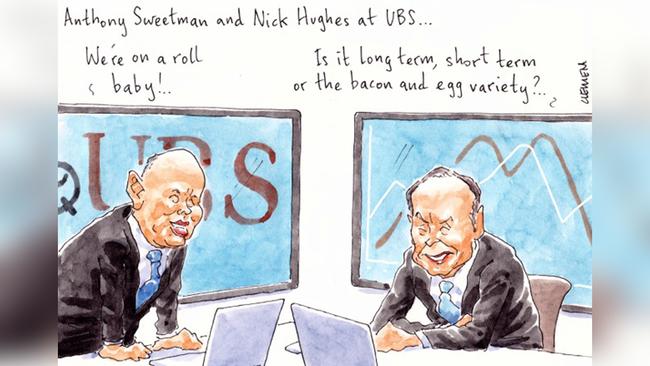

UBS profit machine still rolls on

How long can this investment banking party last?

For full service institutions like the Anthony Sweetman and Nick Hughes-led UBS it’s been a bumper start to 2020.

Equity capital markets departments are going gangbusters so far thanks to the COVID-19 driven economic crisis leaving corporates seeking fresh capital to keep the wheels turning.

For the Swiss banking giant, which is a dominant force here, recent months come hot and heavy off the back of what Margin Call has discovered was a ripping year in 2019 when old chief Matt Grounds ran things for about six months ahead of Sweetman and Hughes taking over the reins.

Bottom line earnings at UBS in Oz in the year to December 31 jumped an impressive 27 per cent to $94.5m, from $74.9m previously, as the group generated $291m in revenue.

Of that bottom line, $75m was funnelled up to the Antipodean outpost’s Swiss masters in the form of a dividend, compared with $65.4 million sent up the year before. Almost $141m sent home in two years buys plenty of chocolates.

Admirably, the bank paid $38m in tax on its 2019 earnings, on top of $28m sent to Chris Jordan ’s Australian Taxation Office the year before.

Margin Call hears there’s also been some money filtered over the past five months to various worthy causes including Food Bank, The Smith Family, the Red Cross and the Australian Business Community Network to assist with bushfire and coronavirus-related relief.

The Australian office, its charitable foundation and staff have so far donated close to $3m.

But how long until the music stops? The Swiss bank’s local results end on a sober note, noting the outbreak of COVID-19 has significantly amped up risks facing the global economy.

“An estimate of the financial effect of the economic implications of COVID-19 is under evaluation.”

All that, plus some management instability associated with the handling of historic sexual harassment allegations, plus Grounds and his clutch of powerful and connected friends cooking up plans for a new, rival venture.

Enough to send shivers down any seasoned banker’s spine.

Jewel in the crown

No one’s saying who’s going to wear it, but an Australian auction record for a single-emerald pear-shaped jewel was secured this week when The Wakil Emerald sold at online auction. The platinum, gold, emerald and diamond ring by the French luxury jeweller Van Cleef & Arpels was created in the early 1970s.

The Isaac Wakil had paid $US90,000 ($135,000) in 1974 for his wife Susan to wear it. The unassuming socialite couple were ragtraders who held huge warehouse property holdings around inner Sydney, mostly derelict.

They’d sold most by 2015 donating much of their fortune to medical research at Sydney University and St Vincent’s Hospital.

They also gave to Opera Australia, the Art Gallery of NSW, and the Sydney Jewish Museum.

The ring, weighing in at 20 carats, saw bidding go to $190,000, with the buyer’s premium taking the sale price to $231,800. The emerald is of Colombian origin.

Fine jewels specialist Patricia Kontos described the sale as a “very exciting moment”.

All up, the online auction netted $866,000, which reflected a 65 per cent clearance rate, and 94 per cent by anticipated value.

Broadcast bubble

At ViacomCBS-controlled Network Ten is it the case that you can check out, but never leave?

Coming up to three months ago, Ten’s boss of five years, Paul Anderson, resigned from the No 3 Australian free-to-air broadcaster, which was bought by the American giant out of liquidation in 2018.

Announcement of Anderson’s exit came just weeks after he’d been given a lofty new title as executive vice-president ViacomCBS Networks Australia and New Zealand, as well as his existing role as CEO of Ten.

But now we are almost in June and Anderson is still running the network, with Beverley McGarvey promoted to chief content officer.

Ten execs, including Anderson, continue to work mostly from home as the coronavirus crisis plays out, with KordaMentha partner Henritte Rothschild still on secondment at the media company as “interim chief transformation officer”.

A search continues for a new “chief operations and commercial officer”.

Zoom out

“You’re doing a very good disappearing act,” Katy Gallagher, the Senate’s COVID-19 select committee chairman, advised James Shipton, the boss of Australian Securities & Investments Commission.

It was not a criticism of the corporate regulator, rather a reference to the pesky technology issues that beset the committee when the video link kept dropping out when the dapper Melbourne-based Shipton was answering questions.

Shipton did manage to advise the corporate cop would have a “laserlike” focus on miscreant behaviour regarding continuous disclosure laws.

Seems the current ASIC leadership doesn’t want to be accused of going missing like their predecessors who were mostly reactive when regulating by press release.

Money-go-round

Julian Babarczy seems set to launch his own private wealth fund having left Regal Funds Management. The former hedge fund portfolio manager, who had been at RFM for 14 years, has enlivened an old entity.

He’s now calling himself chief investment officer at Jigsaw Investments, which has been directed by Babarczy and wife Olivia for the past nine years, but hasn’t had any public role up until now. No website is yet established, but he’s been telling potential clients Jigsaw “cultivates high returning investments in a range of industries using a hands-on and concentrated investment thesis”.

Julian has also a busier role at Perth miner Perpetual Resources, where he’s now the executive chairman, having been the non-executive chairman since 2018.

He has 850,000 shares in the company and 5.75 million options. The miner held a recent extraordinary general meeting which signed off on him getting 13,333,333 shares at 1.5c a share (they’re now trading at 2.5c). He’s also in line for some performance shares, along with fellow directors Rob Benussi and George Karafotias.

Wife Olivia has an background in the finance industry, but her focus for the last five years has been on The Plunge Collective, a resort wear firm, and also The Interior Collective, an interior design company.

For a time the couple appeared to be Melbourne-bound, but they have shelved plans to sell their Wentworth Road, Vaucluse, abode, which was listed with hopes of $15m.

They will instead offload the Toorak home bought just two years ago for $7,205,000 through Marshall White agent Richard Mackinnon.

Its imminent relisting will be an interesting market test. Plans were prepared to spend $3.5m, extending and renovating the Montalto Ave home.

Lawyers cash in

The website Yahoo! Australia & NZ (Holdings) saw their net losses blow out to $27.5m last year, soaring from a $3.9m loss in 2018, according to their latest ASIC lodging.

The losses came in the same year the joint venture between Verizon and Seven West Media ended. Verizon, the US telecoms giant, now has full control with Paul Sigaloff heading the local team.

Not only were revenues down $7m to $33m, but cost of sales jumped $3.5m to $6m.

The biggest blowout was in legal and professional fees which cost $6.4m as they fought Seven over valuation. In the more regular 2018 year their legals sat at $369,000.