Patricia Bergin’s Crown report costs James Packer $85m

Call it the Bergin effect.

Former NSW Supreme Court judge Patricia Bergin cost in-crisis billionaire James Packer a cool $85m on Wednesday as investors ran for the hills from his Crown Resorts following the release of the formidable 71-year-old’s blistering report into the casino group’s operations.

Packer owns 37 per cent of Crown and the stock’s 3.4 per cent decline on Wednesday pushed the value of his controlling stake to $2.46bn — that’s the stake that until only recently allowed Packer to control Crown’s operations from afar despite having no board or executive role at the gaming group, and that dominates the billionaire’s investment portfolio.

In recent years Packer, whose wealth early last year was estimated at $4.25bn in this newspaper’s The List, has relied heavily on the Crown dividend as his main income stream to fund his international lifestyle.

For almost five years, Crown has paid a dividend of 30c a share in each half (with the occasional even higher payout), only suspending this payment at the last reported half due to the devastating impact of the coronavirus on Crown’s operations.

Based on Packer’s stake, that’s a dividend payment of about $150m each normal operating year.

Crown is set to report its full-year results next Thursday and has said “dividends will be subject to the board’s assessment of Crown’s financial position”.

For Packer, that’s a critical $75m question.

Review slow going

Down in Dan Andrews’ Victoria, the punters are still waiting for news of a dedicated commissioner to run the Labor government’s brought-forward review into Crown’s operations announced last year off the back of revelations in NSW.

Has anyone thought to ask Patricia Bergin?

Meanwhile, the ever nimble Victorian gaming regulator doesn’t even have the grunt to get going either, busy recruiting staff to undertake what is the seventh casino review, which the government wants done this year.

Reviews are normally conducted every five years, with the sixth review completed in 2018, but the damning evidence heard in Bergin’s gripping hearings prompted Andrews’ new Gaming Minister and relative newcomer to the state parliament, Melissa Horne, to bring forward the whole shebang.

Towards the end of 2019, VCGLR boss Catherine Myers lamented there was little she could do when it came to overseeing Crown, given her office was severely understaffed.

Well, Daniel Andrews has found some money somewhere and now Myers is seeking to recruit at least four new staff to help with the heavy lifting on the Crown review.

Leading this charge is the newly promoted “acting” head of the casino probity and investigations team Scott May, who until a few weeks ago was the VCGLR’s general counsel.

May is looking for a “principal investigator” to contribute to the successful delivery of the seventh review, as well as a “senior investigator”. Both will be “part of a multidisciplinary team responsible for delivering complex investigations under tight time constraints”.

Bergin’s Crown inquiry ran for 18 months.

May and Myers are also recruiting a “senior policy officer” for their review team, plus an “administration officer” who will support the entire casino probity and investigations team.

All the while over on the west coast, the state’s Gaming and Wagering Commission doesn’t seem too fazed about the unfolding crisis, waiting to consider the report at its scheduled February 23 meeting.

No hurry.

Who gets short straw?

But back to Crown’s scheduled release of first-half results next week.

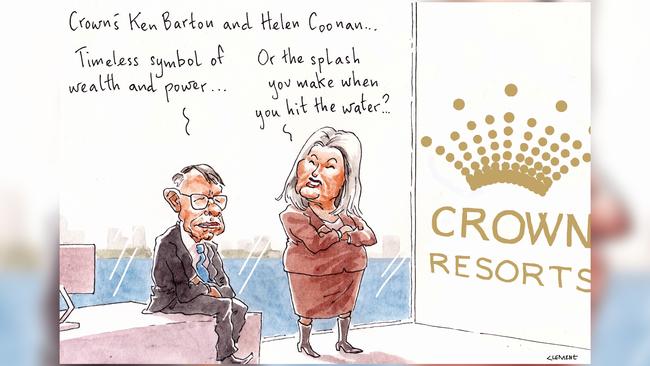

By then, chair Helen Coonan will likely have seen off mortally-wounded Crown boss Ken Barton, but who will draw the short straw to front the market and step into the CEO’s chair, even in an acting capacity?

It’s not a straightforward choice for former Howard Government minister Coonan – following the robust Bergin inquiry the chair’s executive ranks are significantly diminished, with a cull expected to continue in the coming weeks.

Crown’s veteran head of Australian resorts Barry Felstead has gone, as has legal chief Joshua Preston, both whose reputations were smashed in the inquiry.

As has happened in the past, Coonan can’t call on a trusted Packer lieutenant to hold the reins. His key men Mike Johnston and Guy Jalland as of Wednesday morning are no longer on the board, while the future of suddenly former CPH consultant John Poynton also as a Crown director is precarious.

Crown’s head of strategy Todd Nisbet might not be an option given his status as part of the clique that was reporting into Packer after he’d come off the Crown board.

But there is CFO Alan McGregor, who might have only been in his current less than six months, but has a long background counting the pennies for the group in Perth, then Melbourne before gaining the top finance gig.

Of remaining Crown directors, there is one standout candidate – gaming industry specialist Antonia Korsanos, who Bergin has declared “an asset to the Crown board”.

Korsanos, a former exec at Aristocrat, is only 51. She’s been on the board since 2018 so has passed probity, is chair of the audit and corporate governance committee and was further described by Bergin in her report as “honest, clear, direct and helpful”.

Not a bad reference hey.

Cashing in chips?

So things are set to blow in Crown Resorts’ executive ranks, with Ken Barton likely counting down to his own departure, with the Helen Coonan-led board now staring down the prospect of its fourth chief executive in just three years.

There’s certainly no time to be wasted, and with that Barton must see the writing on the wall.

Though his parting from the casino operator may not be on the best of terms, there’s no doubt that after 11 years of loyalty, as CFO then chief, Barton won’t be going home empty-handed.

At the end of the most recent financial year, Barton held 143,128 shares in Crown, worth roughly $1.4m – even after a slight knock to the group’s trade on Wednesday morning.

On top of that, he is a party to the only two long-term incentive schemes in place at the $6.7 billion company.

He holds 3 million options issued as part of the 2017 senior executive incentive plan, which are coming up to their expiry on February 22 – with an exercise price of $11.43 each. Sadly, that means Barton’s stock is out of the money.

But Barton was the only exec to score under the Crown Digital Incentive Plan – giving him a further interest in 8.51 million ordinary shares in Crown Digital, a wholly owned subsidiary of Crown he ran from 2017 that includes investments in online wagering plays Betfair and millennial-targeted Chill Gaming.

Those expire at the end of December 2022 and were granted with an exercise price of $1.45, although it is unknown what actual shares those options relate to. If they happen to be just the same or Crown ordinary shares, Barton is in for a bonanza.

Both options are subject to a single vesting condition – that the executive in question continue to be employed four years after the grant date, or that they be classified as a “good leaver” at the expiry date.

Exit strategy

Whether a good or bad leaver is a question for chair Helen Coonan and Crown’s board (albeit now dramatically dwindling in numbers).

The board also holds the power over Barton’s termination payment and any golden handshake, with his contract noting that Crown can show him the door with no notice for a serious breach or misconduct.

Whether Coonan and her fellow directors consider Patricia Bergin’s description of Barton in her report as “no match for what is needed at the helm of a casino” remains to be seen.

Alternatively, Barton is entitled to a notice period of 12 months. He was paid $3.34m last year, so he’d be hoping to get at least that.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout