Grant Thornton bills big at Greensill as GFG makes another promise to pay its overdue bills

Three years on from the spectacular collapse of Lex Greensill’s financial empire and grinding through the entrepreneur’s complex financial web has turned into big business for insolvency firm Grant Thornton, which has so far billed creditors for more than $70m worth of work.

Grant Thornton released its latest administrator’s update on the collapsed Greensill Group to the British Companies House registry over the weekend, showing the process of unwinding the financiers web of transactions has somewhat stalled.

One thing that hasn’t changed, though: Sanjeev Gupta still owes a packet of money.

Greensill’s primary business was offering supply chain financing, for anyone who missed the ugly saga as it broke in 2020 – sitting between a creditor and their suppliers, paying suppliers early and allowing buyers to extend their credit terms. In Greensill’s case it also involved bundling up the resulting debts into bonds through Credit Suisse.

The entire mess collapsed when Greensill’s insurers woke up and realised they were at risk of wearing the entire bill if the wheels fell off elsewhere.

About $US17.7bn worth of goods and other trade assets were caught up with Greensill’s business at March 2021, and Grant Thornton administrators say they have unwound about $US9.3bn three years on – although not much seems to have happened in the last six months, the report says.

A fair few Australian jobs still hang on some of those transactions, though, given Gupta’s GFG Alliance owed Greensill about $US590m at the time of its collapse.

GFG still owes that money, according to Grant Thornton’s latest report, after multiple agreements to pay collapsed over the last few years. GFG first did a deal to replay the cash in November 2022 – or signed a non-binding term sheet, at least. Another non-binding agreement was made in June 2023, which also appears to have lapsed.

But fear not! Another deadline may have come and gone, but on March 15 GFG signed another non-binding term sheet.

Grant Thornton, at least, retains hope.

“The transaction as envisaged under the latest non-binding terms sheet would encompass all amounts due to Greensill Capital UK and if implemented, would result in a below par recovery to GCUK funded by both lump sum and bullet payments,” the report says.

That deal may also have a few problems, given GFG’s Whyalla blast furnace had a whoopsie during its latest major maintenance campaign and has been out of action for much of the last month, courtesy of letting the blast furnace getting too cold during the shutdown.

But that’s not the only thing keeping Grant Thorton busy. The accounts of the last six months also reveal the company has been added to 10 Australian lawsuits as former investors, clients and insurance companies throw lawyers at the problem of Greensill’s financial merry-go-round. Another two are running in Britain, and at least one more in Japan, according to recent media reports.

Greensill’s shell will get nothing out of those proceedings other than legal bills, however, and Grant Thornton is having its work cut out trying to shuffle the costs off onto the various parties.

Lex himself, meanwhile, is trying to fight off an action to ban him from being a company director for 15 years, bought by the Britain’s Insolvency Service in the country’s High Court.

Not a pity party

There’s no reason to feel sorry for the good folks at the accountant’s Finsbury Square office in London, however, with the Greensill legacy rapidly stacking up as one of the most lucrative insolvency jobs around.

Grant Thornton’s latest filings show it has billed £37.1m ($71.4m) worth of work so far, including £9m over the last year. The insolvency firm also expects to generate another £8.5m over the next year.

Those figures, to be clear, are just for a single entity.

Administering a second Greensill vehicle, Greensill Capital Management Company, has generated about another £1m.

Nice work if you can get it.

Candid Canberra

What is it about politicians speaking candidly at parliamentary inquiries, joking with each other, and often with their political enemies, to say things they would likely never utter in more formal settings?

Maybe it’s the camaraderie they enjoy on a committee or inquiry where they sit alongside politicians from other political parties, those long hours and often dreary days of never-ending testimonies can breed some jest as guards are lowered.

Such is the case with the Senate inquiry into the supermarkets, led by the Greens’ Nick McKim and blessed by the Albanese government to act as a distraction from the dumpster fire of the voice referendum and the PM’s lack of attention to cost of living issues – sorry, we mean supported due to the Labor government’s sincere concern over the power of the supermarket chains and cost of groceries.

Before the committee yesterday Nationals senator Ross Cadell admitted, when asking questions of the representatives of the retailer-focused SDA union, that his son was going for a job interview at Woolworths next week. That should be awkward, especially as on Tuesday Senator Cadell will have before him Woolworths boss Brad Banducci, who will be dragged before the inquiry along with Coles boss Leah Weckert.

Even worse than that, Senator Cadell then told the SDA comrades that maybe he should join the union, since because of self-service checkouts he feels he has scanned more grocery items than the average supermarket checkout staff. Don’t think the idea of a Nationals Senator becoming a paid-up member of the union would go over so well in the Coalition party room.

But it’s not just the conservative side of politics divulging their inner thoughts at the supermarket inquiry.

Just before representatives of hardware retailer Bunnings were brought before the Greens inquisition, deputy chair of the inquiry, Senator Glenn Sterle, turned to the chairman and said he just needed to admit that Bunnings was his favourite shop … oh and Dan Murphy’s too.

Hopefully Senator Sterle doesn’t visit Dan Murphy’s first and then handle power tools at Bunnings.

Telfer troubles

Spare a thought for the business development folks at Newmont, whose attempts to offload the unwanted Telfer gold mine and Havieron deposit have hit a few fresh snags.

Telfer was out of action for more than eight weeks earlier this year, after workers spotted sinkholes in the tailings facilities at the mine and Newmont was forced to stop the mill as a result.

Heavy weather up in the remote north has forced a second stoppage, Margin Call is told.

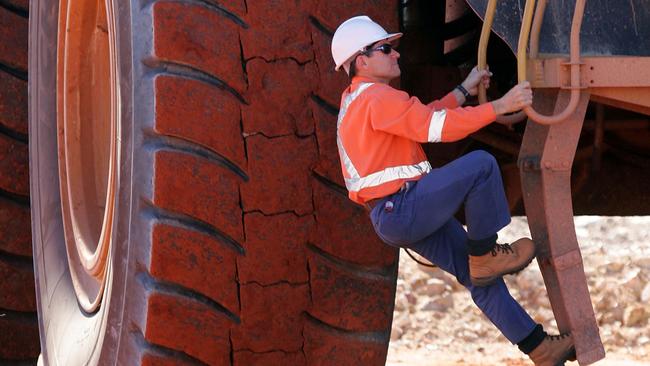

Sadly, that has come at an unfortunate time, given Newmont has been conducting due diligence tours with would-be buyers. Margin Call is told parties from Regis Resources and UK-listed Greatland Gold have recently toured and Northern Star Resources – which has publicly denied any interest in buying Telfer – is also rumoured to have sent a delegation up to the tyre-kicking party.

This year’s eight-week shutdown should already have focused a few minds on the state of Telfer’s tailings facilities.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout