Ex-Liberal Vic boss Damien Mantach to walk free

Here’s something else for Victorian Liberal Party president Michael Kroger to contemplate now that he’s no further advanced in his costly battle to get his hands on the cash locked inside key donor the Cormack Foundation.

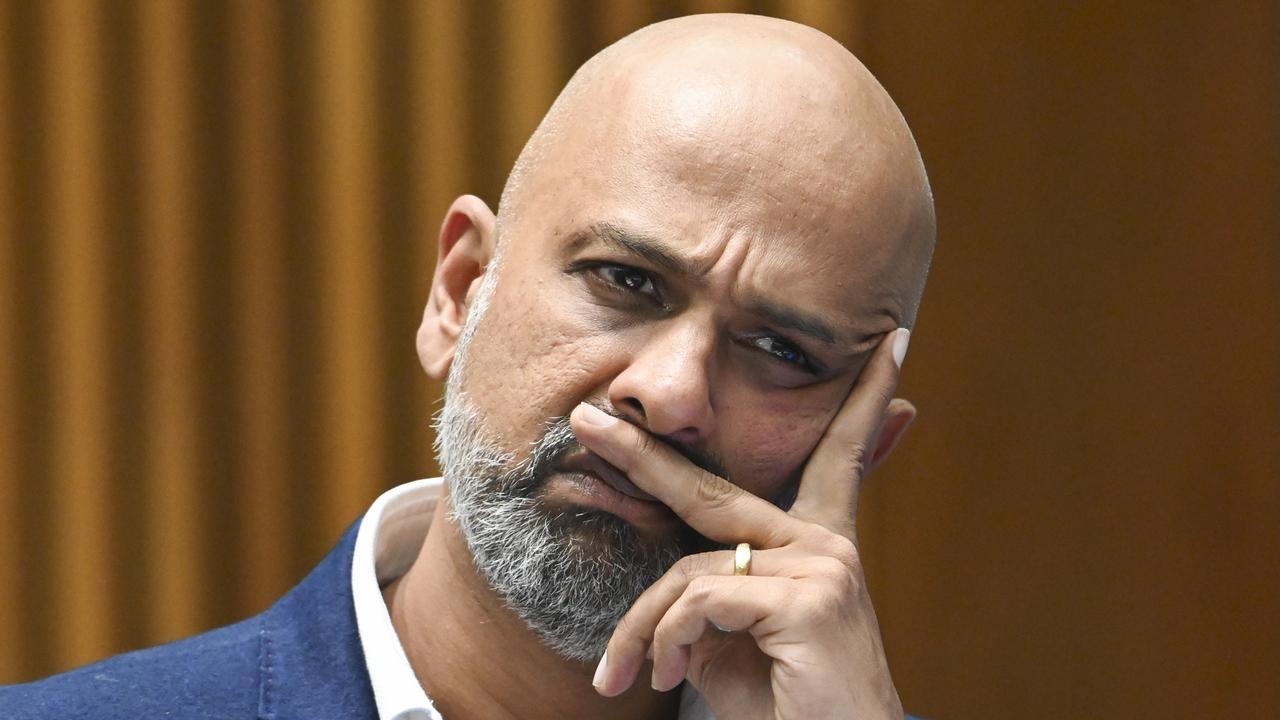

The man who arguably kicked off the funding crisis within the Victorian party, Damien Mantach, stealing $1.55 million from the Libs when he was state director, is set to walk free from jail in a fortnight.

Kroger took over running things for the party in the state as Mantach’s fraud on the Libs was exposed in 2015.

In July the following year Mantach, who pleaded guilty in the Victorian County Court to the embezzlement, was sentenced to five years jail, but given a 2½-year non-parole period.

Mantach had already spent eight months behind bars after he was arrested, all of which means the white-collar criminal, who has spent some of his time behind bars teaching civics to fellow prisoners, is expected to walk free next month.

Just in time to watch Kroger and his Victorian Opposition Leader Matthew Guy campaign to boot Labor Premier Dan Andrews out of government at the state election scheduled for November 24.

And if Kroger can’t come to some agreement with Cormack chair Charles Goode then it’s a campaign that is likely to be run on a shoestring. If Kroger is still president, that is.

In an act of goodwill, the Mantach family home, which remains in the name of the former political administrator, was spared sale by the Victorian Liberals as they sought to recoup funds stolen by the then state director.

Mantach’s estranged schoolteacher wife and their children are believed to still live in the Ocean Grove home, with Jodie Mantach having placed a caveat over the real estate in August 2015 as details of her husband’s fraud came to light.

The home remains mortgaged to Matt Comyn’s Commonwealth Bank.

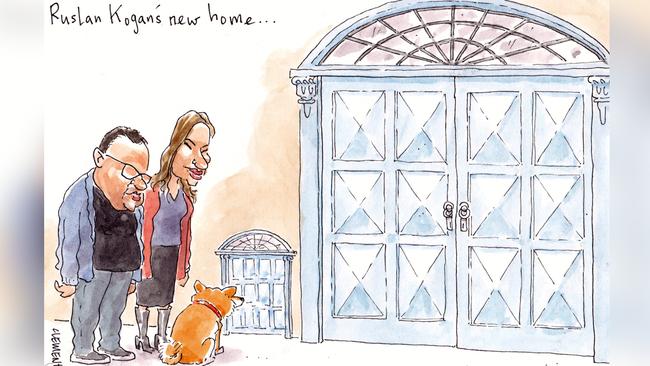

Kogan trades up

Nothing like a stonking great property purchase to focus the mind on funds.

Just ask Stensohlt Index

re-entrant and retailer Ruslan Kogan (estimated worth, $395m).

The Melbourne-based, Belarusian-born entrepreneur is scraping up money left, right and centre as he contemplates settlement on his almost

record- breaking $38.8m lash on a Toorak mansion owned by Vodafone founder Philip Cornish and his wife Caroline Cornish.

This week Kogan, 35, flogged $31m worth of shares in his namesake listed online retailer after an earlier botched attempt by him and his numbers man, David Shafer, to cash in $100m worth of stock, which only served to tank the Kogan share price by 25 per cent.

Never a good look when a proprietor sells down, with Kogan’s stake now at 41 per cent in what has been part of a wider staged divestment by him over the past year.

Now Kogan, who lists his address as his mum and dad Irene and Alexander Kogan’s home in Elsternwick, has put his St Kilda Road apartment in the flash Yve building up for private sale for $1.2m.

Kogan bought the pad for $800,000 in 2009 and appears to have later rented the two-bedder out as an investment while living elsewhere.

The sale follows the millionaire’s low-key purchase of a rural property in the central Victorian township of Hilldene at the end of last year for a modest $735,000, where Kogan and his fashionable partner Anastasia Fai, along with their magnificent shiba inu pooch Toko, are now enjoying his wide open 6½-hectare property and country weekender.

Back cityside and at the other end of the scale, Melbourne buyers’ agent David Morrell at the end of April slapped a caveat with the help of top-tier law firm Arnold Bloch Leibler on the Cornishes’ lavish property, towards settlement later.

Telco investor Cornish isn’t sitting still either, with the multi-millionaire two weeks ago taking out a fresh mortgage with National Australia Bank on the Toorak pile.

Everyone, it seems, is on the move.

Li’s pipe dream

He might be one of the world’s richest men, but Hong Kong billionaire Li Ka-shing and his son Victor Li don’t like to create too much fanfare around their market-altering dealmaking.

But their $13 billion all-cash takeover bid this week for the Michael Fraser-chaired APA Group must have the Cheung Kong group’s Morgan Stanley advisers Richard Wagner in Sydney and Julian Peck in Melbourne popping corks.

It’s the second deal the bank has done for its loaded Chinese client in a bit over a year, with Morgan Stanley also guiding CKI’s $7.4bn purchase of energy utility Duet in the first half of 2017.

But that’s only if CKI, which also has law firm Allens Linklaters in its corner, gets the myriad regulatory approvals (plus APA board and shareholder sign-off) it needs to actually to bring the mega-deal to completion.

CKI has been in Oz for almost two decades. Its Duet buy was the group’s biggest offshore deal ever, gaining the approval of the now David Irving-led Foreign Investment Review Board and ultimately Scott Morrison.

But CKI, which has been granted inside-the-tent access to do due diligence on APA, knows defeat, too, having been stymied the year before by ScoMo in its bid to buy Ausgrid from what was then Mike Baird’s NSW government.

At the time the Treasurer cited “national security concerns”.

Competition boss Rod Sims has already started his inquiry into the CKI bid for APA, which would see the Hong Kong-based conglomerate control much of Australia’s east coast gas assets.

They’ve started talking to FIRB too, at a time when there is much concern about preserving the national security of key infrastructure assets. Just ask China’s Huawei, which is expected to be officially banned from assisting with the rollout of Australia’s 5G mobile network.

We won’t be surprised to hear much made of Victor Li’s status as both a Chinese and Canadian citizen.

All that leaves a big strategic job for CKI’s key man on the ground in Australia, Ben Wilson, who runs the group’s Australian Gas Infrastructure Group, which now includes Duet.

Wilson, if he wants to add APA to his portfolio, is going to have to do some heavy pedalling to see his rich boss’s deal flashed the green light.