George Calombaris creditor a Made man

Former Goldman Sachs investment banker Adam Gregory pulled the plug on celebrity chef George Calombaris’s now collapsed business empire in January, but that’s not where the businessman’s connection with the failed hospitality group ends.

Not yet, anyway.

Three weeks before Calombaris and business partner Radek Sali’s Made Establishment was placed into the hands of voluntary administrator KordaMentha on Monday, Gregory resigned from more than 20 corporate vehicles that formed the Made Establishment group.

Gregory is the co-founder with Swisse vitamins millionaire Sali of Melbourne-based venture capital outfit the Light Warrior Group. Eight days before the restaurant empire collapsed, Sali registered two of his companies as secured creditors of the Made group. So he’s a major shareholder as well as claiming he’s owed money by the failed empire.

Sali lodged documents to that effect on February 3 citing vehicles The Trustee for Super Radek Super Fund and The Trustee for Sali Investment Trust as being owed funds.

That was two weeks after Gregory resigned from the Calombaris web of companies.

Sali is said to have tipped money in on the weekend to help pay Made employees, but registration of the security on Monday week ago came well in advance of those payments.

And look who Sali listed as the contact name for any service of documents relating to the companies that he says are owed money and hold security over any assets that are left in the wash-up of the collapse.

His banker mate Gregory, who didn’t return Margin Call’s telephone calls to his Cremorne office, which just happens to be in the same Melbourne inner-city building that Made Establishment operates out of.

Cosy.

As for Sali, he might have thought he was being clever by putting his hand up as a secured creditor at a minute to midnight, but a spokesman for KordaMentha told us any claim less than six months old is unenforceable.

“He can be a creditor, but he can’t jump ahead of the bank (CBA) and employees,” the spokesman said.

How refreshing. Even millionaires have to get in line.

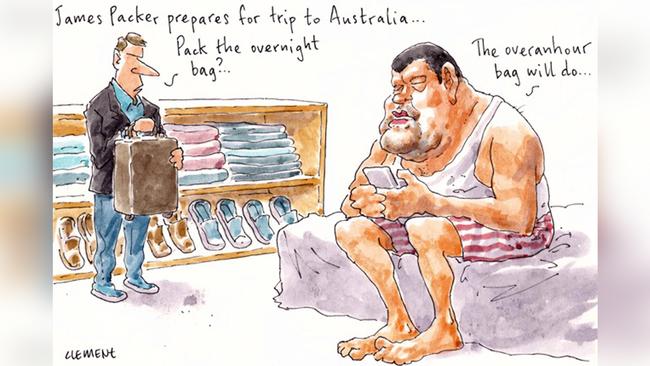

Packer cuts down

His $1.76bn planned sale of Crown shares to Lawrence Ho has been partially thwarted, but billionaire James Packer is still marching on with streamlining his operations in Australia.

The past 18 months have seen Packer scaling back his official corporate links to Oz, beginning in mid-2018 when he quit all his local directorships in favour of handing over the reins to long-serving and trusted finance director Mike Johnston.

Packer, of course, still pulls the strings via his directorship of private parent company Consolidated Press International Holdings, which is registered in the Bahamas.

Now Margin Call has learned that Johnston has in recent months pulled the plug on 14 private Packer companies, deregistering vehicles that in some instances have been part of the multi-billion-dollar empire for more than 15 years.

These include the likes of CPH Property, comic printer Murray Publishers and record company Engine Room Music.

Of course, Packer, 52, hasn’t officially lived in Australia for more than five years, since 2015 variously calling Tel Aviv, Los Angeles (where his children live with their mum Erica Baxter) and Aspen home.

He’ll be back on Sydney soil, however, in a few weeks to appear before the NSW Independent Liquor and Gaming Authority’s public inquiry into his sale of what’s become a smaller $880m stake in Crown to Ho’s Melco.

But Sydney, according to our colleague Damon Kitney’s best-selling Packer biography The Price of Fortune, makes the billionaire feel “scared” and even at times physically sick, so don’t expect the businessman to hang around for long.

Jalland on move

With all that’s unfolding in billionaire James Packer’s gaming empire, you’d think there would hardly be time for a haircut let alone tackling one of life’s more stressful undertakings — moving house.

But that’s not the case for trusted and long-serving Packer lieutenant Guy Jalland.

Margin Call has learned that the businessman and lawyer, who’s served as one of Packer’s right-hand men for more than two decades, has in recent weeks moved house from one fancy terrace in London’s fashionable and elegant Belgravia to another. Crown Resorts director Jalland, who also runs Packer’s private company Consolidated Press Holdings, looks to have upgraded his abode from a £4.9m ($9.4m) house that he purchased in 2017 to another a short walk away.

From what we can see, the new pad last sold for £6.9m, also in 2017.

Before London, Jalland had moved from Sydney to Antigua in the Caribbean.

Margin Call called the Packer camp to find out the reason behind Jalland’s latest move, but with no details forthcoming.

Everyone there is deep in preparation for execs’ appearances later this month at the NSW Independent Liquor and Gaming Authority’s public inquiry into CPH’s — now shelved — sale of an $880m stake in Crown to Lawrence Ho’s Melco.

We’ll endeavour to check back in when Jalland jets into Sydney for his time in the witness box, for which we bet he can’t wait.

Macquarie pushes on

The masters of the universe, Macquarie Group, will shrug off Brexit.

Macquarie Group boss Shemara Wikramanayake, who presided over the bank’s 50th anniversary last year, has said the ASX-listed outfit has all the licences required to carry on regulated activity in the new Europe landscape.

“Macquarie does not believe that the UK’s withdrawal from the EU will be a material event for the group,” she said at the bank’s annual operational briefing.

She said Macquarie had a “longstanding and deep commitment” to the UK as the hub for Macquarie’s Europe, Mid-East and Africa operations, and this would continue.

There’s about 2000 staff based in the UK and Europe, where Macquarie has operated for more than three decades.

Macquarie has been steadfast in its view on Brexit as David Fass, Macquarie’s head of Europe, said last year that Brexit had been a distraction but it had not caused a negative impact to Macquarie.

Macquarie recently had all of four of their former CEOs at a gathering to acknowledge the group’s 50th anniversary late last year. Given everything in Macquarie world works in circles, the anniversary just pipped last month’s benchmark, where the investment bank crossed the $50bn market capitalisation

Wikramanayake said nearly all of the executive directors there were “really struck by the consistency of the attitude [of the business], going right back to when Stan Owens set [Macquarie] up”.

They heard from Mark Johnson, the former Macquarie Bank deputy chair, as well as Tony Berg, Macquarie’s first managing director and chief executive, Allan Moss, the 15-year CEO, and the most recently retired boss Nicholas Moore.

Wikramanayake, a Macquarie veteran, was sure to be thorough when quoting anything APRA-related.

Opening the presentation, Wikramanayake confidently reeled off some of the team’s overseas assignments over their some two decade careers at the group without prompt, but had to pause and put her glasses on when quoting the bank’s relationship with APRA.

Wikramanayake said there was a “long list of things we’re working on with one of our two principal regulators APRA”.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout