Massive costs, slow progress, an industry up in arms, and now billion dollar legal threats – it could be any day in the life of the Albanese government. But the mess surrounding the Northern Endeavour oil platform is special by any standards.

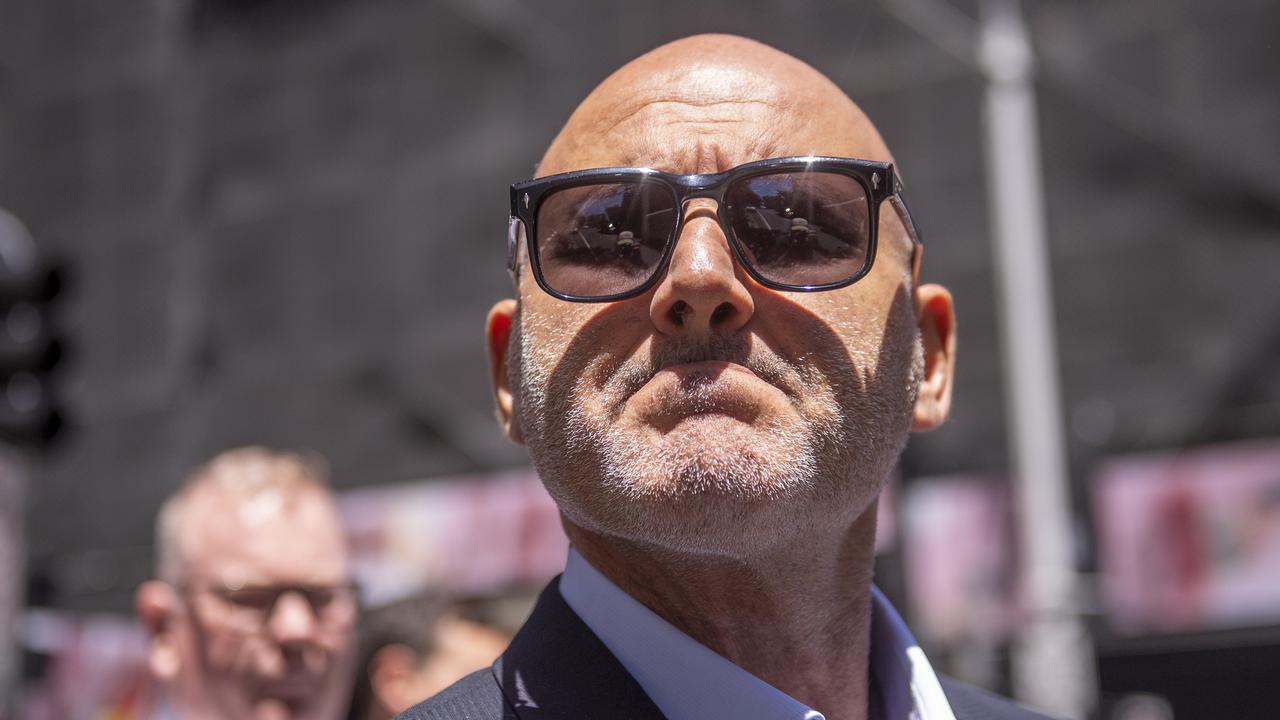

Five years on from the collapse of Northern Oil & Gas Australia and the vexed issue is set to drag on for a few more years after former NOGA boss Angus Karoll found an ally to look into legal action over the debacle.

The 2019 collapse of NOGA left the Northern Endeavour floating platform in the Timor Sea as a stranded asset, landed the federal government with a massive clean-up job and the oil and gas industry saddled with a widely hated levy to fund the bills.

Remember that NOGA was losing money until the Northern Endeavour was shut down by the petroleum safety regulator in July 2019, and then slipped into administration as the revenue dried up.

Since then the clean-up job has dogged successive governments with slow going on the actual work and a steadily climbing bill – all paid for by a $400m a year levy on the rest of the industry.

NOGA acquired the assets for a peppercorn payment to Woodside, and the selldown and subsequent collapse has triggered much angst about the rest of Australia’s ageing fleet of oil and gas assets.

Hilariously, the levy since has since spawned legal action between heavyweights Shell and Woodside, with Shell (another former part-owner of the platform) arguing Woodside should have to pay its share of the levy because it was indemnified from future costs when it sold out of the project decades ago.

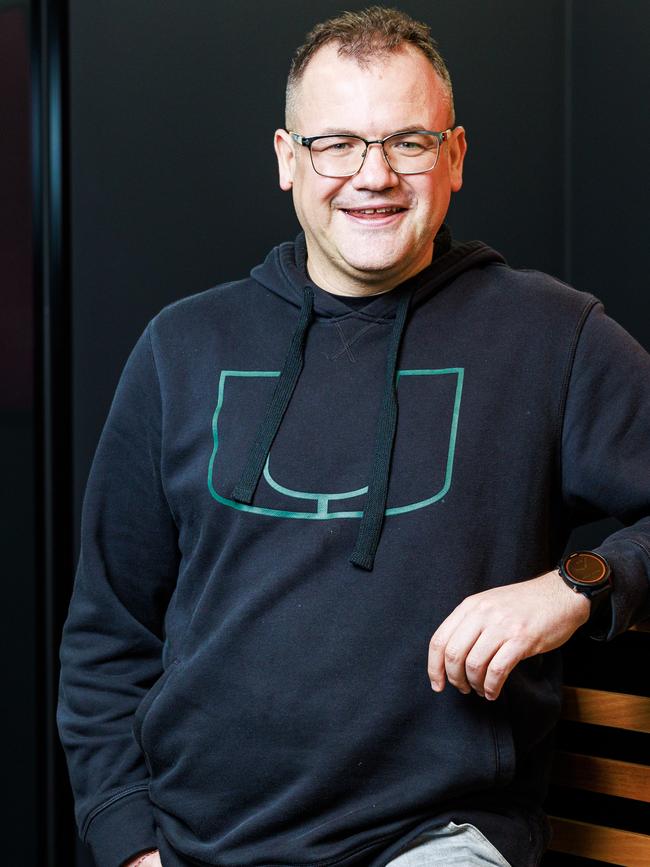

And now comes the latest twist, after the replacement of NOGA liquidator KPMG which gave up the thankless gig this week after Karoll helped swing a creditors’ vote in favour of Hamilton Murphy’s Trent Hancock.

The rationale? Karoll thinks there’s a legal case to say the feds should cough up yet more money over the collapse – firstly for agreeing to hand over 30 per cent of NOGA’s tenements to East Timor, and secondly for the fact it was shut down in the first place.

Karoll reckons the government could be on the hook for up to $1.1bn if he succeeds – a figure that would win him plenty of new enemies in Canberra.

It’s not one that KPMG’s Peter Gothard and Robyn Duggan wanted to run, but Hancock has at least agreed to examine the prospects.

Karoll has already failed in multiple bids to win agreement for a recapitalisation of the company, but told creditors he’d already had interest from litigation funders – which probably won’t help their cause either, the next time the subject comes up in the nation’s capital.

BCA’s Labor spinner

After the brouhaha around Anthony Albanese’s grim reception at last month’s annual Business Council of Australia dinner in Sydney, the BCA is drafting in Labor-aligned reinforcements as it looks to ease tensions in Canberra.

Chris Bowen’s former chief spinner Eliza Mitchell is joining the BCA as its director of government relations, amid perceptions of a deepening divide between big business and the Albanese government.

Her appointment presumably helps even the ledger after the BCA tapped former Liberal premier Dominic Perrottet’s former chief of staff Bran Black as its new boss a year ago.

Industrial relations is the major tension point for the government and the business lobby these days, but no doubt Black’s tentative support earlier this year for Peter Dutton’s pivot to nuclear will be a point of discussion when Mitchell next catches up with her former colleagues.

But, amid broader concerns the BCA is losing its influence in Canberra, the mere appointment of a few Labor staffers may not help matters significantly, no matter how well regarded.

And hardliners in the business sector – including Gina Rinehart’s Hancock Prospecting, a new BCA member – may be wanting the peak business group to head firmly in the other direction.

Kogan’s settlement

In February we brought you news of a bizarre fight between Ruslan Kogan’s eponymous internet retailer and US supplier Pacific Link Traders, an footwear and clothing exporter run by US businessman Harish “Harry” Chatlani from his Beverley Hills home in California.

Kogan claimed in the US courts it had been fleeced by Pacific Link to the tune of about $US230,00 for goods paid for but not delivered and cash owed after invoices were paid twice.

So concerned was the Kogan founder that he intervened personally, chasing the debt directly with Chatlani via WhatsApp, sadly to no avail.

Pacific Link denied the allegations, and lodged a countersuit in May claiming the entire thing had been made up by a Kogan “employee or agent” bent on defaming the company’s good name to its other customers.

Happily, the matter has now been settled, according to Chatlani, who sent out a missive on Thursday trumpeting the amicable settlement of the dispute and ascribing it to a “misunderstanding that was caused by an accounting error”.

Weirdly enough, the Pacific lawsuit was one of several filed with much the same substance by Kogan in the US over the last 18 months, after the retailer took action against another shoe supplier, NBG Trade, for $US1.5m goods paid for but allegedly never delivered.

That, too, was settled, with NBG Trade agreeing to make good on delivery of “certain goods” to Kogan.