Cormack Foundation war chest nears $100m; live like Jayne Hrdlicka for $8000-a-week

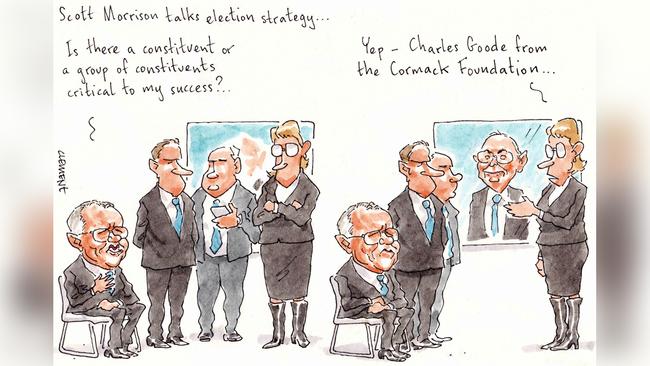

Now that Scott Morrison has the nation on an effective election footing, it must be time to take a deep dive into the Victorian Liberal Party’s Cormack Foundation.

Towards the as yet unknown actual polling day next year, the major parties will spend millions of dollars trying to secure support. Outdoor advertising space is already being booked and campaigns planned.

The Cormack Foundation, whose directors include former ANZ chair Charles Goode, former prime minister John Howard and Howard’s communications minister Richard Alston, is typically the single biggest donor to the Libs.

So how much the organisation, which in the past has also controversially given to other conservative parties, hands over to the Libs can make a big difference to how a campaign is run.

So how much is Cormack, whose assets comprise a long-held portfolio of blue chip shares, really worth?

Australian Electoral Commission returns reveal that Cormack holds 13 stocks dominated by the big four banks and leading miners, and also including leading retailers, a couple of investment funds and a sprinkling of transport.

The foundation was established as a corporate entity in 1988 with seed funding from the $15.75m sale of Melbourne radio station 3XY.

Since the last federal election in May 2019 the Australian sharemarket is up 18 per cent, growth from which Cormack has benefited.

Labor leader Anthony Albanese might be interested to know that Margin Call’s back-of-the-envelope calculation puts the value of the group’s share portfolio at a massive $92.6m.

Plenty of airtime to be had with that.

Cormack’s shares in the four pillars alone amount to $40m, with the banks regularly paying strong dividends that further stock the electoral war chest.

Cormack also has stakes in BHP, Rio Tinto and South32, as well as Coles, Wesfarmers and Woolworths.

The Cormack portfolio is rounded out by toll road group Transurban, as well as holdings in diversified funds Argo Investments and Milton.

Enough to make any PM salivate.

–

Rent flies high

A year on from taking on the task of reincarnating the Bain Capital-controlled Virgin Australia, now Brisbane-based boss Jayne Hrdlicka has put her Melbourne mansion up for rent.

But to live like an international airline chief of her calibre, you’ll have to dig deep, with Hrdlicka, also the Australian Open chair, seeking no less than $8000 a week for her 1886-built pile Crossakiel.

For that, or the equivalent of $416,000 a year, the new tenant will enjoy the two-storey period home’s sprawling 2000sq m grounds, which sit on prestigious Kooyongkoot Rd in the leafy Melbourne suburb of Hawthorn.

The home features up to five bedrooms, a pool and a tennis court on which federal Treasurer and local Member for Kooyong Josh Frydenberg is known to have played a set or two.

The home is a spit from elite private boys school Scotch College, has a climate-controlled wine cellar and home office. It’s available from the first week of December.

With Queensland hitting the milestone 70 per cent Covid vaccination rate, Hrdlicka and her family now settled into their new Coorparoo digs and borders opening, the airline chief is all set for Virgin’s operations to burst back to life.

She’ll need somewhere to stay come January though, when Hrdlicka’s back-to-full-capacity Oz Open fires up.

–

Making an impact

With a delay on the pandemic bill vote in the Victorian parliament on Thursday, there’s more time for members of the well-heeled Liberman family to canvass their campaign against Dan Andrews’ pandemic powers. Meanwhile, others are harnessing the power of the family name in other ways.

The Liberman-backed renewables and green real estate-focused Impact Investment Group, run by Berry Liberman and husband Danny Almagor, has only in recent weeks unveiled its latest adjacent venture sparked during the city’s long lockdown.

The couple have set up a consulting outfit dubbed Sentient Impact Group to tackle big issues of climate change and clean energy, familiar topics for the fund and with plenty of familiar faces.

None other than Melbourne’s busiest businessman Luke Sayers gets a call-up as a director for the new group, adding to his recent role as Carlton chair, along with new executive chairman and former NAB boss Andrew Thorburn, already well integrated into the team through his part-time position as adviser to IIG.

The firm has set a bold goal to “bring impact investing to the mainstream”, already touting its management of six renewable energy facilities across the nation.

Holding up democracy while saving the world from climate change – what can’t they do!

–

Iris pay bloom

The Nasdaq debut of sustainable bitcoin miner Iris might have been rather underwhelming, but when it comes to performance it’s hard to miss the haul of the Australian firm’s short-lived chief executive, Jason Conroy.

The firm, now led by founding 30-something brothers Will and Daniel Roberts, joined the US boards on Wednesday after raising a cool $US231m ($317m) towards its plans to mine the lucrative cryptocurrency.

But absent from the low-key listing celebrations (or perhaps commiserations, given the stock’s 13 per cent opening day dive) was ex-CEO Conroy, now languishing in the land of his non-compete after parting ways with the firm in September.

Recall the former Transgrid CFO had jumped ship to join the upstart mining outfit in May as it plotted its way towards listing, but ultimately left the company just months later as it opted to take the Nasdaq route over any local IPO.

Still, despite his short tenure, Conroy earned a pretty penny out of the arrangement.

Details lodged to the US regulator show he continues to draw a salary from the firm six months after his departure and, after the successful IPO this week, receives a lump-sum payment of 0.1 per cent of the offer proceeds, roughly $31,000.

Not bad for a total of four months work, though we are assured he is deserving of his crust.

In return, Conroy, now a director of ASX minnow Tymlez, is subject to a non-compete obligation out to June 30, 2022 and non-solicitation of employees or customers until a year from his exit date.

With trade in the company proving to be just as fickle as the cryptocurrency itself, we can’t help but think he may have dodged a bullet.

Berry Liberman and Danny Almagor

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout