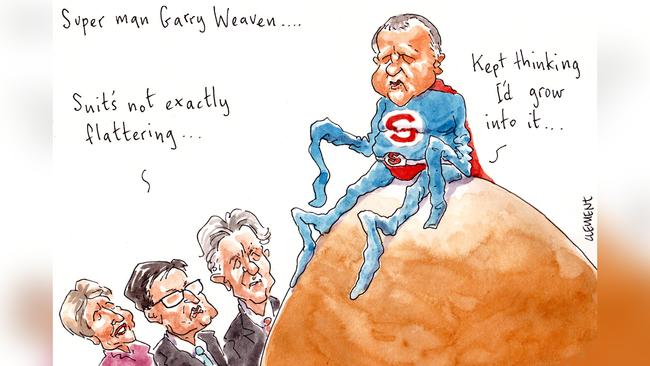

Is IFM’s Garry Weaven about to retire?

Two new directors have stealthily joined the board of chairman Garry Weaven’s $107 billion fund manager IFM.

It has some in the gossipy industry wondering: is the Godfather of Australian superannuation preparing to step down?

That would excite the industry super-obsessed members of the Liberal Party. Through Weaven’s longtime leadership of IFM (whose precursor he helped to found in 1992), the former ACTU assistant-secretary has become one of the most powerful figures in the Australian super landscape.

Margin Call’s digging through the fund’s corporate records unearthed that this month, ahead of the release yesterday of IFM’s light-on-details result, two new directors joined Weaven’s board.

The newbies are former ANZ banker Alison Larsson (now a director of Burnet Institute, a medical research outfit) and current ANZ banker Grant Dempsey (previously a vice-chairman at JPMorgan).

For now no one has stood down, which has seen the board swell to 10 people.

Alongside the former ACTU assistant-secretary Weaven (an Essendon fan and unpublished poet) is deputy chairman Greg Combet (the former Rudd-Gillard minister and before that ACTU national secretary), former Macquarie banker Murray Bleach, consultant Deborah Kiers, former BT banker Michael Migro, super director Linda Rubinstein (a long time ACTU-er), Canadian Carol Gray (once the CEO of credit report company Equifax Canada) and the now third most recent addition to the IFM board, John Denton, the chief executive of law firm Corrs Chambers Westgarth who is off to Paris to run the International Chamber of Commerce.

There was no mention of the new additions to the board in the fund’s “results”, which while outlining the growth of the fund’s money under management (up 15 per cent to $107bn) also failed to mention its investment performance over the past 12 months.

Weaven — who was yesterday unable to comment — turns 70 in November.

His fellow former ACTU comrade Combet (also the deputy chairman of the related Industry Super Australia board) is the hot tip to replace Weaven, when the time comes.

Daily spotlight

Before a new IFM godfather is anointed, the fund and its superannuation peers are going to have their fortnight staring at Kenneth Hayne’s royal commission into all things financial.

Showtime is August 6, less than three weeks away.

Margin Call hears Hayne’s peeps have made multiple inquiries about the online publication The New Daily, which is edited by former Herald Sun editor Bruce Guthrie and is entirely owned by another Garry Weaven-chaired board, Industry Super Holdings Pty Limited.

Ever since its establishment in 2013, the website has been a hate figure for those who believe the industry super giants are profligate with their members’ money.

The news website’s spruikers have countered that it’s useful for promoting financial literacy.

Sitting alongside Weaven on the New Daily’s nine-member board is the former editor of The Australian Financial Review Gerard Noonan, now the apparent chairman for life at industry fund minnow Media Super.

We’ll find out soon what, if anything, Hayne makes of the superannuation industry’s lunge into digital media.

A super holding

Really, though, The New Daily is just an industry funds trinket.

The core of Garry Weaven’s power in the $2 trillion-plus Australian superannuation sector is his chairmanship of The New Daily’s parent company, Industry Super Holdings.

Along with chairman Weaven, company records show Industry Super Holdings’ three-member board includes two of his fellow IFM board members: former BT banker Michael Migro and former ACTU comrade Linda Rubinstein.

Industry Super Holdings is also the 100 per cent shareholder of Industry Super Australia, the industry’s lobbying arm.

ISA’s chairman is former NSW Liberal leader Peter Collins and its deputy chairman is Greg Combet.

Fellow board members include Cbus chair Steve Bracks, Hostplus chief executive David Elia, the CFMEU’s national secretary Michael O’Connor (co-chair of First Super and brother of Bill Shorten’s employment spokesman Brendan O’Connor), AustralianSuper’s mustachioed CEO Ian Silk, ACTU secretary Sally McManus and, of course, Weaven.

All paths in industry super funds lead to The Godfather.

Most significantly, the Weaven-chaired Industry Super Holdings is the 100 per cent shareholder of IFM investors, the outfit that now has $107bn under management and which, according to yesterday’s “result”, has been independently valued at $869.5 million.

According to yesterday’s one-page results sheet, IFM Investors is owned by “27 major pension funds”.

Company records show these include AustralianSuper (the biggest shareholder with a 20.55 per cent holding), Cbus (second-biggest with a 17.9 per cent stake), the Motor Trades Association of Australia Super fund (with 4.6 per cent), UniSuper (with 1.7 per cent), Maritime Super (with 1.7 per cent), Tasplan Super (with 0.48 per cent) and WA Super (with a modest 0.35 per cent).

The shares of other funds are held in opaque nominee companies.

IFM’s spokesman wouldn’t answer Margin Call yesterday when we asked if it publishes an annual report (doesn’t seem to) or releases its board and executive remuneration (doesn’t look that way).

Wonder what the renumeration is for being The Godfather of industry superannuation?

Utegate clarity

Oops. In our piece on AMP director John O’Sullivan in The Weekend Australian, we left open the tiniest sliver of a suggestion that he could be seen as a “rogue” involved in inappropriate activities in relation to the so-called “Utegate” saga.

As our colleague Pamela Williams has so comprehensively demonstrated in her exposes on O’Sullivan’s involvement in the Utegate affair, not even the most partisan Labor person could now hold any reasonable belief that Mr O’Sullivan had behaved other than impeccably.

Apologies if we weren’t clear enough.