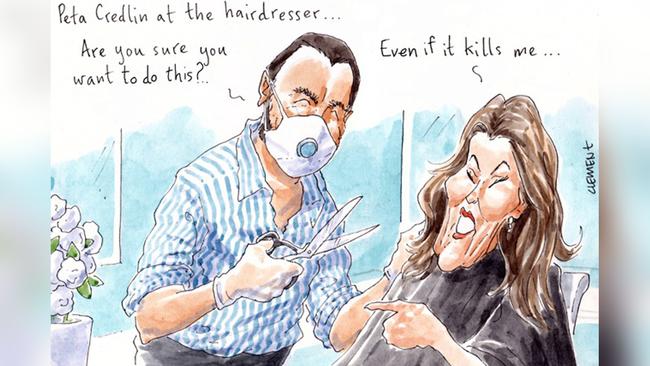

The most influential players in overturning the coronavirus 30-minute hairdressing appointment edict were possibly the Sky News presenter Peta Credlin and her hairdresser Joh Bailey.

Prime Minister Scott Morrison’s backflip came after the Double Bay celebrity hairdresser explained the dynamics of a frenetic hairdressing salon on Credlin’s influential program.

“You’d think this decision was made by a room full of bald men,” Credlin proffered, while noting the presence in the national cabinet of premiers Gladys Berejiklian and Annastacia Palaszczuk.

“Who has ever been in and out of a hair salon in 30 minutes, if you are a woman?” the political commentator asked Bailey.

“No one that I know of and certainly not at Joh Bailey, especially you Peta with all that mane of hair of yours,” Bailey replied.

“Probably the only thing that could get done in 30 minutes is a quick man’s haircut.”

“How are you going to make money in 30 minutes?” Credlin then asked, seemingly fully knowing the economics of the offerings like colour, extensions, treatments and hair cuts that cost anything from $44 to $300.

“Feedback on the practical implementation” was the reason Prime Minister Scott Morrison gave for the 30-minute rule per patron being lifted.

A masked Bailey, who employs around 60 staff across four different salons, was busy welcoming his loyal clients at his modern Double Bay salon yesterday, sounding just a little muffled.

There was hand sanitiser galore, client stations set at adequate distance, and Glen 20 disinfectant spray overpowering the smell of the blooming flowers from Mandalay florist.

“It is like an operating theatre,” he told Margin Call.

He was still bemused that his appearance on Credlin’s show played such a defining role in the nation’s week.

“This was really serious for me as I’ve usually just been fluffing around on Mornings with Kerri-Anne,” he said, name-dropping another client, the veteran television star Kerri-Anne Kennerley.

Like many in the industry of 40,000 or so, Bailey said he would rather be shut down, given the issues of safety from contagion and physical proximity that the tasks require.

Over the past 35 years, Joh’s clientele has included Olivia Newton-John, Kylie Minogue, Terri Sissian, Eva Longoria, Karin Upton-Baker, Elle Macpherson and most notably Princess Diana.

Holiday’s over

Possibly not since the Hawke government’s pilot strike in 1989 has Hamilton Island been so quiet.

The Great Barrier Reef’s crystal blue ocean swell, infinity pools with sunset vista and the cheaper bathtubs overlooking the treetops remain unphotographed as Instagrammers seek new types of relevance.

There have been typically 20 or so flights into Hamilton Island, but that has all changed with airlines slashing their fleets and flights.

However, unlike the appalling delays in the major airports in our capital cities, the island was quick to activate thermal imaging cameras capturing incoming passengers at the airport to seek out potential coronavirus carriers.

Homeowners and residents are on the island, but guests are not longer welcome, with the world-famous Qualia, the go-to hotel for holiday-makers with deep pockets, closed. Their most basic rooms rent at $1400 a night in the off-peak season.

The Oatley family, who have owned the island since 2003 when the late family patriarch Bob Oatley bought it for $200m, are no doubt going to take a major hit to their earnings this year, so they’ll be happy their other passion, their winemaking business, is ticking along nicely.

Robert Oatley Vineyards bucked the trend of the struggling wine industry, posting a 16 per cent jump in revenue with $92m in sales, up from the $79m in FY18, in their recently lodged financial report.

They posted a $278,000 profit, better than their $820,000 loss in FY18.

The family planted their first vineyards in the late 1960s.

Tuckwell tucks in

Graham Tuckwell, the millionaire funds pioneer who recently returned to Australia after spending the last decade living on Jersey, was back in leafy Hawthorn last weekend.

It was to watch the Marshall White auction of his four redundant cottages that adjoined his former 1916 Federation estate, Ponderosa in Hawthorn’s sought-after Scotch Hill precinct.

Tuckwell, the founder of ETF Securities, which holds over $40bn in assets, secured close to $6m with strong Australian Chinese interest.

Tuckwell bought the properties so there would be no development bordering his former longtime Hawthorn home, which he sold for $12m in 2018.

The five-bedroom Berkeley Street property sold again earlier this month for $12.6m, again to Chinese interests.

Perth recovers

There’s finally been some promising signs of life in the Perth prestige real estate market. One of the finest riverfront homes at Dalkeith has been sold for $14m to buyers from south of the river.

The contemporary six-bedroom Victoria Ave home, named Fortune Bay House, sits on 2280sq m with seven separate zones for entertaining, including the river terrace with barbecue.

It has been home to Irish horse trainer David O’Brien and his wife Catherine who moved to Perth in 2009. Now all five of their children live overseas and they want to spend more time with them and their grandchildren.

The O’Briens expanded the master suite to include two bathrooms, two dressing rooms and a study since the property was bought in 1999 at $6.5m.

They unsuccessfully listed twice over the past two years, initially seeking an ambitious $19m, and sold this week through Ray White agent Jody Fewster.

Fewster is asking $35m for the former Dalkeith home built for the late entrepreneur Alan Bond, her dad. Vendor Sue Gibson, the ex-wife of mining magnate Steve Wyatt, had hoped for $50m on its listing two years ago. Mack Hall has a $15m Peppermint Grove trophy home under offer. The veteran agent William Porteous seeks a $12m buyer on Jutland Parade, Dalkeith.

Marks sells

The rag-trading Gazal family have emerged as the buyer of the south coast retreat of the Channel 9 boss Hugh Marks. His short-lived 40 hectare Broughton Vale weekender was listed following his split from his wife of two decades, Gayle.

They secured $4.325m with settlement this week to Michael and Helen Gazal.

The Gazals have pocketed a $100m-plus windfall following the $270m takeover of Gazal Corp by the New York-based PVH group, the fashion powerhouse behind Tommy Hilfiger and Calvin Klein.

The couple paid $250,000 more than Marks paid two years ago, with the price secured by Belle selling agent Nick Dale just enough to cover Marks’ $223,000 stamp duty.

His matrimonial Californian bungalow at Artarmon is now just in Gayle’s name as Marks moved out to take a $2450-a-week modern townhouse rental on Balmoral slopes.

Douglass expands

Billionaire Hamish Douglass has yet again expanded his rural holding in the NSW Southern Highlands. He has spent $3.1m to take his Moss Vale patch to around 122 hectares.

Douglass initially bought in 2016 for $1.7m, then added another parcel called Majellan Park just along and across the road for $1.9m two years ago.

The $6.7m outlay has hardly dented the slightly diminished fortune of the chairman of investment house Magellan.

With $1.66bn at the market’s peak he ranked as the 64th richest person on The List — Australia’s Richest 250. The Neutral Bay-based funds manager once suggested only conservative investors sleep well which might explain why few of us are getting a good night’s sleep in these trying times.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout