Patricia Bergin’sinquiry into Crown Resorts might be missing appearances from billionaires James Packer and Lawrence Ho but one big name is set to step into the witness box next week.

Crown’s former head of VIP operations, Jason O’Connor, takes the stand.

It was O’Connor who served a 10-month sentence in a Shanghai prison from October 2016 until August 2017 for promoting gambling.

O’Connor is still working for Crown as its innovation and strategy manager.

He was visiting China to meet with Chinese high-rollers in 2016 when he was picked up by authorities on his way to the airport.

He was convicted of gambling crimes.

“It’s all still too raw,” he advised the month after his release, when approached by a reporter outside his home in suburban Melbourne after his deportation from China.

“I’m just not ready to talk to you guys yet. Maybe one day.”

That day comes next Wednesday in Bergin’s witness box, which the former NSW Supreme Court judge herself recently described as “not a place of comfort”.

One solace for O’Connor is that he will have a star-studded team representing him in the form of Neil Young, the former Federal Court judge, and the former star counsel assisting the banking royal commission, Rowena Orr.

The last post

Lost in the mail?

Normally, if you can churn out a profit during a pandemic, chief executives want to tell everyone and their dog about how good their management is.

Not so for our chief postie Christine Holgate, who it appears has suddenly developed a modest streak.

The postal service quietly published their annual profit results on its website, a day after copping a reprimand from the Senate about dodging scrutiny in its much hyped inquiry into Australia Post’s efforts to slow down letter deliveries.

There were none of the typical media briefings and calls. We don’t know why. The results were good. Revenue rose 7 per cent, or more than $500m, to $7.5bn on the back of surging parcel deliveries during COVID lockdown.

Its profit soared 30 per cent to $53.6m.

Sure letters revenue fell 10 per cent to $2bn — not a bad effort considering only a few months ago when Holgate secured government permission for posties to deliver every second day she warned of a collapse in letter volumes.

Opposition communications spokeswoman Michelle Rowland was quick to have her say.

“These results completely contradict the narrative Australia Post were briefing out to the press gallery when they began laying the groundwork to cut services and jobs under the cover of COVID-19,” Rowland said.

“It hasn’t addressed letter volumes that ‘collapsed’ in April — but rather the integrity of (Communications) Minister (Paul) Fletcher on Australia Post.”

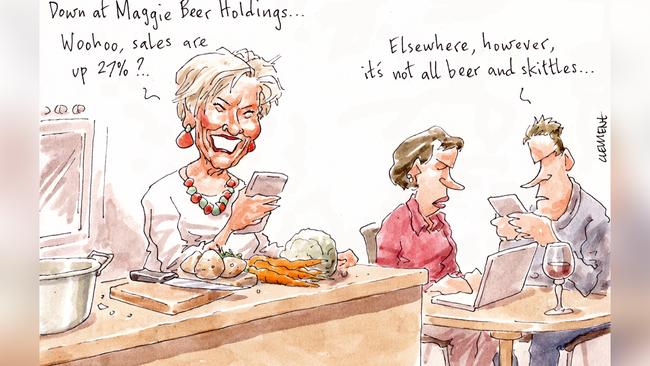

Beer goes vegan

Much-loved gourmet foodie Maggie Beer could soon be the poster girl for veganism.

She’s set to unveil a range of vegan meals with a new range of Maggie Beer plant-based take-home meals to be sold at Coles from October.

Beer owns a 3 per cent stake in her namesake company, which saw a $5.6m turnaround in the latest finance year.

Margin Call doesn’t mind her capsicum and eggplant roulade or chickpea and beetroot salad, but ideally with her chargrilled Barossa lamb recipe.

The company announced this week that annual net sales were up 27 per cent in July, given the push to home cooking during the pandemic.

Her online cooking series, Cooking with Maggie, has attracted 4.5 million views over the past few months, while its shares have trebled to 28c.

Beer is a director of the ASX-listed company, which assumed her name in July after dumping its previous moniker Longtable Group.

Maggie Beer isn’t the only company pivoting to plant-based meals — v2food, the company backed by Jack Cowin, is seeing its plant-based meals stocked in the meat aisle of Drakes Supermarkets in Queensland and South Australia.

Sharma takes stock

The thoroughly modern politician Dave Sharma’slatest round of investments has seen him again favour the booming technology sector. He’s become an investor in FANG, the exchange-traded fund that focuses on the high-growth technology sector.

The ETF product offers low-cost access to global innovation leaders listed on major US stock exchanges. The acronym refers to the stocks of Facebook, Amazon, Netflix and Alphabet’s Google, with Apple causing the acronym to be rewritten as FAANG in 2017.

On the local tech front, the member for Wentworth has added Nearmap to his portfolio. It is the Peter James-led Australian imagery technology and location data company that provides high-resolution aerial imagery around the world.

JPMorgan outbreak

Further staff at JPMorgan’s Sydney office have been caught up in the COVID-19 cluster.

Two more cases took the tally to three by Thursday morning.

All apparently on the same floor as the initial case identified on Tuesday when it was closed and cleaned.

The Castlereagh Street office floor staff, told to stay at home, have all had a work station set up for them for the past few months, given the preparation in March when JPMorgan country head Rob Bedwell decided to split the entire Australian firm into smaller teams.

Margin Call wonders what its genomic tracing will show. Possibly caught in the David Jones food hall, or maybe the Fitness First gym on Bond Street. Unlikely any of them caught it on the train from Woy Woy.

Focus on BidEnergy

The former co-founding Afterpay executive David Hancock has dived back into the fintech market. He has joined the global utility bill management solution service BidEnergy as a non-executive director.

BidEnergy currently has an interim chair, the Crown Holdings chief financial officer Geoff Kleemann, following the departure of Andrew Dyer in June.

Dyer was in a dispute earlier this year with its former chair, Melbourne businessman James Baillieu, which saw a confidential settlement.

It is also seeking a financial officer to replace Matt Watson.

“David is a tremendous addition to the board, having previously demonstrated what it takes to take a local Australian tech story to become a global success,” Kleemann advised.

Hancock will subscribe for 574,713 shares under a placement to invest $500,000, based on an issue price of 87c being the 30 day volume-weighted average share price leading to Wednesday. They jumped on Thursday to $1.03. The company will also seek shareholder approval for the issuance of up to 225,000 director incentive options with an exercise price of $1.46 with an 2024 expiry date.

Falloon’s penthouse

The veteran media player Nick Falloon had other priorities on Thursday than being desk-bound as Nine Entertainment announced its disappointing full-year financial result.

His attention was on renovation plans for his $15.5m Villard, Potts Point penthouse.

The Iain Halliday refurbishment of the two-storey Macleay Street apartment has an estimated $2.8m cost.

The Nine deputy chairman and Domain chairman partook of a quick mince on toast lunch with wife Diane before heading back to their longtime Longueville waterfront.

The couple were overheard planning their dinner.

Chicken at 6pm!

Nine announced a net loss of $590m for the year to June, hit by impairment charge of $588.7m, compared with a net profit of $221.2m a year earlier.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout