Harold Mitchell’s Tennis Australia loss has no bearing on Crown: Defence

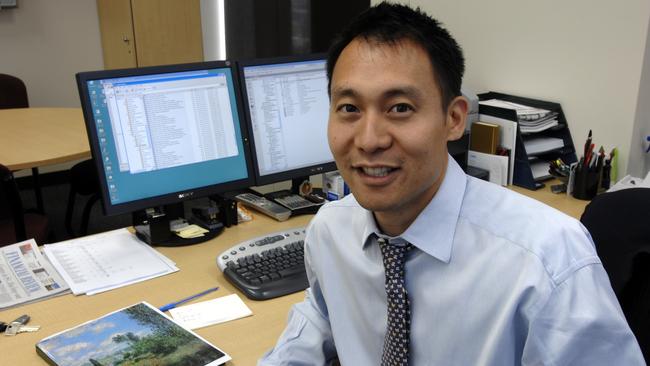

A sweet 50 per cent jump in bottom-line earnings from Sherman Ma’s financial services group Liberty Financial last financial year sets the scene for the group’s unfolding $1.8bn float.

Accounts just lodged with the corporate regulator for the 12 months to June 30 reveal that Liberty, which has just changed its name from Minerva Technologies in preparation for its IPO, made a net profit of $134.7m in the year, from $89m previously.

But, ahead of the start of the group’s Credit Suisse-led roadshow towards a mid-December listing, Liberty had said it was unable to forecast the financial impact of COVID-19 on the group’s 2020-21 operations.

“Given the high degree of estimation uncertainty, management cannot reasonably assess or quantify the potential short or longer-term financial impact (of COVID-19) on the company or the group,” the 46-page accounts, which are signed by Ma and audited by KPMG, reveal.

Credit Suisse research released after the accounts points to an expected adjusted net profit of $165.6m.

Collin Street, Melbourne-based Liberty is said to be seeking $360m from investors, with a bookbuild scheduled for the middle of next week. Company founder Ma, 48, is an executive director of the group, but lives in Las Vegas.

The float is said to be priced at 11 times earnings, somewhere in the ballpark of $1.8bn.

The accounts show the jump in last year’s profit was thanks to reduced finance expenses in the year flowing from lower interest costs. Directors, who are led by Palm Beach, Sydney-based former investment banker chairman Richard Longes, did not declare a dividend in the year.

Wrapping up

The appearances of Crown Resorts’ directors before Patricia Bergin’sinquiry could perhaps best be summed up as colourful.

Better then to leave the final arguments to their respective legal teams (of which there are many) to make their last-ditch efforts to preserve any semblance of their clients’ reputations.

Wrapping up on Thursday, Neil Young QC for Crown made his way through each appearance by the group’s directors before the inquiry, detailing just why they remained suitable associates of the licensee.

Of Andrew Demetriou’sshambolic performance and denial of his use of notes, Young proffered the tough circumstances in a then-locked-down Melbourne, while Jane Halton’s longwinded answers were at least “careful and considered”.

Then he got to adman Harold Mitchell, whose appearance, you may recall, included the revelation that he had shared weight-loss tips with James Packer.

A brief adjournment was made to consider the latest submission from Mitchell’s own counsel Matthew Collins QC before returning on the question of whether an adverse finding in his recent case against ASIC had any bearing on Crown’s suitability to hold the casino licence.

The Tennis Australia case, for which Mitchell was fined $90,000 for breaching his director’s duties, is a familiar one for Young — he had previously acted in Mitchell’s opposition for TA’s former president, Stephen Healy.

This time there was quite the change of tune.

Young noted that Mitchell had been on the Crown board at the time of the TA incidents, including when he forwarded sensitive emails to Seven Network boss Bruce McWilliam (whose lawyer wife Nicky McWilliam sits on the ILGA board), but that such conduct had nothing to do with Mitchell’s role at the casino group.

“Mitchell was motivated by belief he was acting in the interests of Tennis Australia … those matters do not reflect Mitchell’s character, honesty and integrity,” Young told Bergin.

Going on, he added that Federal Court judge Jonathan Beach had rejected any order of disqualification on the basis that Mitchell had done what he was told when ordered to stop intervening.

So basically it was Young telling Bergin that Mitchell’s role in the TA broadcast rights debacle shouldn’t affect how his place on the Crown board might influence Bergin’s decision on suitability.

Whether Bergin buys that argument on Mitchell, we’ll have to wait and see.

Electric dreams

Mineral Resources boss Chris Ellison has found at least one way to spend some of the money from the sale of his heli-skiing station in New Zealand’s Queenstown that he and co-owner and fellow rich lister Tim Roberts put on the market this week for $47m.

Ellison won the plaudits of shareholders at MinRes’s Thursday annual meeting for the company’s record $1bn profit, which was partly fuelled by the exquisitely timed sale of its Wodgina lithium mine to Albemarle for $1.2bn last year.

But at least one naughty shareholder found the time to take the MinRes founder up on a broken promise, reminding the industry heavy hitter he’d told the previous year’s meeting he’d reflect the company’s interest in the lithium business in his own (four-car) garage, and buy an electric vehicle.

Ellison, famed as a tough customer in an industry not known for its shrinking violets, was forced into a sheepish admission that he just hadn’t got round to it yet, despite a bit of additional pressure on the subject from the home front.

“I did say last year that I should be driving an electric vehicle, and I’ll be heavily criticised when I get home because I’ve been encouraged to get one and I just haven’t had time to get one with all the stuff we’re doing,” he admitted.

“And that’s a poor excuse because we’ve actually got a lot done this year, but I just haven’t bought an electric vehicle.”

“But when I’m standing here next year, I commit that I will have one. Or two.”

With MinRes shares closing at $28.40 on Thursday, Ellison’s 11.75 per cent stake in the company is worth about $620m. So here’s a tip for the WA hard man: after an October price cut, a top of the range Tesla Model S Plaid, with all the fruit, will only set him back a lazy $225,000.

Half of the Queenstown property proceeds would be enough to buy 104 of them, and he could probably use the time he’d otherwise have spent skiing to nip down to the dealership and pick a couple up.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout