Fortunes flow for Tesla’s Robyn Denholm; Newcrest chair Peter Hay signs off

Loopy lines of query

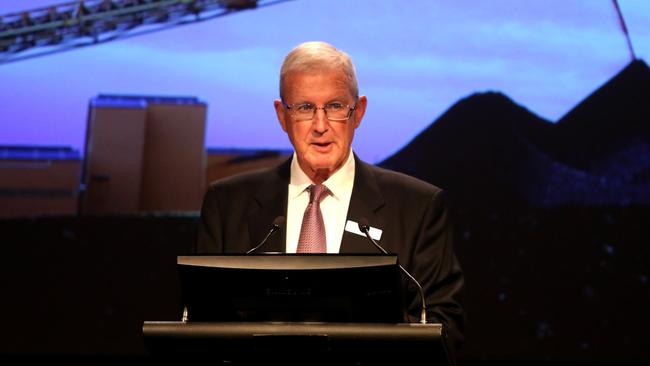

Veteran Newcrest chair Peter Hay signed off on his final annual shareholder meeting on Wednesday, surely relieved he’d no longer have to maintain a straight face when responding to some of the miner’s loopier shareholders.

Newcrest’s AGM seems to bring out the kookier members of the investment community, mostly in the form of gold bugs.

Hay last year was forced to play a straight bat to questions on why the company wasn’t stockpiling all its gold for when the price went up, as well as whether Newcrest was preparing for the end of fiat currency and the return of the gold standard.

This year it was the turn of anti-vaxxers to take centre stage – though it would probably be fair to assume there’s a pretty solid community crossover with the gold bugs there.

Despite his eight years’ experience dealing with the quirkier members of Newcrest’s shareholder base, even Hay must have been surprised to learn that the company’s $20m community support fund – announced in the early days of the coronavirus pandemic – made the company’s board and executive team the “lapdogs of big pharma”.

“Why does the company deem it necessary to spend $20m towards a Community Support Fund which, in essence, channels funds to UNICEF and big pharma?” one shareholder asked. “Has each board member and executive member of Newcrest mining forgotten what it means to be a good citizen and not just the politically correct lapdog to big pharma?”

They haven’t, and they aren’t, apparently.

Then there was a question on whether Newcrest’s support for the “experimental” vaccination of its workforce meant it was in breach of the Nuremberg Code.

Vaccines aren’t experimental and Hay was pretty sure the Nuremberg Code doesn’t apply.

In signing off as chair, Hay told reporters he would miss his annual joust with the Monster Raving Loony Investment Fund arm of Newcrest’s shareholder base.

“I’ll miss it terribly. We do get some quirky questions, there’s no doubt about that. I try to just pick out what the subject is and deal with the subject rather than the quirkiness of it,” he said.

Next year it’ll be new chair Peter Tomsett’s turn in the hot seat.

–

Denholm gets busy

All eyes may be on electric vehicles this week thanks to Prime Minister Scott Morrison’s renewed electric pledge and seeming backflip on “ending the weekend”, but for all the local interest it seems Australian-based Tesla and Tech Council of Australia chair Robyn Denholm has other matters on her mind.

The notoriously private exec, and close business associate of the outspoken world’s richest bloke Elon Musk, has in recent weeks set up no fewer than three new corporate vehicles, named Wollemi Finance, Wollemi Capital Group and Wollemi Capital Notes 1.

It comes after Denholm sold down her Tesla stake significantly earlier this month, predating Musk’s controversial Twitter poll, reaping $US28m from the sale of 25,000 shares in the $US1 trillion ($1.35 trillion) behemoth.

All that after an earlier $US22m sale in August and several more during the year, planned as a means of “an orderly liquidation of options scheduled to expire in 2022”, according to the company’s filings.

All of which reveals that Denholm is sitting on a fair chunk of cash.

Denholm’s two grown children, Matthew and Victoria, are so far the only other directors listed on the new entities, though the Tesla chair herself looks to be in charge of the greatest parcel of equity in the form of $20m in shares through another private entity.

No word on whether the venture relates to the Wollemi National Park in the Blue Mountains of Denholm’s home state of NSW, but the fact each of the entities are based out of Deloitte’s Melbourne office suggests otherwise.

Closer to the coast but with just as stunning views, Denholm, who also in the past year has picked up a role as operating partner of the Atlassian-linked Blackbird Ventures, continues with work on her beachfront Whale Beach abode.

Much is made lately of unrealized gains being a means of tax avoidance, so I propose selling 10% of my Tesla stock.

— Elon Musk (@elonmusk) November 6, 2021

Do you support this?

The 58-year-old bought the cottage on the beach for $6.25m in October last year mortgaged to herself via Holmden Pty Ltd and has quickly embarked on a transformational upgrade.

Plans lodged to council just months after the sale show costs of the build are upwards of $3.4m, work said to be well under way. Not a bad spot to sit and just count her money.

–

Over to Twiggy

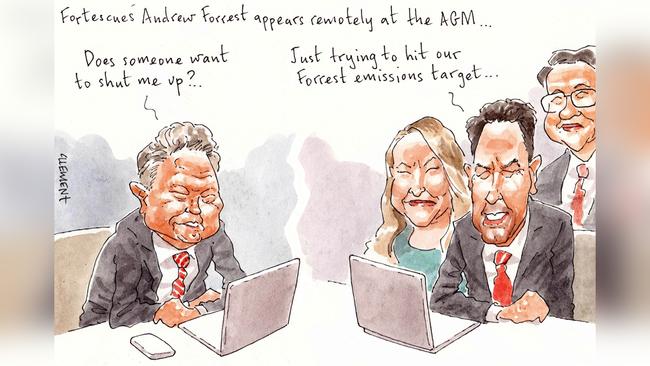

Australians who are getting a bit tired of the Twiggy Everywhere phenomenon following the billionaire’s world-saving hydrogen blitz to Glasgow might be relieved to learn that their views appear to be shared by at least one member of Fortescue Metal Group’s own team.

Chairman Andrew Forrest was still in Glasgow for Fortescue’s annual shareholder meeting on Tuesday, so director Mark Barnaba deputised and ran the meeting on the floor in Perth.

After Forrest delivered his 20-minute chairman’s address, extolling the virtues of the company’s push into green energy and hydrogen, a shareholder asked why the company was focused on green hydrogen rather than using methane – an idea Forrest has been pretty vocal in opposing before.

After a brief moment of confusion and some whispered discussion over who would take the question, Barnaba threw it to the chairman.

At which point it became clear that the Perth-based Fortescue team had failed to learn the cardinal rule of lockdown life and mute their mikes when not speaking.

As Barnaba turned to the big screen and said, “Andrew, would you like to answer that question, or I’m happy to …”, shareholders listening to the webcast could clearly heard some unknown patriot in the background giving their opinion on his decision to give Twiggy the option, in a tone of muted despair.

“Oh, Barney….” they said.

Mind you, a cynical observer might already have concluded there was a conspiracy by an element of Fortescue’s workforce to avoid hearing any more of their founder than absolutely necessary, given that the early part of his address was so plagued with audio distortion it raised genuine hopes they might have to call the whole speech off.

–

Rallying cry

Meanwhile at Helloworld’s shareholder meeting, it was left to chief exec Andrew Burnes to provide the questionable content. Describing the company’s trade through a period of exceptional challenge through the pandemic, Burnes borrowed from a monologue of Alec Baldwin’s Lieutenant Colonel Jimmy Doolittle in the 2001 film Pearl Harbour.

“Victory belongs to those who believe in it the most and believe in it the longest …”

While he stopped short of the full quote that “we’re gonna make America believe too”, it was quite the rallying cry.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout