Greensill suffers another court rebuff

The Bundaberg-born billionaire Lex Greensill has again lost in the Federal Court in his battle with the Tax Commissioner over a tax bill on about $60m in capital gains levied by the ATO.

The founder of the controversial supply chain financing company Greensill Capital believes he should be exempt under the Income Tax Assessment Act given he is a UK resident and Greensill Capital is based in London.

But the 2010 family trust was set up in Australia by the former Queenslander.

Briefed by the Ernst & Young legal team, Greensill’s barrister Mark Robertson QC filed an interlocutory application three days after he lost his initial appeal. They claimed the court had “overlooked material matters and points”.

But Justice Tom Thawley ruled the interlocutory application was “misconceived”.

“The applicant’s remedy lies in appeal, not in seeking to re-argue the matter after entry of orders dismissing its case,” Thawley ruled.

With his home at Saughall, in the UK’s northwest, Greensill hasn’t been able to make it back to Australia for his regular one month-stint every autumn.

This time last year he spent $4m on The Glass House, a trophy home in Bargara, as his antipodean base.

Lex and wife Vicky were also keen last year to purchase around 1000 acres on the outskirts of their English village with plans to create forests, orchards and wildflower meadows and introduce some rare breeds of livestock.

But the deal has not gone ahead after the vendor decided not to relinquish the acreage.

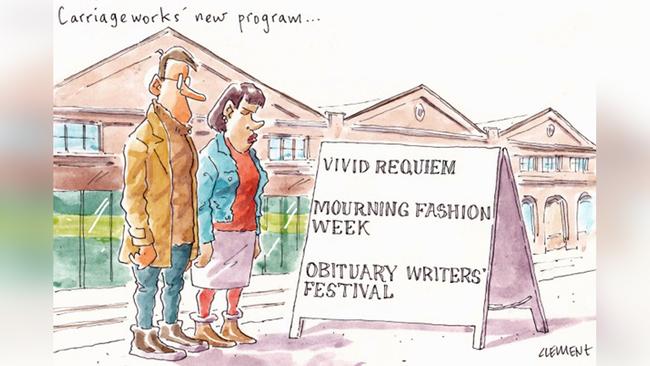

Art hub doomed

The arts world has been devastated that Sydney cultural institution Carriageworks may not survive the unfolding global health crisis, having been placed into voluntary administration.

But the art hub’s board — led by investment banker and Prime Media director Cass O’Connor, whose career has included stints with Mark Carnegie and John Wylie’s old shop Carnegie Wylie and Malcolm Turnbull’s Turnbull and Partners — saw the writing on the wall well before this week. KPMG’s entree into the Redfern arts institution came via corporate law firm Arnold Bloch Leibler, with the call made to KPMG special adviser and corporate failure veteran Stephen Parbery several weeks ago that Carriageworks was in dire straits.

With money running out, in the fortnight leading up to KPMG’s appointment this week, Parbery and colleague Phil Quinlan dialled into five teleconference meetings with the Carriageworks executive and board, which also includes pokies heir and philanthropist Geoff Ainsworth and Herbert Smith Freehills partner Michael Gonski, who is the son of ANZ chair David Gonski.

By Monday, the path was clear and Carriageworks was declared a corporate failure.

The first video conferencing meeting of the undertakers with its creditors, which include the Matt Comyn-led CommBank holding security over Carriageworks’ assets, will be held on May 15.

No handyman

Maybe the recently departed NSW arts minister Don Harwin only had to bang a nail in the wall and hang a painting at his Pearl Beach investment rental for him to have avoided his departure from the mess that is Gladys Berejiklian’s NSW cabinet.

The NSW deputy premier John Barilaro reputedly did not breach coronavirus lockdown rules last weekend by travelling to his Oallen hobby farm, Dungowan, because he did some maintenance tasks. That included building a cubby house, something that Harwin didn’t need.

Harwin instead saw the halving of his ministerial salary to a backbencher’s $170,000, and the imperative to now offload his Elizabeth Bay apartment which comes with $1.2m plus hopes for its May 26 auction through LJ Hooker agent David Malouf.

Being in the upper house meant there was no prospect of a nuisance state by-election were Harwin to resign and reside permanently at what had been an Airbnb.

But Berejiklian simply can’t risk her premiership with any lower house Coalition member resigning for a personal folly. Especially since ICAC have yet to report back on MP John Sidoti’s inquiry. The sidelined Sidoti has been under investigation by the state’s corruption watchdog for nearly seven months after a series of Daily Telegraph articles.

Meanwhile, Barilaro’s empty 94ha farm on the Corang River, bought for $2,015,000 in 2014, is on Airbnb websites at $1500 a night.

Many Sydneysiders, who now reckon they’ve been mugs having complied with the stay at home, stay away from the regions messages, will be tempted to mimic the muppets on Macquarie Street and escape lockdown by heading to their empty rental weekenders.

Maintenance tasks to do, of course.

McBain chips in

With the conservative side of politics doing their best to combust, Anthony Albanese’s faithful are working to hold Mike Kelly’s NSW seat, Eden Monaro.

The ugly, egocentric mess that’s played out between the NSW Nationals deputy John Barilaro and the flip-flopping Transport Minister Andrew Constance over who will contest the seat has put Bega Valley mayor Kristy McBain in the box seat for the upcoming federal by-election.

While a date for the vote is yet to be announced, as well as any detail on how a ballot in these strange times would be conducted, ALP federal members are throwing money into the local coffers to run a thorough campaign.

ACT Senator Katy Gallagher, who is chairing the new Senate select committee examining the government response to COVID-19, has chipped personal funds into the local branch to help the seat stay Labor.

Unpaid levy

The legal battle consuming a Point Piper company title apartment block has escalated with co-owner lawyer, Greg Golding, at risk of being evicted.

It comes after Golding allegedly declined to pay a special levy to repair the dilapidated apartment block, Wentworth Place.

Golding, a partner at law firm Ashurst, and his wife Deborah, have an unpaid $150,000 bill.

The company went into nominal administration last October after contested winding up proceedings. Grant Thornton administrators issued special levy notices in November to undertake urgent repairs. Golding argues the levy was not validly imposed.

Wentworth Place Pty Ltd is also made up of former judge Stephen O’Ryan QC and his wife Jane, along with Melanie Freyberg. The O’Ryans have paid their $77,000 levy, and Freyberg $48,000, reflecting their stakes in the company.

The Goldings own two ground floor apartments in the block of four, in a conversion of a not so grand Georgian mansion on 1000 sqm. They own 54 per cent of Wentworth Place with his name appearing on records since the late 1990s.

Hot property

A clutch of Melbourne investment bankers will be hawkishly watching the seaside property listing at Anglesea on Victoria’s west coast amid the COVID-19-pandemic.

The energy infrastructure executive Jeff Harding wants to offload the almost half-acre holding that he’s controlled for several decades. Set in a prime oceanfront position on Point Roadknight’s prestigious Melba Parade, there are two attached homes on the holding which is expected to sell for up to $6m. It would set a new record for the low-key town.

Harding, who is on the board of Infrastructure Capital Group alongside the likes of Mike Fitzpatrick, is a former boss of renewable energy operator and developer Pacific Hydro.

The property has been owned by Harding since 1999 following its matrimonial transfer.

The property is diagonally opposite the local watering hole, the Rusty Anchor, run by the Anglesea Motor Yacht club, which heaves over summer.

The former Macquarie banker and one-time Packer operative Peter Yates, who has a contemporary home just up the road, is often spied gripping a stubby holder in his boardies at the bar. Ditto Flagstaff Partners chair Tony Burgess, who has a holiday pile nearby.

Morgan Stanley’s investment banking boss Julian Peck also owns on Melba Parade.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout