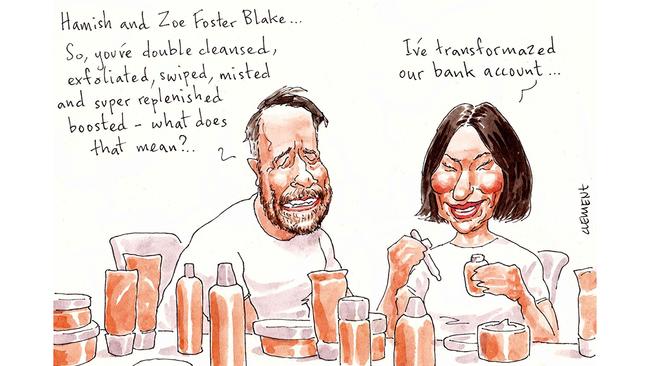

Go-To Skincare founder Zoe Foster Blake makes $30m in BWX sale

Media personality and entrepreneur Zoe Foster Blake made a splash with her and husband Hamish Blake’s tourism campaign earlier this year, on the hunt for Australia’s next “big” thing.

Alongside Ballina’s Big Prawn or the Sunny Coast’s Big Pineapple, best to add Foster Blake’s new big $30m pay cheque to the mix.

Such are believed to be the proceeds of a deal with locally listed cosmetics and haircare group BWX, which sees Foster Blake sell down her holdings in the fast-growing Go-To Skincare brand.

The 41-year-old founder and the face of the brand, whose loyal band of one million social media followers have helped the group climb to a $177m valuation, announced on Friday that she would sell down her stake as part of a “partnership” to hand over 50.1 per cent control to BWX.

The deal sees Foster-Blake sell down roughly half of her existing stake, alongside three fellow key shareholders – Peter Lehrke, Stefan Drury and Paul Bates – who have backed the group since its launch in 2014.

She will retain her role as chief creative officer, alongside other key execs, and is contracted to stay with the group for three years, with potential for put and call options every year after that.

It comes as no surprise, the brand in recent months tapping financial advisory Canterbury Partners to seek out potential partners.

BWX, led by former Blackmores exec Dave Fenlon and owner of fellow brands such as Sukin and Andalou Naturals, announced a $100m equity raise to fund the deal and laid out settlement of the transaction in the first quarter of the 2022 financial year. Roughly a third of those proceeds are destined for Foster Blake’s back pocket.

The high-profile duo recently made the switch from Melbourne to Sydney, shelling out $8.93m for new digs in the harbourside suburb of Vaucluse.

Plenty in the kitty now to fit it out with all the trimmings, too.

–

Coonan’s clean break

Outgoing Crown Resorts executive chairman Helen Coonan is said to have made a clean break from the casino group on Friday, marking just shy of a decade of service on the board and drawing a line under the “old Crown” she often sought to distance herself from.

Coonan, who passes the baton to Jane Halton as acting chairman while her incoming replacement Ziggy Switkowski awaits the required checks from state regulators, punched her time card for the last time on Friday, was said to be without any continuing service contracts or notice periods holding her back.

That’s unlike her former chief Ken Barton who, six months on from his announced exit date, also clocks off for the final time this week, and $1.5m richer thanks to the service agreement negotiated as part of his departure.

Margin Call hears there was little fanfare to mark the occasion on Friday, Coonan’s parting public statement making reference to the new era of the company.

“With an experienced management team in place supported by a high-calibre Board, Crown is firmly on a pathway to rebuild trust and positioned for success over the long term,” she said in a release to the market.

It’s a long way from her appointment to the board in December 2011, when the just-retired senator, the last of ex-PM John Howard’s guard in the Senate, made her first foray into the world of the ASX.

Coonan’s exit makes for tidy timing for the group, set to hand down its full-year results on Monday, as fronted by new chief Steve McCann, said to be on the cusp of receiving his final probity ticks.

The usually Sydney-based exec is plotting his move to Melbourne too, in order to satisfy the regulator, as he takes on the dual role of leading the Melbourne casino following Xavier Walsh’s recent exit.

But back to Coonan and, despite her tenure, the long-serving director only waded into the market for Crown in February last year, picking up just over $100,000 worth of shares. Due to a choppy performance and those all-too-familiar coast-to-coast probes, her holdings have seen their value slip by $10,000.

A small price to pay for the experience.

–

Ringing up the cash

There’s more reasons than one for Telstra chief Andy Penn to be all smiles in recent weeks, not least the telco’s upbeat outlook and recent two-year high for shares.

As revealed in the group’s latest annual report, the chief executive also clocked up his biggest pay cheque in five years.

The telco’s accounts shows the Melbourne-based exec took home actual remuneration of $5.3m, a 45 per cent boost on the year prior after Covid-19 trimmed his pay packet and restricted his incentives.

Still, that’s nothing on the $6.7m he banked in rosier times during FY16, back when profit was growing so much the telco launched a $1.5bn buyback.

Penn set out aspirations to reach similar lofty heights as he set out the group’s latest results, including handing back the $1.35bn in proceeds of the group’s towers transaction.

That bodes well for his 2 million shares and further more than one million performance rights, the latest portion of which have been set out for approval by shareholders at the group’s October 16 AGM.

Among other points of business, including the reappointment of directors Roy Chestnutt and Niek Jan van Damme, chairman John Mullen has recommended a vote in favour of granting 400,000 restricted shares and a similar amount in performance rights to the CEO, based on hitting almost 100 per cent of his target opportunity.

Not a bad year at all.

inside margin call

Plenty of reasons for Andy Penn to be all smiles

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout