Directors schooled on old school tie risks

Another day, another private school crisis.

The arrival of the coronavirus at elite Baptist coeducational Carey Grammar in Melbourne’s leafy, affluent Kew.

A governance crisis at Catholic boys school St Kevin’s College in Toorak, and before that youthful stupidity in the drive through from students at nearby Anglican institution for girls St Catherine’s School.

Melbourne’s elite schools have made headlines in recent weeks for all the wrong reasons, highlighting the risks of the city’s leading business men and women taking on pro-bono directorships of their kids’ (or their own former) schools.

Carey was closed on Tuesday for the rest of the week after two teachers tested positive for COVID-19.

That puts ANZ director and Amcor chairman Graeme Liebelt in the frame as a member of the school’s board and its treasurer, along with senior counsel Norman O’Bryan, who is Carey’s deputy chairman as well as chairman of Stephen and Peter Hill’s Globe International.

At fellow Associated Public School, the Catholic St Kevin’s College, Commonwealth Bank director and former BlueScope boss Paul O’Malley has taken over as chairman with effective oversight of the school following the exit of principal Stephen Russell and a clutch of his most senior staff over their handling of child protection issues.

And up the road at St Cath’s, Westpac director and former ANZ chief numbers man Peter Marriott, Herbert Smith Freehills veteran Jane Hodder, Credit Suisse vice-chairman and former career MacBanker Wayne Kent and Bell Potter stockbroker Patrick Cody will be thanking their lucky stars all they had to deal with was a drive-through posting on TikTok.

Such directors might be on school boards for free, but recent weeks sheet home that it might pay to start reading the board papers. And checking their professional indemnity insurance.

Down on Crown luck

Here’s the lesson in having an undiversified portfolio.

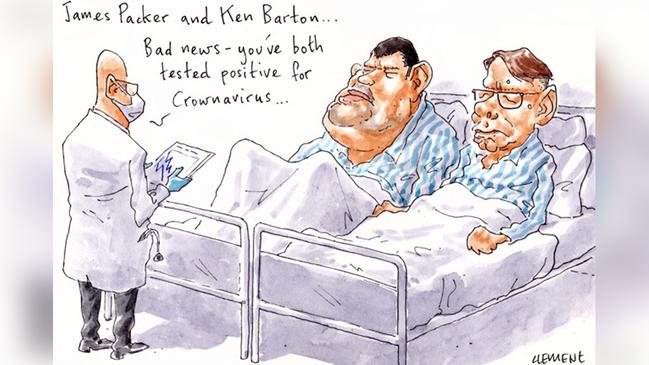

While gaming billionaire James Packer and his trusted lieutenants await news on the future of the Patricia Bergin-led NSW gaming regulator’s paused inquiry into Crown Resorts, shares in the Australian businessman’s listed empire are crumbling amid the unfolding equity market rout.

The coronavirus and the regulatory uncertainty that is overhanging Crown has resulted in the group’s shares falling by about one third in value since the start of December last year.

And that decline has wiped more than $1bn from the 52-year-old Packer’s personal wealth that’s tied up in Crown.

Ouch.

The now reclusive billionaire has about 35 per cent of the listed Crown, due to the collapse of his deal with Hong Kong billionaire, close friend and former business partner Lawrence Ho, who was supposed to buy almost 20 per cent of Crown in a deal that was eventually scaled back to 10 per cent.

At the end of November, Packer’s 237.03 million Crown shares were worth about $3.2bn as the stock traded at $13.18. But since then Crown shares have dropped like a stone to trade as low as $8.88, valuing Packer’s stake at $2.1bn.

That’s $1.1bn down the toilet as traffic at Crown’s Melbourne gambling den continues to decline due to concerns about catching COVID-19 there.

It’s all looking like a hospital pass to new Crown boss Ken Barton and chairman Helen Coonan, who took over from former executive chairman John Alexander at the end of January.

The news isn’t great for new shareholder Ho, either.

He paid $13 a share for his 67.675 million Crown shares and so is down $280m on the deal.

They might do better playing the pokies.

Bellevue Hill battle

Billionaire shopping centre developer Bob Ell is not happy that his Bellevue Hill neighbours in Sydney’s east have $9.1m worth of new home plans.

It’s not so much that the 29-year-old China-born Kunyu Zhang, director of investment firm Bridgehill Management, wants to demolish a 1920s home, but rather its overarching size.

Ell and wife Bridget, who are not the only objectors to the proposal, maintain that the proposed Brewster Murray Architects design exceeds the 9.5m height rules. They also calculate the floorplate shows a 50sq m breach.

They question compliance with the 12m balcony privacy separation rules.

Ell, who has homes on the Gold Coast and Noosa, is concerned at likely excavations volumes.

The 1600sq m Cranbrook Road holding was purchased by Zhang for $15m in 2018 from the family of the late Singaporean banker and hotelier Tan Sri Khoo Teck Puat, who some 33 years prior had paid $1.5m in 1985.

It was around the time Khoo was ranked Australia’s richest man, a spot he shared in between the years when Robert Holmes a Court was our richest. Khoo had an estimated net worth of about $600m.

The home, Ngarita, has a historic sandstone entryway, tree-lined driveway and grand entry portico.

There are dramatic fireplaces, original joinery and stained glass period windows.

Meanwhile, the Ells’ longtime Noosa holiday home is under offer after asking $11.5m.

The Leda Group founder knocked down the 1980s waterfront and had Vantage Holdings build a luxury six-bedroom, seven-bathroom home complete with 10 Nascam security cameras. And, of course, six Foxtel outlets.

It was an astute purchase by Ell, who paid $2.75m in 2011, four years after it traded for $4.85m, just before the GFC hit Queensland. Real estate agent Tom Offermann, who sold the property to Ell, was marketing it this time round alongside his daughter Rebekah.

Scooti court case

The major backers of scooter ride share start-up Scooti had fallen out ahead of the recent appointment of administrators.

Cameron Nadi has NSW Supreme Court proceedings under way. The Mascot-based entrepreneur is claiming $168,000 is owed to him. The action is against Scooti, the entity co-directed by William Harris, a Glebe-based entrepreneur who has held the controlling stake since mid-2018. Nadi is seeking operational expenses including hiring IT professionals via Seek for the disrupter start-up. There’s also all those flights to and from Melbourne, where Scooti was launched in 2018.

Nadi wasn’t exactly jetsetting, predominantly flying with Jetstar or Tiger Air, according to billing invoices. The Scooti app got to Sydney, but apparently just south of the bridge. Holding a 30 per cent stake, Nadi had been its initial chief executive from 2017 to 2018. Scooti’s chief executive, Brett Balsters, was named a co-director this time last year. The Uber-style scooter taxi start-up is being administered by Deloitte, which found a buyer of its licensing agreement to keep the business operational. Last month, Margin Call revealed Deloitte got the gig after a referral by insolvency player James Byrnes. The case will be heard at the end of the month.

McGrath’s Tassie trip

The mainland estate agency McGrath Estate Agents had 120 of its key agents in Hobart on Tuesday at a franchisee leadership talkfest, where they heard from the likes of REA Group executive manager economic research Cameron Kusher on the market outlook.

McGrath doesn’t have a presence in Tasmania. However, it is on their radar and then apparently even New Zealand. Geoff Lucas, the chief of the ASX-listed agent, led the troops using the trip to speak with a couple of local agents about entering the market. It was then off to MONA for dinner then on to the cocktail bar The Den, at Hobart’s Salamanca Place. McGrath shares are at around 26c having dipped as low as 20c last August.

Founder John McGrath was back at his Breakfast Point apartment suffering laryngitis.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout