Huawei Australia paid Chinese parent company over $111m in dividends in two years

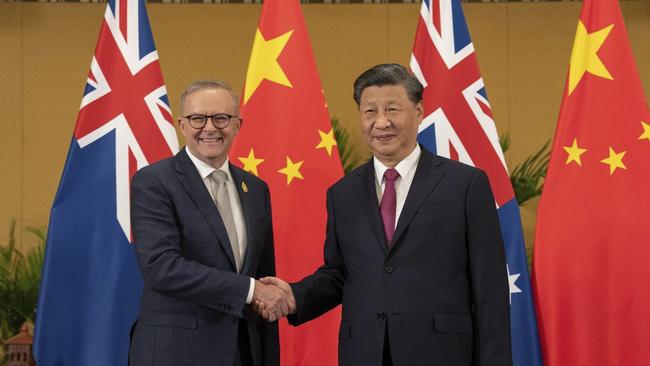

On Tuesday evening, Xi Jinping broke the deep diplomatic freeze with Australia and sat down with Anthony Albanese on the sidelines of the G20 summit.

So there is no better time than now to return to one of the original sins, the first of many apparent transgressions that led to a total breakdown of relations between Beijing and Canberra – a dispute over Chinese telco Huawei.

Malcolm Turnbull, then the prime minister, put a kybosh on the company’s dream of playing a roll in the local 5G rollout in 2018.

The company’s recently filed financial accounts show Huawei appears to be a spectacular basket case – at least locally. No wonder the telco turned (unsuccessfully) to one-time Senate powerbroker Nick Xenophon in recent years in an effort to turn around its fortunes.

Huawei, which once counted former foreign minister Alexander Downer and businessmen Lance Hockridge and John Lord as local directors, made a net profit of just $5.1m in the last year – down from a party $9.7m one year before that, they show.

There is one group – apart from the lobbyists – that has seemingly done quite well from Huawei’s local operations. Its Chinese parent, which has managed to extract a whopping $111m in dividends from the company in just two years. The accounts show Huawei Australia paid it $67.7m in dividends last year, on top of $43.2m one year earlier.

The local company’s newly arrived chief executive, Yan Fan, faces a daunting task turning around the slide in fortune. According to the financials, revenues last year stood at $148.6m, down from $355.9m in 2020.

Port in a storm

One China-backed deal local authorities did allow through – to serious disquiet – was the 99-year, $506m lease for Darwin Port granted in 2015 to Chinese company Landbridge by the Northern Territory government.

For what it is worth, Landbridge’s local operations are adamant its Shandong-based parent company has “no input” into the daily operations of the terminal.

The Prime Minister however, has asked for a review of the lease amid concerns about the foreign ownership of the key northern infrastructure, which along with welcoming cruise ships and handling all sorts of cargo also provides berthage for the Australian Navy.

Like Huawei, a former parliamentarian – former trade minister Andrew Robb – made a motza working for Landbridge shortly after he left politics.

But unlike Huawei, there are no dividends being paid back home. In fact, Landbridge relied on a statement of financial support from its Chinese parent in order for the local operation to trade as a “going concern”.

According to corporate accounts for the financial year to June 30 – lodged just in time for Albanese’s meeting with Xi – Landbridge’s long-term borrowings have now topped $672m. Goldman Sachs syndicated out $250m of that, which matures in 2029, while the rest came from Landbridge’s Chinese parent and which is due for repayment in January 2026.

But the group last year brought in only about $54.3m in revenue before recording a net loss of $8.4m, which, we might add, was from a $55.6m loss the year before.

The show is allowed to go on, only because its Chinese parent has promised to prop the port up if it runs out of money. “The parent company Shandong Landbridge Group has provided a letter of support that it will provide sufficient financial assistance to the Group as and when it is needed,” the accounts reveal.

“On this basis, the directors believe the group will meet its debts and commitments for at least 12 months from signing the director’s report and, accordingly, have prepared the financial report on a going concern basis.”

Verdia unravels

Once a beneficiary of ample media coverage, energy services firm Verdia was revealed on Tuesday to have been placed into administration, leaving uncertainty over the positions of several dozen investors.

It turns out a few of these shareholders include a few notable characters. The company touts ex-Wallabies captain and Magellan director John Eales as an investor via his Ruck and Maul Super Pty Ltd outfit, although the sums involved amount to $61,813.

Fund manager Catherine Allfrey owned nearly 3 per cent of the company along with her husband, Nigel, through their Caana Pty Ltd vehicle, amounting to $450,134. Allfrey’s day job is to serve as the principal and portfolio manager of WaveStone Capital, which has more than $5bn under management.

A bit of star power on the share register, too, with former NBA basketballer Josh Childress owning just under 4 per cent of Verdia. We suspect he became involved while playing for the Sydney Kings in the 2014-15 season (when the company was founded).

Another investor of note is Jon Nicholson, a former senior VP at Boston Consulting who now holds directorships at Insurance Australia Group and Cape York Partnership. He owns about $300,000 worth of shares in Verdia.

The company is said to have encountered difficulties owing to project delays that were caused by the pandemic. For a while the company received favourable plugs in the mainstream press, namely within wider articles concerning rooftop solar uptake by outfits like Stockland and Coca-Cola Amatil.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout