High stakes for Toni Korsanos as Scientific Games mulls ASX listing

She was the only one to emerge unscathed from Patricia Bergin’s damning inquiry into the James Packer-controlled Crown Resorts, and now it seems Toni Korsanos has a new ASX hurdle to jump, and more than $48m riding on the outcome.

Talk around town is that Nasdaq-listed pokie maker Scientific Games is testing the market for a local listing, which would hand the well-credentialed Korsanos her third local board seat.

That would be alongside gigs at the aforementioned Crown as well as Treasury Wines, with space in Korsanos’s schedule cleared after she stepped back from Roger Sharp’sboard at Webjet earlier this year.

But despite all the publicity around her role on Helen Coonan’sCrown board, Korsanos’s position as executive vice-chair at Sci Games is wildly more lucrative, thanks in large part to a generous promotion by Caledonia’s Will Vicars just last October.

In the very same month that Korsanos was grilled for her part in the Crown debacle, she was also negotiating a bumper new employment contract with Vicars and his partner Mike Messara after they led a consortium to stump up $1bn for a stake in the Las Vegas-based gaming outfit.

The 51-year-old secured a $65,000-a-month consultancy fee (that’s $776,000 for the year), as well as a bonus equity award of 662,933 stock options granted last September.

At their last closing price, that equates to almost $US37m ($48m) worth of stock if all the options vest, though details around exercise prices and other conditions are scant.

In addition, she has more than 30,000 options granted near the beginning of her employment with Sci Games in 2019, when she was drafted in by former boss at AristocratJamie Odell, now the US group’s executive chairman.

Those options have an exercise price of $17.26, which would give her a $US1.14m profit based on current trading levels, as long as she meets certain performance hurdles.

Initially her services were solely based around the US company’s supply-chain project, but over the past two years her duties have ratcheted up significantly — with financial incentives to match.

Her most recent consulting agreement lists the Burwood, Sydney-based director as “adviser to the company’s president and chief executive officer” providing expertise on matters of corporate and business strategy, mergers and acquisitions, divestitures and supporting recruitment activities for senior roles.

No doubt mulling a potential listing on the ASX falls into that category, too.

At the time of the agreement, the parties noted that “it is their expectation that the level of the services will increase substantially following the Caledonia Purchase, commensurate with the increased compensation provided for under this agreement”.

Judging by their generosity, there’s certainly some large expectations.

The bonus is the same handed to Odell in a similar agreement, no doubt a sign the new major shareholders are expecting big things from the power duo who shot Aristocrat to the top ranks of the ASX.

For what it is worth, both former Aristocrat execs still hold stock in the local gaming outfit, Sci Games’ major competitor, though under the terms of their employment agreements are both restricted from increasing their ownership interest without express permission from the company’s president, Barry Cottle.

Same goes for Korsanos’s stake in 10,000 Crown shares (worth a mere $121,000), which Sci Games deems as no violation of restrictive covenants, as long as she doesn’t go out of her way to purchase more outside of those received in connection with her director role.

Which begs the question, if the US company thought it necessary to disclose Korsanos’s interests in Crown, both formerly as a mere consultant then more recently as a director, why is it that the local casino operator hasn’t followed suit?

A statement from a Crown spokesman said Korsanos had been appointed in her board role at Sci Games after its most recent annual report had been printed, adding that she had advised Crown’s people, remuneration and nomination committee (which she now chairs) of her intention to take the role.

The committee “considered the matter of independence and conflict of interest and put in place a procedure to ensure any actual or perceived conflicts of interest were managed”, the spokesman added.

All that hassle and just a $260,000 annual pay cheque from Crown, you would have to be wondering whether it is even worth her time.

-

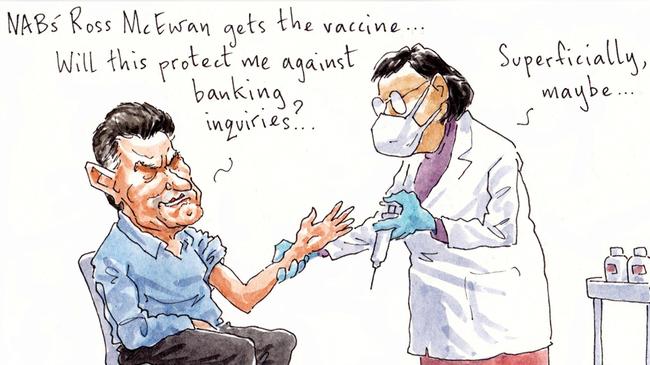

A jab for NAB chief

National Australia Bank boss Ross McEwan had more things on his mind on Thursday than just his institution’s bumper $3.3bn cash profit.

The community-minded 63-year-old Kiwi-born bank boss revealed he was doing his bit to fight the global coronavirus pandemic, having booked in to have his vaccine jab later this month.

McEwan, who relocated from London to take the top NAB job, is now based in Melbourne, having purchased a $3.8m penthouse apartment in Toorak in February last year — with the assistance of a mortgage from the Phil Chronican-chaired NAB.

When it comes to the virus, McEwan is also thinking big picture, last month at his appearance before a parliamentary committee indicating that his bank could help with the national coronavirus vaccine rollout by giving jabs at its corporate offices, just like it does for flu shots.

McEwan says he had the idea, which could affect NAB’s 35,000-strong workforce, when he was getting his own flu shot at the start of April.

Meanwhile, McEwan endures as an early shareholder in the quickly growing Brick Lane Brewing Company, which is based out of the Melbourne suburb of Dandenong.

The group, whose shareholders include Melbourne businessman David Evans, rugby league great Billy Slater, AFL player agent Craig Kelly and sports marketer and New Zealand Rugby director Bart Campbell, has in recent months executed a restructure of its share capital and capital raising.

Brick Lane how has paid-up capital that is close to $25m.

McEwan is one of the brewer’s largest single investors and has emerged with a stake of just less than 5 per cent in the group.

-

AMA’s pile-up

No strangers to a wreck, smash repairer AMA Group on Thursday filed a statement of claim against its former chief Andrew Hopkins, alleging breaches of his contract and director’s duties.

And just like a car crash, it’s hard to look away.

Details of the McGrathNicol independent investigation claim Hopkins purchased not just one but three luxury vehicles for his immediate family using the company’s funds, and kitted each of them out with matching personalised plates.

For his wife Rachel, a $150,000 Land Rover Discovery with plates 1RH, for his son Edward a $69,000 Land Rover Defender with 1EH, and for his daughter Florence a $36,000 Range Rover Evoque with … you guessed, plates 1FH.

On that logic you’d expect Hopkins to have given himself the 1AH, but sadly for us there’s no detail on his own ride.

Elsewhere in the report, however, is more than $21,000 billed to the company for painting payments completed on the Hopkins’ personal residence and winery “Swings and Roundabouts” in Yallingup, Western Australia.

In total, the microcap, now led by Carl Bizon, is out to recover just over $2.4m from its former chief — not an insignificant sum given its market cap sits at about $363m — though the company says it “continues to investigate the matter and may make additional claims in due course”.

Quite the pile-up indeed.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout