Dividends the right medicine

The billionaire Gance and Verrocchi families who control the discount Chemist Warehouse chain have just declared a $200m dividend for themselves from the chunk of their retail empire that sits within the families’ CW Group Holdings operation.

The payment, declared on March 12, is in addition to a whopping $350m dividend that directors of the holding company paid family shareholders in the most recent full financial year, for a total payout of $550m over the past 20 months of trading.

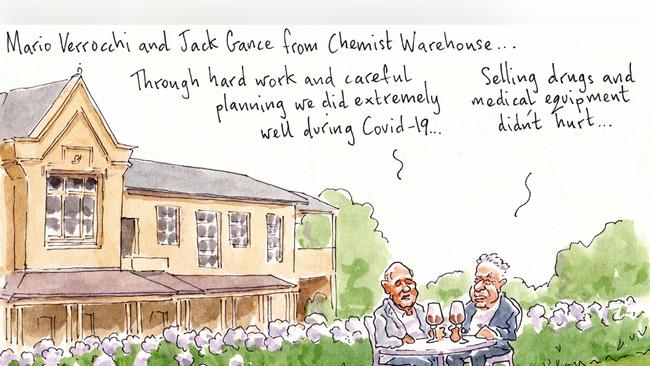

Financial accounts just lodged by the group for the year to June 30, 2020, reveal the bumper payouts follow what notoriously private billionaire founders Mario Verrocchi and Jack Gance said was a year in which their operations proved their adaptability.

“The group has proven highly resilient to the impact of COVID-19,” Verrocchi and Gance said in their directors’ report.

The massive withdrawal of monies from the operation via dividends comes as the family owners continue toying with the idea of floating the retail group on the sharemarket.

The company is being advised by Rothchild but is yet to appoint managers for a float.

The dividend payment would also have assisted with Verrocchi’s estimated $40m purchase of Morning Star Estate on the Mornington Peninsula towards the end of last year.

Corporate records for CW Group Holdings, which was previously known as CW Retail Trust, do not reveal relative ownership stakes in the company and do not appear to reflect the entire operations of the retail giant.

Part of the CW empire is controlled by Verrocchi’s East Yarra Friendly Society, with the combined operations said to generate in the order of $5bn revenue a year.

Accounts show that for its part, CW Group Holdings reported $2.45bn in revenue in the 2020 financial year, up from $2.18bn previously.

That translated to a bottom-line profit of $229m from $190m in 2019.

Since balance date, the company has purchased five existing Chemist Warehouse stores in New Zealand and opened its first store in the European Union, located in Blanchardstown, Ireland.

In the year the group also altered agreements with existing franchisees as part of its corporate reorganisation towards a possible float.

But the dividend splurge has not left the tank empty, with CW Group still boasting a retained earnings balance of more than $30m.

Oh happy days.

Stamp of disapproval

Months of silence from former Australia Post boss Christine Holgate turned into an extraordinary crescendo on Tuesday, with no less than 154 pages of pure fire aimed squarely at her former chairman Lucio Di Bartolomeo.

The blame, according to Holgate, lay with Bartolomeo, whose actions she claimed “were unlawful and made my position completely untenable”.

In an unprecedented move, Holgate laid bare every minute detail in her personal submission to the Senate inquiry into the circumstances surrounding her exit, going so far as to list hour-by-hour chronologies of the events leading up to and following the decision.

Aside from the sheer gravity of the allegations in the document, the detail paints a clear picture of just how connected the now scorned businesswoman is — in her hour of need calling on her impressive rolodex of top names in the business and political realms.

It is any wonder then that she also included a glossary of personalities — listing everyone from Treasurer Josh Frydenberg to her lawyer Bryan Belling.

The detailed, almost diary-esque recollection notes text message conversations with several continuing board members, including one from Bruce McIver that read “Sad Day” after Australia Post had announced her resignation, as well as to-the-minute text message transcripts from the likes of Communications Minister Paul Fletcher and Trade Minister Simon Birmingham.

A few subtle digs for the pollies among the barbs for the board, with Holgate noting that Fletcher and PM Scott Morrison’s approach to the situation “was in complete contrast to how they have treated people in their own party or who had paid $30m for a piece of land which was valued at $3m”.

Of course that was a reference to the Western Sydney Airport land deal that got Fletcher in hot water last year.

But it wasn’t all bad, as plenty of staff at the organisation had come out in support of their in-limbo chief, she said.

General manager of customer services Taeressa Fawthrop was the first listed in a section of acknowledgments, along with Holgate’s former EA Vicki Ballantyne and People and Culture head Sue Davies.

And who could forget her former boss Marcus Blackmore, at whose northern beaches pad she was spotted among the turbulence, or former Allianz Australia chair Shaun Bonnet, so-called Liberal powerbroker Drew Abercrombie and AustralianSuper’s Ian Silk.

Evidence included in the submission, including that Holgate is still yet to sign a deed of release from the top job, gives some insight into the hold-up in hiring for her replacement — with Post still being headed by CFO Rodney Boys (who Holgate wasn’t particularly impressed with either).

Don’t expect Holgate’s weighty dossier to be the last we hear of this whole sorry affair, with the first public hearing on the matter scheduled for next Tuesday.

We can’t wait.

Just horsing around

Meanwhile, back at the ranch, none other than mega bloodstock operation Inglis and its chairman John Coates (better known for his Olympic pedigree) was kicking off its two-day Easter auction, touted as the Southern Hemisphere’s No 1 equine auction.

We wonder what Gerry Harvey and his Magic Millions will have to say about that.

It was the auctions that got most of the attention, with Hong Kong banker and casino operator Tony Fung, represented by Shane McGrath, splurging more than $3m for two colts sired by Exceed and Excel, including one of his most expensive yearlings to date at $2.1m.

But he wasn’t the only to break the $1m barrier — Tom Magnier of the prestigious Coolmore Stud picked up a colt with James Harron for $1.15m, and another on his own for a flat $1m, taking his total spending for the day to a cool $4m.

Racing royalty Gai Waterhouse managed to make a few bids. With business partner Adrian Bott she spent $2.7m across eight different auctions. Not bad for a day on the track.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout