-trusted lieutenants run deep and are difficult to break, with the businessman still connected to Jacob via fund manager Ellerston Capital.

Packer’s enduring stake in Ellerston is a minority 25 per cent, with Jacob, once a confidant to Kerry Packer, leading the firm as executive chair and portfolio manager.

Until recently, Packer had two representatives on the Ellerston board, namely Sydney-based former Crown Resorts director Mike Johnston and Monaco-based Guy Jalland, both executives of Packer’s private CPH investment vehicle.

Their photos have disappeared from the Ellerston Capital website, and Margin Call understands they’ve stepped off the board. That leaves three directors to gather henceforth: Jacob, fellow portfolio manager Chris Kourtis and executive Brian O’Sullivan.

Jalland will have his hands full from here anyway as a member of the CPH investment committee that’s been tasked with figuring out how Packer should use the $3.3bn received from Blackstone’s freshly sealed takeover of Crown Resorts.

Also on that committee, alongside Jalland and Packer, is former Magellan chair Hamish Douglass and futurist entrepreneur Daniel Nadler, as revealed by Margin Call last month. Packer, we’re told, has no plans to sell his remaining stake in Ellerston, which was reduced from a 100 per cent holding in 2011.

–

Charity change

Now that the billionaire has cashed out of his Crown Resorts dream, his family’s philanthropic relationship with the gaming empire, now owned by Blackstone, is also being unwound.

For context, Crown and the Packer family announced a joint venture in 2014 to establish a decade-long commitment that would provide $200m for charitable endeavours, split evenly between them.

Unfortunately, numberless inquiries into the casino group, its affairs, and Blackstone’s buyout of Crown apparently soured the matter and, from here, the company and the Packers will go it alone on good deeds.

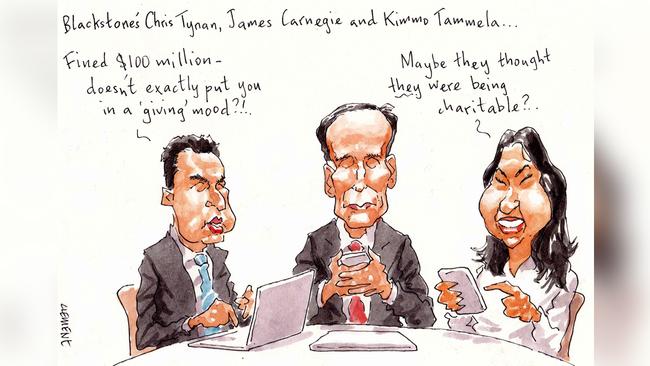

Speaking of inquiries, it may not be so easy for Blackstone’s Chris Tynan and James Carnegie to erase the memory of Crown’s former ownership and management regime, with the Victorian gaming regulator on Monday launching fresh disciplinary proceedings against the casino over its responsible service of gambling obligations.

The news could mean fresh fines of up to $100m for Crown’s new owners. Wonder if the private equiteers saw that coming?

But returning to the matter of charity and what was dubbed the National Philanthropic Fund a decade ago.

Margin Call understands that while pre-existing funding agreements will be honoured with certain organisations, there has been a noticeable freeze on fresh grants and funding allocations out of the entity since mid-last year.

Crown’s foundation is now in the hands of Blackstone executives, with Tynan and Carnegie on its board along with their Singapore-based colleague Kimmo Tammela.

The Packer family’s charitable board, which includes Gretel Packer and mother Ros Packer, along with a clutch of James Packer’s key associates, remains unchanged.

In the 2021 financial year, the family foundation, which operates domestically only, made grants amounting to almost $7m.

–

Taxation speculation

Just how much tinkering with the country’s tax system is likely to come over the coming years of the Albanese government?

Changes afoot at the Department of Treasury provide a harbinger of where the country may be heading, with the appointment of Sam Reinhardt to the position of deputy secretary, fiscal group.

Currently head of division at the Productivity Commission, Reinhardt, of Labor sympathies, is scheduled to commence in the role on July 18, succeeding Jenny Wilkinson, an architect of JobKeeper, who’s been appointed secretary of the Department of Finance. She takes up that role in August.

A memo outlining Reinhardt’s appointment listed a CV brimming with accomplishments, including her stints as a tax adviser to Julia Gillard, leading roles on the Henry Tax Review, in Treasury’s corporate and international tax division, and elsewhere at the Department of Industry.

We are reluctant to make unnecessary inductive leaps, but putting a renowned tax expert in charge of Treasury’s fiscal group suggests to us possibility of adjustments to follow. Or at least someone forward-leaning enough to make it happen.

Especially considering remarks made by Treasury secretary Dr Steven Kennedy barely two weeks ago, in which he effectively opposed further tax breaks and talked up the need for an “ongoing review” of the tax base and tax expenditures to ensure commitments can be funded.

It’s the second significant appointment at the Treasury in as many weeks, with Margin Call revealing last week that Diane Brown, a former staffer to Labor’s Stephen Conroy, will imminently take up her role as deputy secretary for markets.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout