Investor, columnist Christopher Joye has narrow market escape

What a stroke of luck for Coolabah Capital boss Christopher Joye, with the NSW government this week declaring it plans use some of the $11bn proceeds from the sale of its remaining share of the WestConnex motorway to pay down its debt.

In early August, Joye was complaining to Coolabah investors that the fund’s poor returns were partly due to a punt on NSW government bonds which “continued to get beaten up as the market moved spreads wider on the back of the large debt funding surprise revealed by the NSW government following its otherwise impressive budget in June”.

By borrowing to invest in shares and other assets on the global financial markets, the state and its Treasurer Dominic Perrottet would have to fork out $200m every year in extra interest. “We plan on publicly discussing the circumstances surrounding the NSW’s funding shock in greater detail at a later date,” Joye wrote at the time in a client note for investors in his Smarter Money Fund.

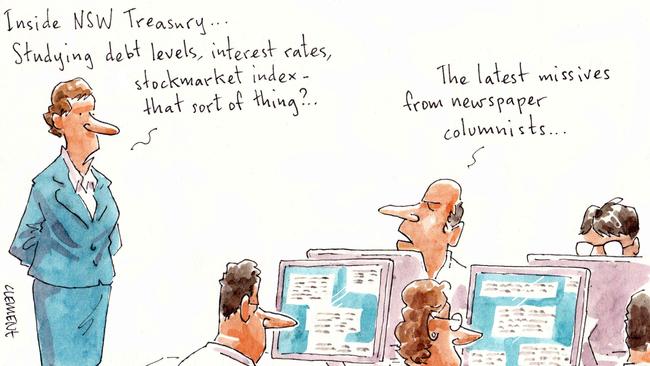

Of course, Joye is not just Coolabah’s chief investment officer. He’s also a high-profile columnist at the Australian Financial Review. And how fortuitous for him that, days after his missive to investors in June the business tabloid decided to pursue the NSW government and Perrottet over just that issue.

“Government and market sources said Mr Joye had pressured NSW to not raise the extra debt and instead use the fund to reduce debt,” the Fin’s economics editor John Kehoe reported.

Asked for a comment, Joye told Kehoe it made “no sense whatsoever for NSW to raise vast amounts of debt to fund a debt retirement fund, when NSW is running record budget deficits and issuing record volumes of debt”.

That Friday, Joye was back in the Financial Review. “The proposal to voluntarily boost NSW’s debt burden by some $20bn to $47bn to punt on stocks via a ‘pay fund managers forever fund’ is a serious … concern, specifically around potential governance dysfunctions,” he wrote. “My interest in this matter is that we lend billions to governments – including the Commonwealth and the states – companies, and banks, and require them to behave in a manner that meets our strict environment, social and governance expectations.”

Altruistic he may be, but that was unlikely to have been Joye’s only interest in the matter.

On Tuesday, Coolabah circulated its August performance results. The fund manager, which oversees more than $8.4bn, was particularly pleased Perrottet had decided to use some of the proceeds from the WestConnex buy, courtesy of Transurban chief Scott Charlton, to pay down the state’s borrowings (thus lifting the face value of the bonds).

The net returns from the August report shows Coolabah’s Smarter Money Higher Income Fund was running at -0.51 per cent over three months, -0.34 per cent on the month and -0.18 per cent over six months. One-year returns for the fund were running at 1.47 per cent, falling just under the 1.5 per cent to 3 per cent 12-month rolling target for the fund.

“NSW’s announcement had the immediate impact of crushing the interest rate spreads that NSW government bonds pay above Commonwealth government bonds, reducing its previously elevated cost of capital back towards other States,” the note reads. “This is, as a result, now powering strong returns across Coolabah’s portfolios.”

Lucky because Coolabah’s performance fee clips the ticket to the tune of a hefty 22.5 per cent of any return over RBA cash rate-plus 2 per cent.

Joye told Margin Call his interests were disclosed. You just need to read the fine print.

–

Westpac women

Westpac has been keen to spruik its achievements in the gender equity space, but by the looks of its most recent ESG update the bank has got some work to do still.

Chief Peter King on Tuesday set out the banking giant’s credentials on all things climate change, risk and diversity, noting Westpac was “taking the next step on gender equality”.

That included signing up to Hesta’s 40:40:20 Vision initiative seeking to have at least 40 per cent of either gender in executive leadership.

If current hires are any indication, there’s set to be a shake-up on the cards to reach its target by 2027, with women making up just three of 12 listed senior execs at present.

The bank’s women in leadership metric, however, continues to be its standout, sitting around 50 per cent – bang on the aspirational target set by former chief Brian Hartzer, who we note also projected a 50 per cent senior executive target by 2017.

Might have something to do with the group’s broad interpretation of leadership.

The bank notes that women in leadership refers to quite a range of positions – from CEO level to general managers, then to “senior leaders with significant influence on business outcomes”, team leaders three below general manager and even assistant bank managers.

Widening the sample size sure boosts the result.

In comparison, rival Matt Comyn at Commonwealth Bank is seeking 47 to 50 per cent above executive manager level, while Ross McEwan at NAB has its sights on 40 to 60 per cent of either gender on all levels of the business.

At least Westpac’s board looks to be headed in the right direction, with Audette Exel to replace Craig Dunn at the upcoming AGM. They’ll be sitting at 36 per cent female representation – no statistical meddling needed.

–

Racing to reopen

Like there already wasn’t a big enough state rivalry when it came to Spring Racing, the nation’s Covid vaccine rollout sure has raised the stakes.

Victorian Racing Club president Neil Wilson this week acknowledged his Premier Dan Andrews’ road map to reopening, noting with keen interest that the 80 per cent vaccination target “gives the VRC confidence to continue to plan for crowds across the 2021 Melbourne Cup Carnival”.

Never mind the fact that the state’s own modelling tips that threshold to be met three days after the Cup on November 5.

Still, we’ve told you previously they were optimistic.

Meanwhile, their Sydney compatriots at the Matthew McGrath-chaired Australian Turf Club are gearing up for 5000 punters to join the festivities trackside three weeks earlier – on the condition the state reaches 70 per cent fully vaxed.

Add that to the list of things the states can’t agree on.

INSIDE MARGIN CALL

Westpac sets its sights on Hesta’s 40:40:20 Vision

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout