Graham Richardson’s dispute over diner turns sour; Andrew Forrest entourage’s hefty carbon footprint

Labor lobbyist Graham Richardson did his best to shoo away Margin Call’s inquiries earlier this week as we probed the legal action he’d taken against long-time associate Danny Meares, the restaurateur with whom he bought a Townsville eatery back in 2014.

“Not much to tell. Just winding up my restaurant business,” Richardson shrugged, downplaying any further inquiry.

But by Wednesday a raft of documents had arrived brimming with detail about their dispute and the ill-fated joint-venture to purchase and operate the Watermark Bar and Grill.

To suggest it was even Richo’s restaurant, as he told us, would already be over-egging the pudding; by his own admission, the former senator never held more than 10 per cent of the business, and even that figure is imprecise.

Once clear of the legal banalities, Richardson’s statement of claim paints Meares to be an almighty scoundrel: he’s alleged to have surreptitiously removed Richardson as a company director, deprived him of agreed profits, loaned money without consent, and secretly sold the business from under the old man’s nose.

The defence filing, expectedly, paints a different version of events. The necessary background is that this all started with Richo and his wife Amanda striking up an acquaintance with Meares after 20 years of frequenting his once-renowned restaurant in La Perouse, Danny’s Seafood, as well as a satellite operation located on Bondi Beach.

By 2013 Meares was flirting with selling up and retiring, or perhaps opening a new restaurant as an opportunity for his sons. Richardson suggested that he examine the Watermark in Townsville and within months Meares had bought it off the owner, Peter Collings, now the managing director at Skytrans airlines, co-owned by Johnathan Thurston.

Richardson agreed to fund 10 per cent of the $3.6m purchase price, but whether he intended to remain a “silent” partner, as alleged by Meares, or a director with some level of operational control, is the nub of the dispute.

Such control and input, as Richardson alleges, would naturally include the “marketing and sale of the Watermark business”, which was offloaded in May to Melbourne-based Kickon Group for a sum of $2.5m, amounting to a loss for both sides.

Meares contends that he was always supposed to be provided with “full decision-making control” of the restaurant, and that’s why Richardson was removed as a director within months of the Watermark opening its doors.

The fine print of their arrangement was apparently discussed in a July 22, 2014, phone call between their lawyers, according to Meares, and the details were confirmed in subsequent emails.

Richardson is further claiming that he was denied 10 per cent of the profits, and that Meares engaged in “misleading or deceptive” conduct by using a bank loan to purchase the Townsville property, instead of raising the funds from the sale of his seafood restaurant, as allegedly agreed.

Meares says there’s paperwork to dispute that account, because not only was Richardson fully informed of the bank loan, he even assisted with the finance application and provided Meares with statutory declarations to support it.

–

Jarden spreads wings

Are they tough times or are we about to witness a period of growth over at investment bank Jarden’s budding local offshoot?

The New Zealand outfit was one of three companies – alongside American firm Jefferies and homegrown Barrenjoey Capital Partners – to open offices in Australia in recent years.

First to patch over was UBS banker Robbie Vanderzeil, then Goldman Sach’s former head of equity capital markets Sarah Rennie. They were quickly followed by UBS head of investment banking Aiden Allen and many others.

In February, Jarden said it was raising more than $NZ60m ($54m) from its wealthy clients to fund near-term growth. Has some of that money begun to flow to Australia? Documents filed with the corporate regulator last week suggest Jarden’s New Zealand HQ has pumped some $20m into its Australian business with the issuance of 20 million shares valued at $1 each.

There’s been persistent speculation – including from the investment banking sector’s heaviest hitters – that not all the new entrants will survive in the long-term. After all, they are still competing for deals against traditional bulge bracket banks, including Goldman Sachs, JP Morgan, Morgan Stanley, UBS and Citi, not to mention local giant Macquarie. Paying for high-profile names also comes at a cost.

No doubt Jefferies boss Michael Stock and Barrenjoey executive chairman Matthew Grounds haven’t embarked on their new ventures for charity.

The launch of a full-service local operation by British giant Barclays – one of Barrenjoey’s major investors – certainly raised eyebrows, although its local executive Richard Satchwell later told The Australian he was “very happy with the partnership we have and the investment we have and how it’s working today”.

Sources at Jarden, of course, say the money isn’t plugging any holes. It’s setting the Australian operations up for substantial growth. Recent activity appears to confirm this, although continuing market volatility has put a dent in some capital markets plans.

In February, Jarden nabbed former Credit Suisse managing director Rohan Gallagher to run emerging companies on its equities desk. It has also taken a lease over a glitzy Melbourne office that could fit some 50 people.

–

Twiggy on tour

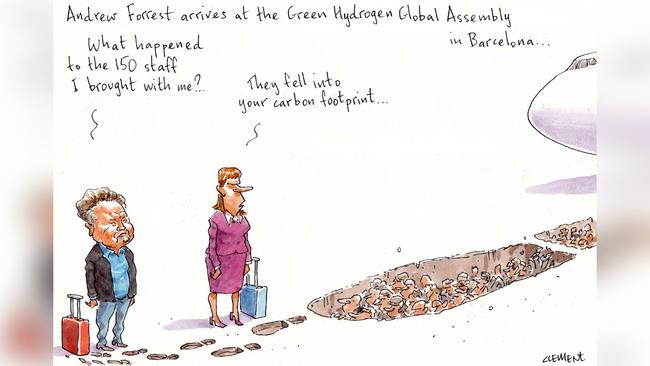

Andrew Forrest provided more grandiloquent pronouncements from the Green Hydrogen Global Assembly in Barcelona last month, where he predicted that the elusive fuel source would be in commercial use to make steel within a couple of years.

The remarks, along with Twiggy’s megaproject investments and, indeed, the conference itself, are ultimately in the service of reducing carbon emissions across industry and elsewhere.

But we were bemused to find out that Forrest’s delegation to Barcelona included a staggering number of advisers, officials, policy makers, executives, divisional management and scores of other employees from Fortescue Metals and Fortescue Future Industries.

Margin Call has confirmed that the entourage amounted to a number in the region of 150 dispatched from across Twiggy’s outposts, a journey sure to set back the companies’ efforts to reduce their CO2 footprint.

An FFI spokeswoman declined to comment.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout