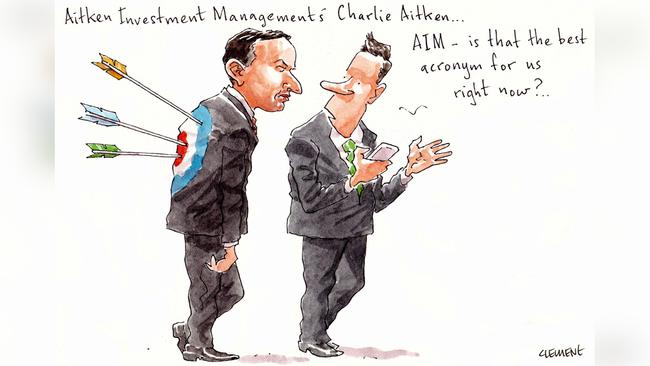

Ellie Aitken leaves Aitken Investment Management; David Di Pilla unveils reno plans

Is it over for Sydney power couple Charlie and Ellie Aitken?

Eyebrows were raised when Ellie, a director at the one-time Kerry Stokes-backed Aitken Investment Management, appeared at the rival Pallas Capital.

That was probably all that it took to send the Eastern Suburbs rumour mill into overdrive.

Besides, the Aitkens have long cozied up to some of the city’s most colourful business identities including Sanjeev Gupta and his wife Nicola.

Stokes might be out of AIM – no surprise given the fund’s rather average performance – but it still counts ex-Packer family lieutenant Rob Rankin and wealthy publican Chris Nasser among its backers.

Sources close to the family told Margin Call that the couple were taking a permanent break.

And not just professionally.

Ellie, meanwhile, is now the director of distribution at the Double Bay-based Pallas, a fund run by Charles Mellick, in what she told a recent profile was all just a matter of chance.

“Originally, I was looking to relocate Aitken Investment Management to an office in Pallas House Double Bay,” she noted in September.

“Whilst AIM didn’t proceed with that lease, Charles Mellick suggested I might like to join the … team. I met with Mark Spring and Craig Bannister and the rest is history.”

Ellie’s adventures with Sydney’s finest, including Mike Cannon-Brookes’ new business partner Russell Crowe, have long been the talk of the town.

She made headlines in 2016 as Rusty’s “mystery date” to a pre-Oscars party in the US, even accompanying him to a workout the following day.

Neither Ellie nor Charlie responded to calls on Monday.

Whatever the story, we wish them all the very best.

–

Demolition man

Meanwhile – could it be an omen – the Aitken’s most recent residence is set for the scrap heap courtesy of the ambitious plans of the Bellevue Hill home’s new owner David Di Pilla.

The former UBS banker turned HomeCo mastermind bought the Kambala Rd home for $9m from Arabella Rayner and F45 director husband Damien Rayner earlier this year, adding to his impressive land holding in the blue chip suburb.

Now, Di Pilla and wife Victoria have lodged plans to amalgamate the two sites into one mega estate, set to raze the site, the Aitken’s last registered address, entirely to make way for a new tennis court.

Such is the case when you control a mammoth private aged care group, benefit from its regular and healthy dividends and oversee more than three billion dollars of listed assets.

Plans seen by Margin Call estimate the cost of the reno at north of $3.5m.

Aside from not leaving any skerrick of the former home next door, the upgrade includes the reconfiguration of his current multi-level home around a grand spiral staircase, to include a cinema room, sauna and library, as well as three ensuite bedrooms and a new master suite.

Such plans are still yet to garner the approval of the local Woollahra Council but with several other multimillion-dollar renos on the street, including that of former Aussie Home Loans boss James Symonds and wife Amelia across the street, you’d have to hope the neighbours weren’t keen on any peace and quiet for at least the next 12 months.

–

Buying spree

It seems no matter where he looks Di Pilla has been in an acquisitive mood of late.

Only last month his listed HomeCo Daily Needs REIT set out plans for a mega merger with Brett Blundy’s Aventus, details of which were presented to several broking houses over the past week.

According to their presentation, the mostly scrip-based deal provides “significant scale and enhanced capability to unlock value from a highly strategic land bank”.

Doesn’t sound too much different from what’s going on in his own backyard.

But despite the enthusiasm from the two major parties, it seems all shareholders aren’t entirely convinced, with some raising concerns as to just how much of a cut HomeCo might take as management fees in the upgraded portfolio, set to surpass its closest listed rival SCA Property Group.

It is the timing of his recent share purchases however that have caught this column’s attention.

Earlier this month Di Pilla picked up $500,000 worth of HomeCo Daily Needs REIT shares on-market via his private Aurrum Holdings entity.

That was then followed in the subsequent days by multiple more purchases worth $5.5m through the listed HomeCo, all set out to shareholders in an update to the market last week.

While the average price paid per share is comparable, it hasn’t failed to raise a few eyebrows.

–

Returning serve

It was time for consulting giant KPMG to return fire Monday, following a scathing attack on the firm by a former partner Brendan Lyon at a NSW Parliamentary Inquiry into a spin-off of the State’s rail assets.

Patient they may be, but there was no holding back by the big four firm as Sydney partner Heather Watson fronted pollies at Macquarie Street, while Brisbane-based Paul Low beamed in virtually.

A submission by the firm noted, “the evidence, provided under parliamentary privilege, was misleading, either by omission or design as part of a campaign of misinformation” adding that it “this is not about criticising individuals”.

“KPMG does not make this submission lightly. However, given the most serious nature of the allegations raised in the hearing about KPMG, our people, our processes and our clients, we felt that it was wrong to leave baseless claims unchallenged,” the document went on.

As for any suggestion that the firm deviated from its conflict management requirements, Watson was forthright,

Asked by State Greens MP David Shoebridge if she had any regrets on how she had handled the matter, she replied, “We have provided advice to two parts of government. We believe when you have different perspectives to solve a problem you will get better outcomes”.

With plenty of differences in opinion across the range of witnesses called before the inquiry to date, we’ll just have to wait and see whether any “better outcomes” come to fruition.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout