How Virgin kept ahead of repo man

A legal tussle over four jet engines has laid bare the dirty tactics allegedly used by Virgin administrators, including how they directed staff at the airline to withhold key documentation related to the engines from its creditors.

US aviation leasing outfit Willis Lease Finance and its trustee Wells Fargo have taken Virgin and its administrators — led by Vaughan Strawbridge — to court in a bid to reclaim four jet engines and related equipment which is out on loan to Virgin.

It is no small matter, with each of the engines worth as much as $US11m.

The crux of the issue is the unwillingness by Virgin to hand over key documents relating to the compliance and maintenance of the engines — three in Melbourne and one in Adelaide — without which the engines cannot be used.

Under cross-examination, Virgin engineering and aircraft servicing general manager Darren Dunbier revealed that one of the reasons the paperwork had not been provided was not any practical difficulty but rather “because he was being expressly directed by the administrators not to provide them”.

Dunbier accepted that passing over the paperwork in question was a key part of the end-of-lease process, but said guidance from the administrators was that “we are not in a lease return process” and while the company was under their watch, “they act as my board”.

In documents filed to the Federal Court, Willis went further to describe the attitude of the administrator and Deloitte national restructuring lead Sal Algeri as appearing “to treat the provision of records as a bargaining chip with creditors”.

In Algeri’s own words, the signing off of the engines “would expose the administrators and the Virgin companies to an unacceptable level of risk, where no commensurate benefit is being offered”.

That is of course discounting the benefit of having the engines in the first place.

It is no wonder Virgin is breaking out all the stops to avoid sending the engines back to the US lender, with freight costs from Melbourne to Fort Lauderdale alone in the six-figure realm and a clear liability for the already cash-strapped airline. And one of the engines in question was said to be attached to a plane in Adelaide, and subject to an alleged lien by the UniSuper and Perron Group-backed Adelaide Airport.

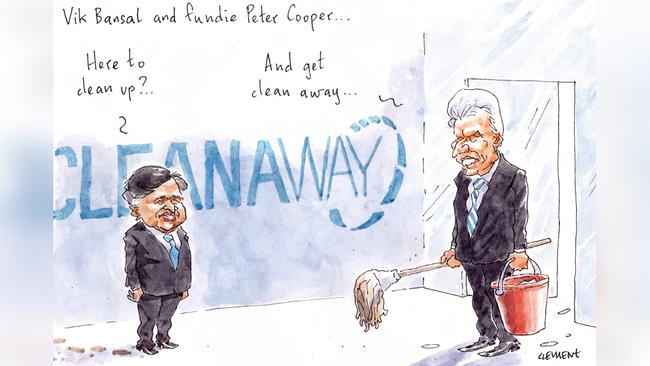

Cooper cleans up

Fund manager Peter Cooper is taking advantage of Cleanaway’s recent woes, joining the ranks of substantial ownership in the past week.

Questions about the conduct of Cleanaway boss Vik Bansal have hogged headlines since the company mentioned his “overly-assertive” behaviour, even prompting a probe from the market regulator in regards to a near $10m share sale.

But that hasn’t deterred Cooper.

Since the release of the bad behaviour allegations on September 14, shares in the waste management group have dropped by 15 per cent and he has used the opportunity to scoop up a 5.016 per cent holding for his Cooper Investors, which manages $13bn in funds.

On the register Cooper is now ahead of both David Paradice’s namesake fund and the Ian Silk-led AustralianSuper, which are sitting on a holding of just shy of 5 per cent.

The race is on

Star Entertainment is no stranger to a gamble, but when it comes to the world’s richest horse race, The Everest, you’d want to hope the odds were in your favour.

The John O’Neill-chaired casino group on Thursday revealed it had snapped up South Australian five-year-old Behemoth to take its slot in the $15m race, but the decision didn’t come lightly.

Despite being a foundation slot holder and one of the biggest sponsors of the 1200m race, Margin Call understands The Star had considered flogging its slot if it couldn’t find the right horse.

At $600,000 apiece, there’s a select market for starting places.

In July, Hong Kong businessman Boniface Ho signed a three-year deal with the Australian Turf Club for rights to its slot, while Goldolphin, the horse stud owned by the ruler of Dubai, Mohammed bin Rashid Al Maktoum, picked up the slot vacated by Damion Flower, after the well-known racehorse owner was charged with commercial drug importation last year.

Grand Syndicates is behind the star galloper Behemoth, touted as a bargain $6000 purchase for the group with three wins from three so far this season.

West Australian couple Peter and Karen Morley are the owners of the gelding, while Sam Lyons, a former Puppetry of the Penis star, is the group’s racing manager.

Naming rights sponsor TAB has locked in favourite Nature Strip, while Tony Fung’s Aquis has its hopes on Golden Slipper winner Farnan, trained by racing royalty Gai Waterhouse.

Grand Syndicates are excited to announce that BEHEMOTH will race in The Star's slot for the 2020 Everest!

— Grand Syndicates (@GrandSyndicates) September 22, 2020

Bring it on!#TeamGrandâ#TheEverestðŸ”ï¸ pic.twitter.com/UmfGsVZwQT

Scentre severance

Maybe it was meant to be Peter Allen’s day after all.

Mid-morning the Scentre Group boss appeared to be having his own “Andrew Roberts” moment.

The legendary and at times ferocious funds manager Andrew Parsons took the floor at a property conference, sending tremors around a high-powered room, with a call on Allen to consider privatising the underperforming local Westfield shopping empire.

On Parsons’ logic if the shares are trading at 40 per cent discount to what the centres are worth then why not take the company private in a profitable, albeit very large, trade.

Allen defused the query with aplomb, leaving none really the wiser as to what he thought of the idea, though it did seem to have flittered into the famed Westfield brains trust.

All this was a far cry from Parsons’ savage dismantling of Roberts during the Multiplex scion’s stint running the then-listed company when it suffered blowouts on the cost of the Wembley stadium’s construction.

But Parsons was not the only one to notice Scentre’s share price slump. Step forward the Brian Schwartz-led Scentre board.

The company did a bit of tidying up on Allen’s contract, flagging that he may be at the helm until at least 2023. And they appear keen to keep him after COO Greg Miles departed.

In a late announcement on Tuesday the shopping centre giant snuck out a variation to Allen’s severance agreement.

Despite a restoration of executive pay at the company to pre-COVID-19 levels — perhaps things are swell and the market is yet to wake up? — it appears that the board was keen to make changes to a deal dating back to when the Lowy family ruled the roost at Westfield.

Allen’s severance deal was halved from 24 months fixed remuneration to bring it into line with market practice. But there was a nice sweetener.

If he is around in February 2023 and hits performance hurdles Allen will be in line for retention awards, half of which are due to vest then and half a year later, amounting to 1.65 million performance rights.

Scentre told the market it “wishes to ensure that key members of the group’s senior executive team” are retained “through the current volatile environment”.

Schwartz and co appeared worried that without such a grant, the usual retention components will not operate effectively.

A 40 per cent drop in the share price from its heights will do that.

So the company’s existing long-term at-risk remuneration granted in 2018 and 2019 will not vest in 2021 and 2022. Scentre said the execs had been on track for vesting prior to the impact of the COVID-19 pandemic, but they would now lapse.

The board also determined not to grant 2020 rights to execs that were approved at the AGM in April but are now “unattainable and provide neither a motivational nor retention tool”.

The bosses had also “experienced a significant reduction” in the value of their shares in the group, and on deferred but unvested components of the short-term at-risk remuneration from 2017-2019.

Not to worry.

The board has now stepped in, so “we have the best team to respond to the challenges before us in the best interests of our securityholders and all stakeholders”.

Curious this was not announced ahead of Scentre’s wildly successful UBS-led $US3bn hybrid issue last week.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout