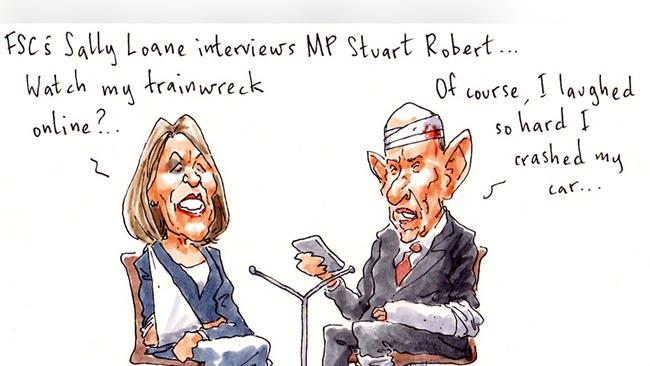

It’s always heartening to see someone getting back into the saddle after coming a cropper. So hats off to Financial Services Council chief executive Sally Loane for pencilling in a return to the public view after what can only be described as a trainwreck appearance at Kenneth Hayne’s royal commission into financial sector shenanigans.

And what a return it promises to be. The FSC, now headed by NAB recruit Geoff Lloyd, has plumped for someone equally prominent in the public eye as the guest for its semi-regular Political Series at the end of October. Why it’s assistant treasurer Stuart Robert.

Could they have picked a better prospective double act than Robert and Loane?

The Queensland Coalition MP is, after all, enmeshed in a little scandal over the expenses he has claimed for internet services, rent and photocopying. Robert has been subjected to an inquiry after booking more than $1000 a month for internet services at his Nerang home, and $2638 in May. He’s paid back nearly $38,000 claimed from the taxpayer for said expenses, admitting his bills were “higher than what our community expects”.

Let’s not forget that after this little expenses issue blew up Robert had his own mini-trainwreck interview on Sky. When they crossed to Robert he was blissfully unaware of the station’s camera and focused on the one in his phone for a pre-interview selfie.

Could he be the only guest to outshine Loane in an interview?

If you’ll recall, Loane was taken to pieces in the witness box last month by counsel assisting the commission Rowena “Shock and” Orr. Loane’s knowledge — or lack — of the insurance industry’s own code of conduct and insurance law was exposed with repeated admissions she could not answer questions put to her.

Perhaps the normally high-profile industry mouthpiece will be more comfortable on the other side of the conversation. The former ABC Sydney radio presenter has used the political series to relive her glory days of political interviews, with everyone from Robert’s predecessor Kelly O’Dwyer, shadow finance spokesman Jim Chalmers and US Ambassador Joe Hockey fronting the FSC in recent times.

Robert was an obvious choice for this particular outing — he’s the bloke the government has assigned to clean up the messes in the industry exposed by the royal commission.

But given the Newspoll out yesterday showing the Coalition trailing by six points just months from a federal election, and the usually safe Sydney eastern suburbs seat of Wentworth in play at a by-election next weekend, it would be a surprise if the FSC didn’t try to show a bit of bipartisanship.

Perhaps Clare O’Neil — the shadow and perhaps next Minister for Justice and for Financial Services (now there’s a super portfolio) — will be the next guest?

Find a friend

How Mark Bouris and his crew at Yellow Brick Road must wish he could click those red Mary Janes together and wish the troubles away.

The former Celebrity Apprentice star is under siege from the pesky Ron Brierley for whom age (he turned 81 in August) has not dimmed his enthusiasm for a public stoush with a takeover target.

Brierley and his lieutenant Gabriel Radzyminski have lobbed a low-ball bid of 9c a share (a take-under, as it is known in some parts) for YBR and is applying maximum public pressure to secure control — if not outright ownership — of the struggling mortgage broker and financial adviser.

Bouris could certainly use a friend right now, especially considering Macquarie Group has effectively walked from the register, selling down an 18 per cent stake in chunks since April, right around the time Brierley’s Mercantile OFM began amassing its near-20 per cent stake in YBR.

All might hinge on Nine Entertainment, the other bulwark on the register with 17.6 per cent, staying strong.

Now helmed by former treasurer Peter Costello, Nine got its 49.6 million shares in company as part of a contra deal that gave plugs for YBR and a slot for the regular and celebrity versions of the Donald Trump copycat The Apprentice.

But a few developments might have weakened Nine’s commitment to the financial services combine. There was Bouris firing himself from Celebrity Apprentice earlier this year and crossing over to one of the Seven digital channels to helm a new show The Mentor.

It’s about helping small business people build their businesses, which seems apt given the performance of YBR under Bouris’s stewardship.

He hasn’t quite been able to repeat the trick he perfected when he founded Wizard Home Loans and sold it to General Electric of the US for $500 million in 2004.

Still, Easts NRL team has won a couple of flags, including this year’s title, on Bouris’s watch on the board.)

The other straw in the wind is the make up of the new board for the proposed Fairfax Media-Nine merger. Former Nine CEO David Gyngell — an eastern suburbs pal who inked the YBR contra deal — is off the Nine board as of merger documents released yesterday.

Nine has shown it is willing to offload minority interests in the past: last year it flipped a stake in Southern Cross Media for $117 million, clocking a $20m profit for its trouble.

But then again, perhaps YBR is too small to worry about. At 11c a share — down from the 70c the contra shares were issued at — the YBR shares are worth just $4.5m in Nine’s last accounts.

Mercantile must be hoping the acceptances come in a rush. With YBR shares at 11c, there have been no acceptances so far and the bid closes on Friday.

On the record

Getting a bead on Clive Palmer’s true worth can be difficult. For one thing, it’s no easier to find public accounts for his myriad companies than it is to his nephew and sometime director Clive Mensink on a holiday jaunt.

Take the flagship Mineralogy, once a hoped-for vehicle to float Palmer’s various mining interests off to the public.

Records at the Australian Securities and Investments Commission show Mineralogy hasn’t filed accounts since 2013. Palmer’s political career has blossomed and withered since then, there have been several booms and retreats in iron ore prices and the Queensland Nickel business he bought for a song from BHP has gone bust.

And how things have changed for the man dubbed (perhaps by himself) “Mr China”. The 2013 accounts are a tale of woe, with Mineralogy pushed to a $104.6m loss — from a $63m profit a year earlier — after being forced to “derecognise” royalty revenue from the Sino Iron project in Western Australia due to a seemingly interminable court battle with the Chinese giant CITIC.

If he ever gets around to updating the record it should make for interesting reading. Mineralogy won a court case last year that forced CITIC to pay $US278m, including backdated royalties on production from the long overdue project. CITIC has challenged the ruling, naturally, but Palmer has been proclaiming he is back on track for an annual stream of royalties worth up to $US400m a year on a project that could stretch to 2056.

It’s not as though Clive is oblivious to the needs for good record keeping. After all, he’s just filed to report that wife Anna Palmer rejoined the board last week — resuming company secretary duties to boot — after an absence of 18 months.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout