Honey Birdette founder Eloise Monaghan making waves in Playboy territory

Australian retail billionaire Brett Blundy’s loss appears to be Playboy’s gain, with the founder of his just-sold Honey Birdette lingerie and sex toy shop, Eloise Monaghan, set to relocate from Sydney to Los Angeles to take up a key role with the iconic Hugh Hefner-founded global media and lifestyle empire.

Monaco-based Blundy, estimated to be worth $1.94bn, this week sold Honey Birdette to the PLBY Group for about $443m. Margin Call has learned the deal, which is subject to Foreign Investment Review Board approval, will be settled 71 per cent in cash and 29 per cent in PLBY’s Nasdaq-listed stock.

That’s going to net Blundy, 61, who controls listed brands including Lovisa and Adairs, about $195m in cash for his almost 62 per cent Honey Birdette stake, along with about $80m in the PLBY stock.

PLBY, which floated via a SPAC earlier this year, has a market value of $US1.5bn – recently pumped up by positive trading momentum thanks to Reddit.

Company founder Monaghan, who is in LA this week for the life-changing deal’s announcement, will net $47.2m in cash and about $20m in PLBY stock from the sale of the company she co-founded in 2006 and which Blundy had the foresight to buy into five years later.

Monaghan, 45, will continue to run Honey Birdette, but will also take on what PLBY Group boss Ben Kohn has described as a key role with PLBY.

“I’ve been enormously impressed by Eloise,” Kohn said of the Aussie businesswoman, who is set to open new Honey Birdette stores in Dallas, Miami and Pennsylvania’s Scottsdale later this year.

As deal negotiations have unfolded, recent weeks have seen Sydneysider Monaghan also in New York and Las Vegas.

The relocation will be something of an upheaval for Monaghan and her wife Natalie Monaghan, who mid-last year forked out just over $3m for a penthouse apartment in inner city Surry Hills.

The home is in Natalie’s name and is mortgaged to ANZ.

Still, if new boss Kohn’s gushing about his new recruit and her brand – he calls her a “creative force” – are any guide, the international relocation will be worth it. “We share the same ethos on pleasure in people’s lives,” Kohn said.

Must be a match made in heaven.

–

Diplomatic deflection

There were no signs of jitters as ING Australia chief Melanie Evans made her first appearance before Tim Wilson’s House of Reps economics committee on Thursday, and with plenty of nearby opinions to tap, is it any wonder?

Evans, who was poached to lead the Dutch bank after climbing the ranks of Westpac and for a time worked as chief of staff to then-chief Brian Hartzer, had plenty to say when it came to the bank’s growth and local customer satisfaction scores, but it was her unique position as both the head of a challenger bank and a four pillar alum that had the committee most captivated.

Just why, quizzed Labor MP Andrew Leigh, was ING’s loan approval time only a fragment of its larger competitor? And its culture, as asked by Liberal MP Celia Hammond, so different?

Far from throwing her former employer under the bus, Evans was quite the diplomat: “Let me talk about ING – that is what I am here to talk about,” she quipped back.

Deflecting another pointed question she noted that the committee “would have to ask the leadership of the banks you refer to why they aren’t moving as quickly as the rest of us. We certainly are hungry for business”.

A fair show of political nous, and one we can only imagine sets household discussions alight with husband and Liberal senator Andrew Bragg.

Both are well entrenched in the banking sector, Bragg the chairman of the Senate financial services committee and a fierce campaigner for superannuation reform, which culminated in him publishing the page-turner “Bad Egg: How to Fix Super” only last year.

Beaming into the committee from the couple’s locked-down lounge room in Paddington, Bragg is not the only banking brain in the area, however, especially when that big four probing gets too much too bear.

Westpac chief Peter King is a neighbour on the street and has so far notched up two appearances before the very same committee.

We’ll leave it to the bank watchers to speculate just who fared best.

–

Helping hand

As we tick over into a new financial year and concerns percolate about housing affordability and the so-called bubble, here’s some interesting grist for the mill.

If you are the offspring of a former Australian Liberal prime minister, home ownership looks to be just that little bit easier.

Remember a few years back when our then PM Malcolm Turnbull suggested parents should “shell out” to help their children get onto the property ladder?

Millionaire Turnbull and his wife Lucy had done just that for their secondary school teacher daughter Daisy Turnbull Brown, who has seperated from her estranged husband Space Industry Association of Australia head James Brown.

The former first lady bought a cottage in Sydney’s Paddington for $3.05m in mid-2007, but then at the end of 2013 a half-share in the slice of eastern suburbs real estate was transferred to the Turnbull’s daughter, “partly for monetary consideration and partly by way of gift”. What a leg up.

And now look what we’ve turned up.

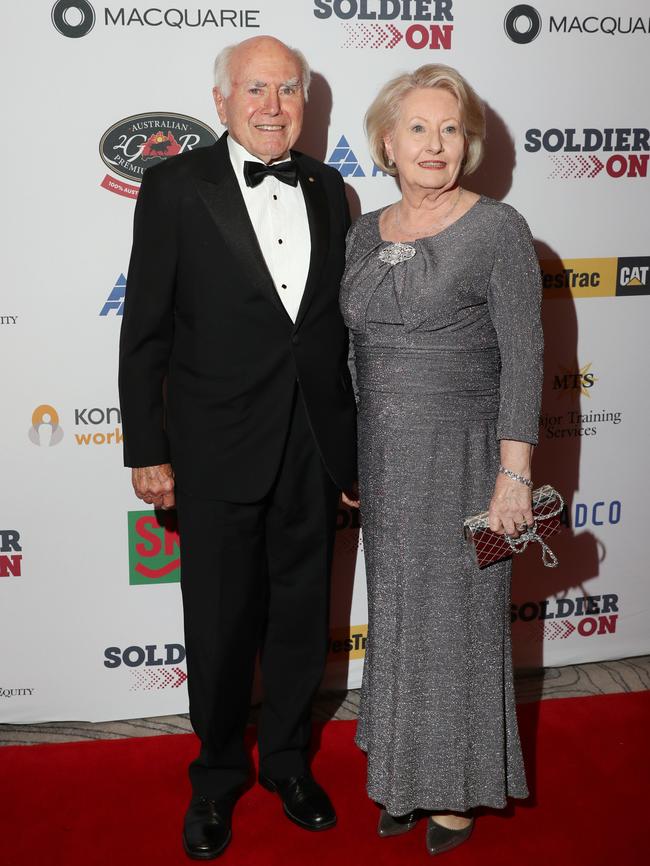

Turnbull’s one-time colleague and fellow former PM John Howard looks to have helped at least one of his kids onto the property ladder – his capital markets operative son Richard Howard and his American-born corporate lawyer wife Ellen Howard.

The young Howards returned to Oz several years ago with the PM’s offspring now running his own shop Howard Capital Management in Sydney.

Amid the pandemic late last year Ellen and Richard Howard paid $2.8m for an expansive home in Sydney’s far northwest.

The home, which is mortgaged to Macquarie is held 70 per cent in Ellen Howard’s name and 30 per cent in John Howard’s name.

If only the rest of us could hand-pick our parents.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout