Denholm’s Tesla gig a tidy earner

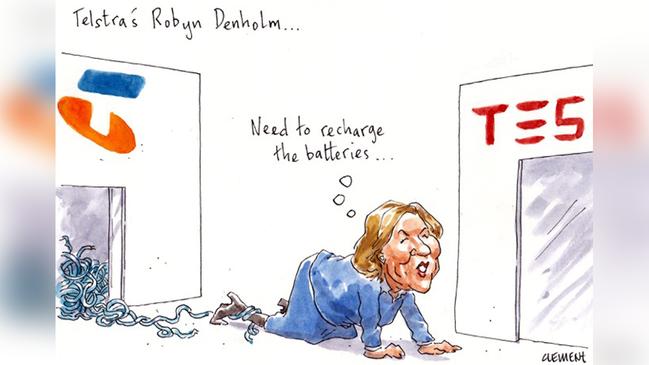

Andy Penn’s Telstra releases its results on Thursday. Just as well Elon Musk’s Tesla boardmate Robyn Denholm hasn’t yet taken over number crunching duties at the telco — how could she find the time?

Denholm’s lucrative side project on the board of Tesla — a company the subject of two new shareholder class actions and interest by the US corporate cop SEC following Musk’s extraordinary tweeted plan to privatise the firm — is becoming increasingly time consuming.

Life will be interesting for Denholm when she takes over Telstra’s CFO duties from Warwick Bray on October 1.

She has had experience juggling an executive role and duties on the $82 billion electric car maker’s board, which she joined in 2014.

Denholm, the former CFO of Juniper Networks, has been the chief operating officer of Penn’s now $34bn telco since early 2017.

Still, if Musk is thrashing about in the lead up to Telstra’s half-year results in February, expect calls to grow for Denholm to focus on her day job at the telco.

There are understandable reasons for Denholm to be reluctant about stepping back from Team Musk. Bloomberg has calculated the average annual remuneration for Tesla directors over the last three years was $US2.6 million ($3.6m).

Most of that is in shares in Musk’s electric car empire. If the many investors shorting Musk are right, that bundle may become a lot easier to give up — should it come to that.

No more hanky panky

Four months ago, NAB executive Andrew Hagger and his exuberant pocket square were the talk of Kenneth Hayne’s royal commission.

Hagger even changed pocket squares when he returned overnight during the April hearing.

This was a proud member of the banking brigade — a man on $3.5m a year with a keen focus on his bonus and nothing to apologise about.

Incredibly, Margin Call was told by NAB sources that appearance was the first time they had seen Hagger wear such a thing. They reckoned he was dressing up for the big moment.

Not so on his second separate summons yesterday.

Wisely, the aspiring Big Four CEO kept the fashion kerchief in his bespoke drawers. The wisdom of age, perhaps. Hagger turned 52 in June.

So, how did he go?

Counsel assisting, Michael “Babyfaced” Hodge, and commissioner Hayne didn’t seem to be too pleased with Hagger’s testimony.

That was not entirely personal.

After spending almost five of the commission’s 10 days looking at superannuation dealing with Andrew Thorburn’s pinstriped ensemble, they gave the impression they are completely sick of the bank.

But in banking circles there was a grudging respect for Hagger. Yes, he looked uncomfortable at times — gulping his water, looking to the heavens — but this was a tough assignment.

As Margin Call revealed on Friday night, Hagger was only summoned just before the weekend.

A bad performance could have been the end of his dreams to succeed Thorburn as NAB’s pinstripe-in-chief, a C-suite vision shared by chief operating officer Antony Cahill, institutional banking boss Mike Baird and BNZ chief Angela Mentis.

Based on his latest royal commission performance, he shouldn’t be entirely out of chairman Ken Henry’s consideration, when the time comes.

Cato’s multi-tasking

What a tangle Ben Roberts-Smith and Fairfax are in right now.

Roberts-Smith, a Victoria Cross recipient now working at Kerry Stokes’s Seven West, has Sue Cato in his corner as he challenges a Fairfax investigation into his conduct while an Australian Army soldier fighting in Afghanistan.

Cato is also chief adviser to Greg Hywood’s Fairfax corporate operation. So far Team Robert-Smith’s tactics have included an unsuccessful legal challenge to stop publication by Fairfax.

A friend of the spinner said it was “proof of Fairfax’s ‘Independent Always’ culture — the perfect illustration of corporate and editorial separation Fairfax”. That’s one way to describe it.

Also in the media storm is former 60 Minutes journo Ross Coulthart, who as Margin Call revealed last month has joined Cato and Brett Clegg’s spinning outfit.

Since going to the dark side in April, the Gold Walkley winner Coulthart has, among other projects, been investigating Fairfax’s reporting on Roberts-Smith.

We gather it’s part of a new “business intelligence unit” that Coulthart is leading at Cato & Clegg.

Scratched

It has been a torrid few days for former Seven West Media executive Nick Chan and his BetMakers boardmates.

The capital raising that is planned to transform the Sydney-based gambling outfit is due to close today at 5pm.

Unfortunately, Margin Call hears the raising — which was originally to close on August 2 — has been a bit short on takers.

The share price demonstrates as much. The ASX-listed BetMakers — which changed its name from TopBetta in June as it repositioned its business — yesterday closed at 7.6c, below the offer price of 8c a share.

When trying to raise money, that’s an unhelpful situation.

The raising is to fund BetMakers’s still-to-be-finalised $10m acquisition of Global Betting Services, an outfit that helps with fixed odds pricing.

Global Betting Services is used by much of the local online bookmaking industry, including William Hill, Sportsbet, Unibet, Ladbrokes and Bet365. It’s an important back end function in the online gambling world.

We gather Chan — who as well as working for Kerry Stokes’s Seven was once at Kerry Packer’s ACP and more recently was the local chief for German billionaire Yvonne Bauer — was yesterday working the phone to some wealthy, horseracing types.

We’ll find out soon how well that went.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout