There will be a few bruised egos in Deloitte’s insolvency division after the battering a couple of its partners copped at the hands of Federal Court Justice Roger Derrington this week.

Australia’s small world of company administrators and insolvency practitioners is notoriously competitive, with relations between rivals occasionally a little fractious. Snide, catty and backbiting are other words that get the odd airing by insiders.

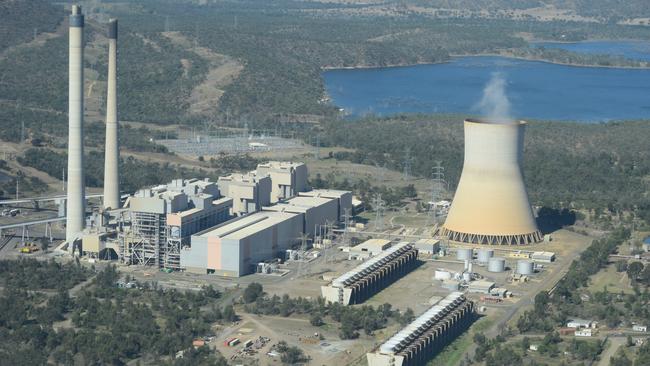

Derrington this week installed FTI Consulting’s John Park and Benjamin Campbell as special administrators to investigate the extraordinary equipment failures that have put Queensland’s Callide C power station out of commission for more than 1000 days.

That’s an embarrassment in itself, but Derrington also became a touch acerbic over the failure of Deloitte’s Grant Sparks and Richard Hughes to do the job themselves.

“Despite the obvious importance of determining the cause of, and responsibility for, the failures of units C3 and C4, the administrators have not undertaken any appropriate investigations. The evidence in their affidavits tends to obfuscate rather than clarify what work they have performed in this respect,” Derrington said in his reasons for the decision.

“In circumstances where Mr Sparks gave evidence that he has considered a number of reports that are (in his apparent view) relevant to the failures of units C3 and C4, it is strange that he omitted from his evidence any opinion that he or Mr Hughes formed as to the causes of those failures.”

Those reports don’t include the one commissioned by Callide operator CS Energy from forensic engineer Sean Brady, now the centre of political controversy in Queensland, because Brady is yet to deliver that report.

As an investor in Callide, Czech coal tycoon Pavel Tykac’s Sev.en Global Investments sought the appointment of FTI – in the clear hope of unearthing enough evidence of failures by CS Energy that would back a court case to recover their losses.

CS Energy is owned by the Queensland government and has helped fund Deloitte’s administration – and also commissioned and paid for the yet-to-be delivered Brady report.

“To exacerbate their failure to perform their statutory function, they have put themselves in a position whereby they might have to rely upon a report produced for CS Energy, specifically – an entity that has an obvious interest in deflecting blame away from it,” Derrington said.

And the hits kept coming, with more than a few references to the administrators having “fallen well short of the standard ordinarily to be met in the performance of their statutory duties” – a clear warning shot in a regulatory regime that relies on individual, not corporate, licensing and never a lot of fun when coming down from the bench.

“Prima facie, therefore, the work undertaken by the administrators to ascertain the vital information concerning the causes of, and responsibility for, the incidents in question has fallen below the standards required,” the judgment says.

In the end, it was a pretty comprehensive win for Sev.en’s lawyers, Quinn Emanuel. But they weren’t entirely confident of victory on Monday, if the brief look of surprise on the face of Quinn Emanuel partner Elan Sasson as Derrington delivered his orders via webcast was any guide. A look quickly followed by a few unsuccessful attempts at covering up a broad grin as the rest of the orders were handed down.

Geminder foiled?

The best laid plans of mice and men and billionaires often go awry.

Billionaire packaging mogul Raphael Geminder will certainly be thinking about the remaining “rats and mice” shareholders on the Pact Group register as he contemplates a possible late hitch in his grand plan to mop up minority shareholders in the listed packaging group, take the company private and put it out of its share price misery.

The hitch comes courtesy of packaging businessmen David Harris and Mark Gandur, who have popped up on Pact’s share register after buying shares to lift their stake to 5 per cent and become substantial shareholders

Geminder, married to Fiona, the sister of fellow billionaire Anthony Pratt, late last year launched a bid for Pact priced at 68c a share, but that lowball bid was rebuffed by shareholders and independent Pact directors, forcing Geminder to come back with a sweeter bid at 84c a share – valuing Pact at $289m.

That was enough to win the support of the Pact independent directors even though an independent expert argued the company was worth between 83c and $1.24 a share.

At its peak in 2017, Pact shares were trading at about $7, to value the company at $2.4bn, but growing losses and a sinking share price looks to have persuaded even the most loyal shareholders to take up Geminder’s offer and cash out.

Geminder quickly upped his stake from 50 per cent when the takeover was launched, to just shy of 85 per cent on Tuesday afternoon, as shareholders rushed to accept his takeover offer.

The few institutional shareholders that had been watching their investment in Pact slowly but surely shrink into insignificance also cashed out.

Investors Mutual, Pact’s largest institutional investor with a stake of 5.54 per cent. sold into the takeover, as did Sydney-based RealIndex Investments (3.66 per cent stake), London-based hedge fund Samson Rock Capital (2.83 per cent), Sydney-based Acadian Asset Management (0.61 per cent) and all the Pact board and management team.

So close to holding a 90 per cent stake and moving then to compulsory acquisition, Geminder must have thought he was almost home.

Not so fast! Harris and Gandur know the packaging game very well and the inside workings of Pact, because in 2018 Pact bought their packaging business, TIC Retail Accessories, for $122m.

The acquisition was paid for in a mix of cash and shares, so Harris and Gandur have been Pact shareholders for a while, but they have now decided to scoop up more stock just as Geminder was looking to close his takeover and delist the company.

The TIC vendors don’t have enough yet to block compulsory acquisition (that needs at least a 10 per cent voting block) but they are getting close and Geminder could be sweating on what happens next.

Geminder could face the worst case scenario of him controlling just under 90 per cent of Pact, a recalcitrant investor refusing to budge and then blocking his plans for taking it all private.

Geminder isn’t believed to have spoken to Harris and Gandur yet, and the advisers in Geminder’s team are scratching their heads as to what their motive and plans are.

Meanwhile, the Pact share price is stubbornly trading just above Geminder’s offer price of 84c a share, further complicating his ability to mop up minority shareholders.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout