Dog day afternoon for Oliver Curtis

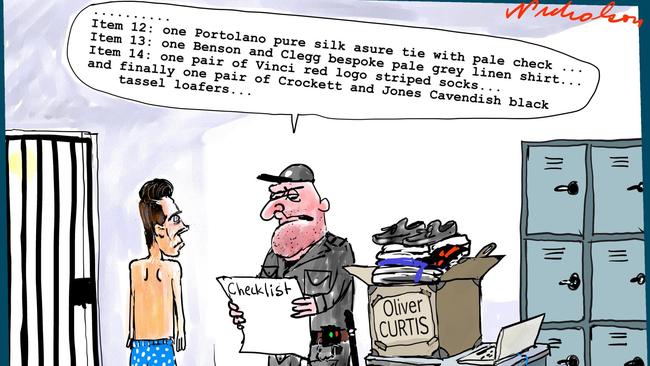

In the end Oliver Curtis’s lucky tasselled loafers let him down, when yesterday he was branded a criminal by the NSW Supreme Court.

All the St Ignatius Riverview school fees, the privilege, the lifestyle and social media amounted to nothing as the impeccably groomed 30-year-old stepped on to Phillip Street, Sydney a convicted insider trader.

His millionaire businessman dad Nick Curtis closed his eyes as his son’s verdict was delivered six years after the young Curtis’s legal battle began.

And PR maven wife Roxy Jacenko, who turns 36 next week, cried real tears as judge Lucy McCallum delivered the jury’s verdict. Roxy’s only comfort was Dior. And Balmain. And Chanel.

Outside the court the couple went their separate ways, Jacenko flanked by her mum Doreen (sporting Beatle-esque style golden reflective eyewear) jumped into a shiny black Range Rover bound for the eastern suburbs and the safe havens of Roxy’s Double Bay office and rented accommodation in Bondi.

At home, the couple’s monetised children, Pixie, 4, and Hunter, 2, got on with business, spruiking Guy Russo’s Target on Instagram. With dad facing time in the Big House, someone’s got to put in the ground work to pay the bills.

Under the pump

Spare a thought for Tony Burgess and Charles B. Goode’s boutique investment bank Flagstaff Partners, which has been mercilessly sledged by counsel for the flamboyant Indian couple Pankaj and Radhika Oswal in their billion-dollar-plus lawsuit against ANZ.

ANZ and receivers at PPB, headed by former Victorian Liberal Party state president Ian Carson, turned to Flagstaff to sell shares in Burrup Fertiliser that were seized from the couple in late 2010.

That was when Goode was chairman of ANZ.

The Oswals counsel, Tony Bannon, was at it again yesterday, slamming Flagstaff’s “deficiencies”, which he said included having no experience in pricing the gas the plant needed, not knowing anyone at the big global ammonia players who might have bought the plant and the “crazy timetable they put up” to do the deal.

Bannon has also made much of the closeness of Flagstaff to Goode’s old shop ANZ, accusing the bank of ordering PPB to hire the boutique firm.

They claim PPB jumped to hire Flagstaff without holding a “beauty parade” of international banks.

Much is also made of Flagstaff’s tiny leadership team of just Goode and Burgess, the fact it had only five execs, Stuart Wills, Kent Greig, Michel Mamet, David Potaznik and Steve Hammerton, and its sole office location inside Melbourne Tower of Power, 101 Collins.

Potaznik, who was senior on the bumbling along Port of Melbourne sale process that Flagstaff is doing for Dan Andrews’s Victorian government, is now on sabbatical from the firm.

Leave troubles behind

Meanwhile, the David Gonski-led ANZ board and executive committee is in Hong Kong this week talking up its corporate culture.

Never mind the brouhaha at home about the alleged sexism of former Bell Potter exec Angus Aitken, who infamously critiqued ANZ’s new CFO Michelle Jablko, or allegations of racism against the bank by the Oswals.

Gonski and his squad, including Kiwi boss David Hisco and Aussie head Fred Ohlsson, have been busy reminding locals that Asia remains an important part of the ANZ strategy — at least until Jablko flogs it.

The ANZ crew have also been impressing Hong Kong Financial Secretary John Tsang with the bank’s “diversity agenda”. What timing.

Cue the violins

Former Bell Potter stockbroker Angus Aitken is dominating headlines — particularly since he engaged media lawyer Mark O’Brien to work on a defamation case against ANZ.

How about those pics of Angus with cute-as-a-button daughter Rosie?

What next? A spread in The Australian Women’s Weekly (incidentally David Morrison’s favourite mag), of Gus volunteering at the bake sale of the Cooma branch of the Country Women’s Association?

You could almost forget there’s another Aitken out there. Remember Charlie?

Angus’s brother has tried to keep a low profile since reports (which proved incorrect) of Kerry Stokes’s mooted backing of Aitken’s new venture, Aitken Investment Management.

But it seems Charlie’s discipline is proving productive. May was the best month yet for his AIM Global High Conviction Fund. It was up 4.7 per cent — comfortably beating the MSCI World Index benchmark.

Not that Charlie was in a boastful mood when we spoke on Thursday. “You’re only as good as your next month.”

The fund has only $75 million under management — still a touch below the $300m that featured in its opening publicity last year.

Aitken and wife Ellie, who’s an executive director, are ready to welcome new money. It’ll take $100,000 to get in the door.

Smooth operator

It’s no secret that Daryl Kerry’s ANZ stadium wiped the floor with the SCG Trust in Sydney’s stadium wars.

So no surprise to see Premier Mike Baird and his wife Kerryn in ANZ Stadium’s suite at Homebush on Origin night.

Baird did briefly leave to work the room in the NRL’s rival suites — whose guests included SCG chairman Tony Shepherd. Baird also bumped into his Liberal colleague Malcolm Turnbull.

But the Premier returned to the ANZ suite before too long. Nothing subtle about that.

Look on bright side

They’re a tough crowd in Melbourne. Even before South32 boss Graham Kerr reached the stage at the Melbourne Mining Club lunch, the 600 mining types fell about laughing at his expense when it was noted Kerr was Fremantle born and bred, and a die-hard AFL Freo supporter.

Poor Freo is yet to win a game, and doesn’t look like it will, either. But Kerr is a glass-half-full kinda guy. Admitting the wooden spoon was on the cards, he said he was looking forward to a high-quality pick in the first round of the draft.

Plane spotters

Virgin Australia’s new Chinese partner HNA Group was always going to be the hot topic at the first night of the International Air Transport annual meeting in Dublin.

Talk continued about how Virgin boss John Borghetti had snookered his unhappy major shareholder, Air New Zealand, which is still trying to sell its stake — now 22.5 per cent after HNA diluted Virgin’s crowded register with its $159m purchase of a 13 per cent stake in the carrier.

Not that Air New Zealand’s boss Christopher Luxon let on that anything was wrong as he cheerily worked the room on Wednesday night (Dublin time).

Unless he left before our Dublin-based spies arrived, there was no sign of Etihad boss James Hogan, whose outfit is another major Virgin shareholder.

Hogan will attend the conference this week and we understand he’s thrilled with the addition of the Chinese.

Their entry complicates a takeover of Borghetti’s airline by Etihad’s cashed-up rival Virgin shareholder, Singapore Airlines. Singapore Air’s boss Goh Choon Phong was along for the opening dinner and was characteristically inscrutable. We sense he’s playing the long game.

Qantas boss Alan Joyce made an appearance but was an early departure. There was speculation that the Dublin native had ducked out for a secret strategy meeting in a Temple Bar pub to discuss his rivals.

More likely Joyce was avoiding the night’s entertainment: Irish dancing. Horrible stuff.

Music to their ears

All agree, music streaming service Guvera looks like an absolute stinker.

The outfit is backed by AMMA Private Equity, which is based on the Gold Coast. Need we say more?

Guvera recently released its prospectus, as it tries to raise up to $100m. It makes for breathtaking reading.

Directors are valuing the business — which reported sales revenue of $1.2m last year — at as much as $1.45 billion. That’s not a typo.

Almost as incredible is the fact that Melbourne’s prestigious Arnold Bloch Leibler are on board.

Mark Leibler’s shop is famous for its pro-bono legal work for senior politicians, including Bill Shorten.

There’s nothing free about their Guvera gig. ABL are in line for a $1.6m payday — if the deal comes off.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout