Ex Premier Investments CEO Mark McInnes returns home; Austrac boss Nicole Rose’s Star moment

Look who’s back.

Millionaire retail whiz Mark McInnes has returned to Australia – Melbourne, to be more specific – following an extended European jaunt with wife Lisa Kelly and their young family.

McInnes left the service of billionaire Solomon Lew last year and shortly after departed the locked-down southern capital in favour of time living in London and Switzerland.

Since 2011, McInnes had worked as the boss of one of Australia’s biggest and most influential retailers, Premier Investments, whose brands include Just Jeans, Peter Alexander, Portmans and Smiggle.

Margin Call hears that underemployed McInnes ventured into the CBD on Wednesday for lunch at De Stasio Citta on Spring St with top-rated Bank of America retail analyst David Errington.

The retailer’s return just happens to shortly precede the release of Premier Investments’ interim results by Lew on Friday.

The numbers will be the first that new CEO Richard Murray, who used to run JB Hi-Fi, will actually be responsible for driving, with the previous strong full-year results played out with McInnes’s hands on the wheel.

We wonder who else is on McInnes’s list of lunch catch-ups, which he will need to efficiently manage ahead of more planned travel to the likes of Greece, Italy and Spain over the course of this year. No doubt Lew, currently in Melbourne, isn’t far down the list.

Slow off the mark

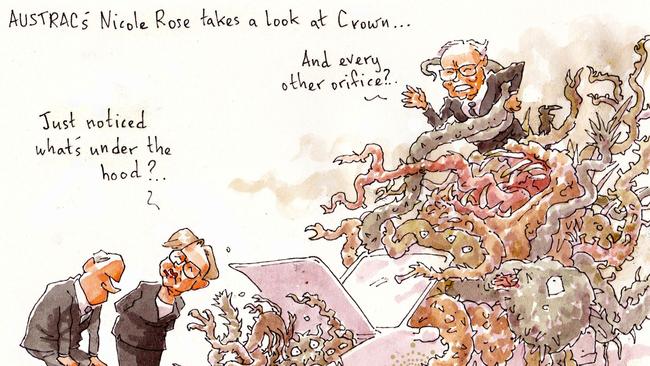

We know Austrac boss Nicole Rose has a reputation for being one of this nation’s most successful regulators.

Particularly when it comes to dollars contributed to Treasurer Josh Frydenberg’s budgetary bottom line via contributions to consolidated revenue from Austrac’s multimillion-dollar headline-grabbing fines and penalties.

There’s been three major fines against corporates in recent years for breaches of anti-money-laundering and counter-terrorism financing laws – $45m to Tabcorp in 2017, $700m to Commonwealth Bank in 2018 and $1.3bn to Westpac in 2020.

And Rose is now negotiating a settlement for breaches of the same Act with the James Packer-backed Crown Resorts, which could attract penalties of more than $1bn. More than $3bn in fines from a small regulatory office makes her a regulatory rock star.

But at Margin Call, we’re having some trouble reconciling Rose’s status with what we are hearing at John Bell SC’s royal commission-like inquiry unfolding around the Matt Bekier-led and John O’Neill-chaired Star Entertainment gaming group.

As far as we can ascertain, Austrac operators began what they call “proactive” compliance work at Star in August 2019, conducting what it then called a compliance assessment review, which saw the casino informed in June last year of its potential noncompliance with the act.

Up until that formal review, Star, like all companies Austrac regulates, was required to provide the watchdog with an annual compliance report as well as other material like suspicious matter reports, international funds transfer instruction reports and threshold transaction report.

But Austrac, it seems, saw no red flags in the material from Star until it actually started “proactively” looking under the hood in August 2019, when it discovered issues of concern as far back as July 2015.

Evidence to the Bell inquiry has revealed that in November 2019, three Star execs – former group treasurer Sarah Scopel (now at Woolworths), chief financial officer Harry Theodore and general counsel Oliver White – worked to disguise as “hotel expenses” $900m in transactions made on NAB Eftpos machines, which were then transferred to patrons’ gambling accounts.

The high-rollers used China UnionPay cards at hotels attached to Star’s casinos to flout anti-money-laundering and capital export controls set by Beijing to access cash.

Based on that time line, their efforts were unfolding right under Austrac’s nose.

And recall it was only in December 2020 that Austrac accused the Vatican of sending $2.3bn to Australia via 47,000 separate transfers over seven years from 2014. Two months later, the regulator wound that massive amount back to $9.5m, with the miscalculation blamed on a computer coding error.

Savvy Santos move

Beach Energy’s loss is Santos’s gain with the latter presciently poaching Rob Malinauskas, the brother of newly elected South Australian Premier Peter Malinauskas, back into the oil and gas producer’s fold. This leaves Beach searching for both a managing director, with Matt Kay making the unexpected announcement last year that he was moving on, and a new general manager of corporate affairs and sustainability.

It’s a savvy move for Santos, which has traditionally been a happy landing ground for former Liberal staffers, although with the transition in train before the state election it was probably more a reflection of Malinauskas the younger’s skills rather than any attempt to read the political tea leaves.

Beach employed Chris Burford, former chief media adviser to the previous state Labor leader Jay Weatherill, following the change of government in 2018. However, Burford says he’s in no hurry to rush back into politics.

Santos, which before trimming down boasted a deep communications line-up, has in the past employed heavyweights such as former Liberal government advisers Christian Bennett, now at Woolworths, and Matthew Doman, formerly at oil and gas lobby group APPEA and now a director at Australian Public Affairs.

However, the team is currently quite evenly balanced, with Santos picking up the services of former SA health media manager Claire Hammond, who worked for Labor senator Anne McEwen for seven years before jumping to health, and James Murphy, who advised the outgoing Liberal health Minister Stephen Wade before jumping to Santos in 2020.