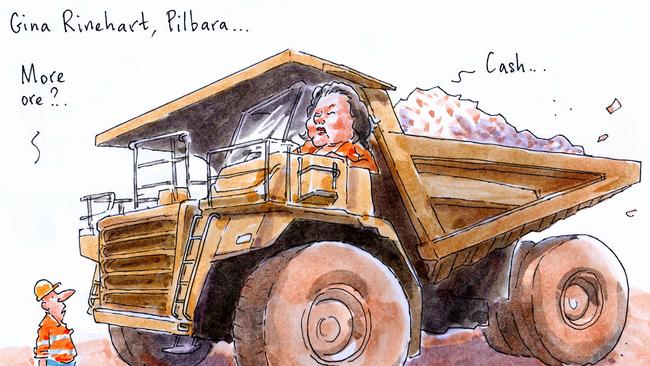

Gina Rinehart splashes the Roy Hill cash

Who knew billionaire Gina Rinehart was so generous?

The country’s richest woman this week broke out the money gun to announce millions of dollars in bonuses across her Roy Hill workforce of roughly 2,400 staff, including the likes of machine operators, admin assistants and diesel fitters, to name just a few.

Ten-year highs in iron ore prices can have that effect, though we might hazard a guess her recent 67th birthday may also have put the billionaire, whose estimated wealth is in the ballpark of $22bn, in a giving mood.

While representatives at the $10bn iron ore miner were tight-lipped as to the quantum of the reward, Margin Call hears the bonus pool is deep, with payments of between 10 per cent and 15 per cent of workers’ base salaries set to land in bank accounts from July.

That’s on top of end-of-year bonuses already announced in December.

A Roy Hill spokesman said the bonus payments for all the miner’s workforce was not just a reflection of the financial results, but recognition of the difficult times endured during the COVID-19 pandemic.

The group’s most recent results for the year to June 30, 2020 show profit after tax was up 60 per cent at $2.2bn, with $475m returned via its first dividend to owners including Rinehart’s own Hancock Prospecting, along with Marubeni Corporation, POSCO, and China Steel Corporation.

It seems there’s plenty of cash to go round, best not mention it to the feuding Hancock heirs.

Raymond Finkelstein - Labor’s go-to man

Any plans for former Federal Court judge Raymond Finkelstein to spend more time enjoying the space and tranquillity of his $2m-plus holiday pile at Shoreham on Victoria’s Mornington Peninsula were blown out of the water by his appointment this week by Dan Andrews to run the Premier’s Crown Resorts royal commission.

Finkelstein has for some time been a go-to man for Labor.

In 2014, he gave legal advice to Victorian Labor that the Liberal government’s East West Link toll-road contracts weren’t enforceable.

This meant then-opposition leader Andrews could commit to rip up the infrastructure contract if he was elected, which he was. For the record, things didn’t exactly pan out for Andrews, with more than $1bn in compensation eventually paid.

Finkelstein, 74, also provided legal advice to the party concerning two citizenship eligibility cases centred around section 44 of the constitution.

That established relationship should at least grease the wheels of Finkelstein’s commission towards achievement of the tight August 1 deadline that Andrews has set for it to report.

Reading the room with Leon Zwier

There’s also a path that stretches between Finkelstein and leading law firm Arnold Bloch Leibler, whose high-profile partner Leon Zwier is assisting Crown Resorts executive chair Helen Coonan in her valiant efforts to engineer the $6.8bn casino group into an organisation that’s suitable to hold a casino licence.

Finkelstein’s wife Leonie Thompson, who died in late 2017, was one of ABL’s longest-serving and most respected partners, having joined the firm in 1994.

Thompson’s contribution to the firm over her 25-year career there resulted in a conference room recently being named after her, the Thompson Boardroom — a venue we couldn’t think more appropriate for Zwier to meet with his client Coonan to nut out royal commission legal tactics.

There’s also the “Leonie Thompson, Ray Finkelstein and Arnold Bloch Leibler Law Scholarship”, which supports high-achieving students from disadvantaged backgrounds who want to study at Melbourne’s Monash University.

Elsewhere, one to watch when it comes to Finkelstein’s selection of his counsel assisting is Melbourne barrister Simona Gory, who has repeatedly acted as Finkelstein’s junior.

The two lawyers formed a company together in late 2018 called Rainy Day Enterprises, with Finkelstein and Gory the only directors and 50-50 shareholders.

Notably, Gory represented ASIC in the matter relating to now-resigned Crown director Harold Mitchell and his role as a director of Tennis Australia.

Mitchell was fined $90,000 for breaching his director’s duties in connection with a 2013 decision by the TA board to award the domestic television broadcast rights for the Australian Open tennis tournament to Kerry Stokes’ Seven Network.

Mitchell gave evidence to Patricia Bergin’s Crown inquiry in NSW last year. Whether he will be back for another turn in the witness box at Finkelstein’s commission remains to be seen.

James Shipton: Seeking ASIC chair

It’s been a bumpy six months or so for the corporate watchdog, but could the worst be behind the Australian Securities & Investments Commission now that the call has officially gone out for a new chair to replace disgraced regulatory chairman James Shipton?

Despite the fact that the nation’s top regulator was cleared of any misconduct following a Vivienne Thom-led inquiry in relation to his expenses, Shipton at the end of last month agreed with federal Treasurer Josh Frydenberg that he would step down as ASIC chair in the coming months.

For those who have forgotten, ASIC paid more than $118,000 for advice relating to Liberal blue-blood Shipton’s personal taxes when he relocated from the US in 2018.

His departure from the high-profile role will come about two years ahead of the expiration of what was Shipton’s five-year contract, with the ASIC chair paid $855,364 in 2019-20.

Towards filling the chair, on Monday Frydenberg, with the assistance of executive head hunting firm Korn Ferry, officially launched his recruitment campaign with a brief advertisement on the likes of Seek for the major role.

“The position of chair … leads the strategy and work of ASIC in administering and delivering its regulatory mandate,” the ad reads.

“The chair is also … responsible for directing and managing ASIC’s delivery on its purpose and obligations.”

Not much to go on with there, but there was a little more flesh on the bone to lure Frydenberg’s star candidate in.

“The new chair will have the ability to lead an organisation of significant scale and complexity, as well as extensive knowledge and experience of the financial system and conduct regulation,” the ad says, noting that applications close on March 5.

“The chair will also have a demonstrated ability to influence and engage with a broad range of stakeholders in support of ASIC’s vision and mission.”

No mention, however, of pay or other contract terms that a chair could expect.

It seems the wound may still be raw.

Raymond Finkelstein - Labor’s go-to man

Reading the room with Leon Zwier

James Shipton: Seeking ASIC chair

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout