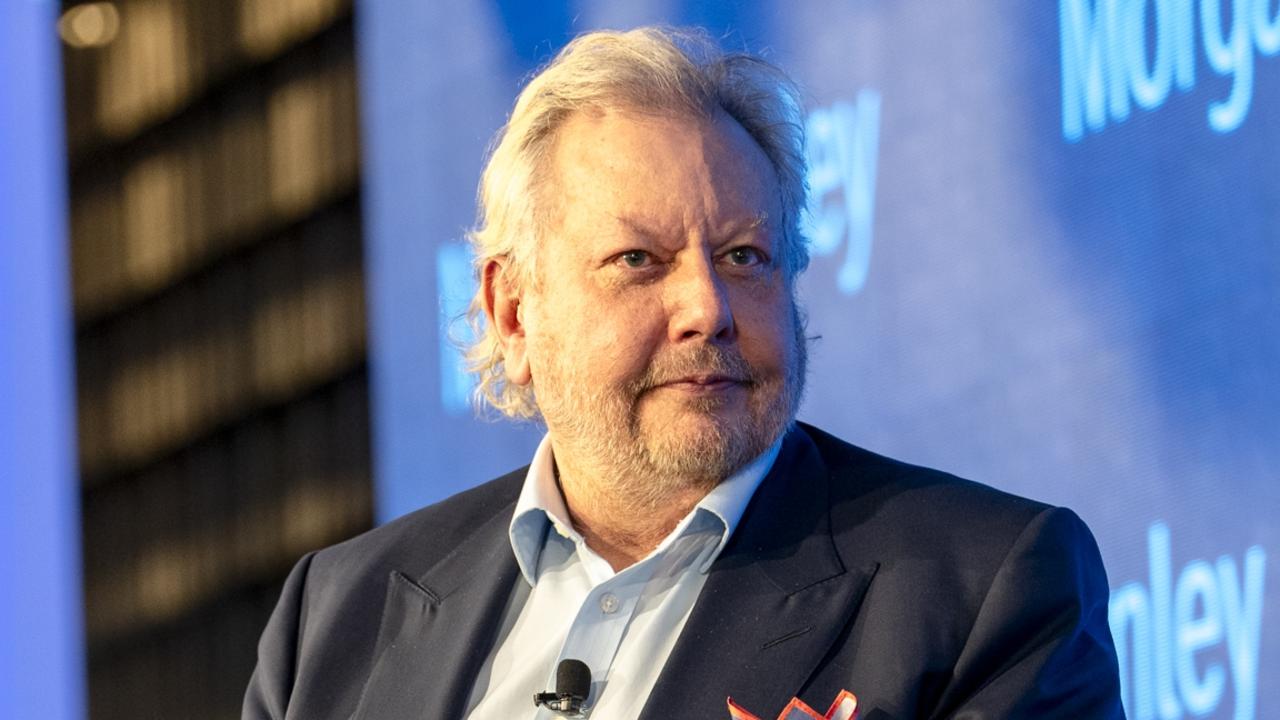

“You may not be interested in war, but war is interested in you,” is perhaps the perfect famous phrase that could apply to the board of micro-cap gas explorer Vintage Energy which has just landed within the cross hairs of corporate raider Nicholas Bolton.

Vintage Energy, chaired by former Beach Energy boss Reg Nelson, has some highly promising gas projects in South Australia’s Cooper Basin that are getting many in the investment community excited. And while it has had some good fortune in securing and exploiting these finds, its choice of joint venture partner has not been as fortuitous.

A 25 per cent minority partner in the projects is ASX-listed Metgasco, a struggling explorer that is too tiny to call micro and whose shares are trading under 1c to give it a market capitalisation of around $8.5m.

Not so long ago Bolton’s Keybridge Capital, which recently won a massive and very lucrative campaign against the Magellan Global Fund, lent some money to Metgasco and was also a major shareholder.

Keybridge and fund manager Michael Glennon of Glennon Small Companies fund were co-lenders to Metgasco, and in the words of one energy sector veteran “Metgasco is screwed and might never pay that loan back”.

Keybridge, which counts as a director property and tech entrepreneur Antony Catalano, is owed around $1.5m and anyone who knows Bolton knows he doesn’t like to lose on a deal.

And so, always thinking a few steps ahead, Keybridge started buying up shares in Vintage Energy and this week popped up as a 5.2 per cent shareholder. It seems the plan is to squeeze Vintage Energy to in turn squeeze its Cooper Basin junior partner Metgasco to pay back Bolton’s loan. Or work out some payment plan.

It is believed Bolton sees Vintage as a much safer and more rewarding way to invest in the energy sector as opposed to losing money on cash-hungry Metgasco which is just the passive partner and junior in the two key gas fields operated by Vintage Energy.

For now Vintage Energy and its board are spectators in this looming war between Bolton and Metgasco. But as that famous quote illustrated, sometimes war will come to your front door even if you don’t want it to.

Hopefully Vintage Energy won’t meet the same gruesome end that the person who coined that phrase did. Has anyone ever seen Bolton carrying an ice axe?

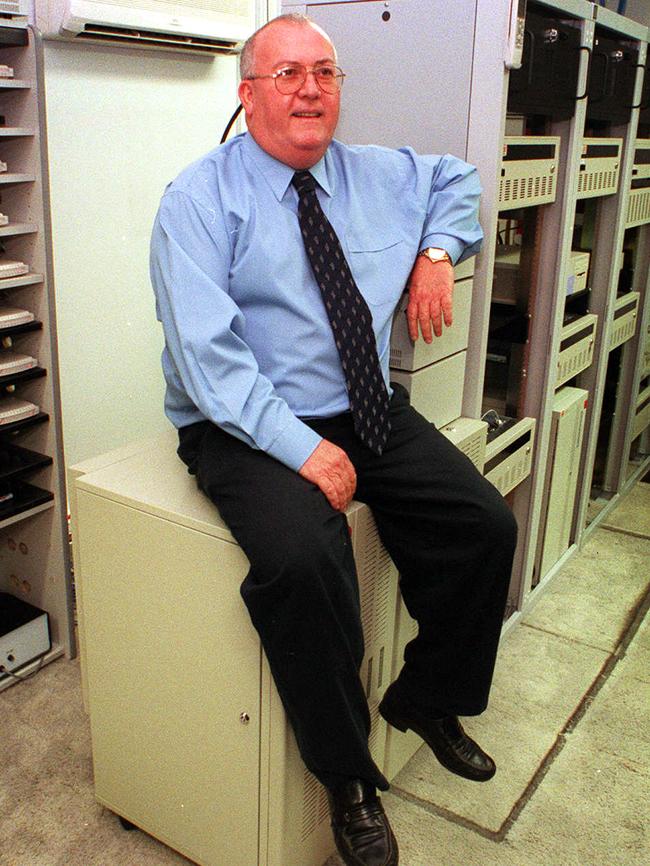

Vale Wallace Cameron

Vale Wallace Cameron, the former boss and major shareholder of Gribbles Pathology, who died late last month.

Actually, the term “major shareholder” in Gribbles should maybe come with an asterisk given back 20 years ago when he ran the publicly listed pathology company it wasn’t entirely clear who owned a 43 per cent stake in Gribbles. In fact for a long time the real owner of that 43 per cent block was also unknown to other Gribbles shareholders.

The owner of that stake was happy to keep Cameron in charge, support his agenda and vote in favour of resolutions at AGMs.

After a long running saga, most of it rather ludicrous, Cameron fell out with the Australian Stock Exchange, ASIC, his investors and Gribbles directors after he refused to reveal who was the beneficial owner behind EC Medical Investments, a European trust that held the 43 per cent stake in Gribbles.

When pushed by fellow Gribbles directors, Cameron only commented that he “spoke for the stake” - you see, how ludicrous. Gribbles directors even went to the lengths to hire a law firm to identify the owners behind EC Medical Investments.

After much pressure, Cameron finally admitted his three adult children owned the trust and that he indeed was the beneficial owner. There was never any allegations or findings of improper behaviour by his children.

Not long after in 2004 Cameron banked $121m after quitting his stake in Gribbles and delivering control to rival Healthscope.

He was a prolific property investor, buying up mansions in Melbourne’s Brighton as well as Portsea and once owned the historic Sefton estate at Mount Macedon which was built by the prestigious and powerful Baillieu family in the 1900s.

A few years after the Gribbles saga, it was reported that Cameron was sentenced in the Melbourne Magistrates Court after pleading guilty to seven charges. Cameron was sentenced on four charges, among them relating to dishonestly using his position as a Gribbles director to gain an advantage for himself, and making misleading statements in Gribbles annual directors reports. He was also charged for failing to give information to Gribbles and the Australian Securities Exchange relating to changes in his substantial holding in Gribbles, and engaging in conduct hindering a person in their exercise of ASIC powers.

Return of the cash box

Cash boxes have not been an investment product that the Australian Securities Exchange has been a fan of, especially those still at the market operator with memories of the bad old days in the 1980s when colourful entrepreneurs used them to play some funny games on the market and with hapless investors.

But the ASX is now about to get a $100m-plus cash box courtesy of listed investment company Excelsior Capital, and its investors aren’t too happy and somewhat nervous about what might happen next.

This week Excelsior, controlled by Leanne Catelan, the daughter of the late property data mogul and RP Data founder Ray Catelan, completed its sale of its electrical cables business for $91.7m and the cash was deposited into its bank account. There is another $8.9m in cash that can be earned depending on the cable business hitting certain earnings targets under its new owners.

That was Excelsior’s only operating business. Its only other key asset is a small investment portfolio worth $22.98m, of which $17.83m is held in cash. That makes assets of around $114m, of which the overwhelming majority is cash now burning a hole in the company’s pockets. Excelsior also has access to tax losses of about $32m and an estimated tens of millions of dollars in franking credits.

Ms Catelan, who recently sold her Potts Point, Sydney, grand Italianate mansion “Bomera” to steel tycoon Sanjeev Gupta for $34m, owns 51.33 per cent of Excelsior.

At a slightly rowdy shareholders meeting last month to approve the sale of the cables business, the handful of Excelsior shareholders who turned up peppered chairman Danny Herceg with questions about how Excelsior planned to invest that near $120m in cash.

Ms Catelan wasn’t actually at that meeting as a previous engagement in Europe meant she had to join via a video link.

Peter Murray was there, a former merchant banker who’s twin listed investment companies Imperial Pacific and London City Equities are Excelsior’s second biggest shareholder with a combined stake of 12.3 per cent. Mr Murray voted his shares against the deal to sell the cables business, but given Ms Catelan owns more than half of the shares it was more of a protest vote.

Now Murray is taking the next step, writing to the ASX arguing that under its own listing rules Excelsior has met the standards of a change in its nature or scale of activities - it has gone from a company with an operating business to a cash box - and that now Excelsior must seek shareholder approval and issue a prospectus to set out its plans for all the cash it is now sitting on.

This column called Herceg and Catelan for a comment, there was no response. So far all Murray has heard from the ASX is similar silence.