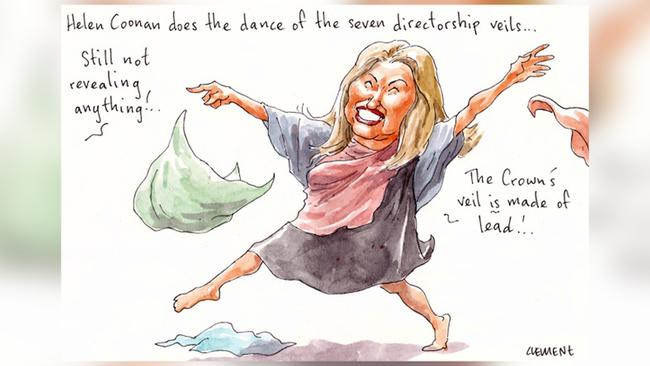

Crown Resorts chair Helen Coonan’s brief time at the ASX-listed minnow investment company HGL finished this week, as she continues to divest her directorships.

She had signalled her intention to lighten her workload when she took on chairing the board at the $7bn casino company in late January.

HGL shareholders were told Coonan’s departure was for “family personal reasons”, but that’s code for the Crown job being so time-consuming, as she also seeks out some downtime with family.

HGL also told shareholders yesterday that veteran board member Julian Constable had resigned. Constable’s departure after 17 years was a follow-up to the shake-up announced at the company AGM in February.

Coonan, who didn’t partake in the recent capital-raising rights issue, had been brought in last August to clean up the company after years of underperformance.

With shareholders still on edge, the share price fell nearly 14 per cent yesterday to 19c as Kevin Eley took on the interim chairmanship.

As Margin Call advised in January, when she took over pre-COVID-19 from John Alexander at Crown, Coonan is also shedding her role on the board of Snowy Hydro at the end of June.

Coonan, has been a director of Crown Resorts since 2011, shortly after she departed the Australian Senate, retains numerous other roles.

She remains the inaugural chair of the Australian Financial Complaints Authority, the chair of the Minerals Council of Australia, co-chair of GRACosway (a subsidiary of the Clemenger Group), and a member of the JPMorgan Advisory Council.

She still sits on the boards of Obesity Australia, the Australian Children’s Television Foundation and the National Breast Cancer Foundation advisory council.

Kirby sells up

Amid the continued rollercoaster takeover battle for the Village Roadshow, its relatively new boss Clark Kirby has secured the settlement of his redundant Melbourne trophy home. Last December Kirby and wife, Sara Groen, the former Channel 7 weather presenter, listed their Armadale abode with a guide of $17.3m to $19m.

Its settlement this week was at a subdued $17.25m to Sofia Tangalakis, wife of Con Tangalakis, who heads Sinapse, the pharmaceutical business consultancy company.

It was the logistics entrepreneur Mark Rowsthorn who sold what was the converted former 1915 Golden Crust bakery for $11.5m in 2014 to the Kirbys.

They have since spent $10.3m on the Gold Coast millionaires’ row home they had been renting. The Hedges Ave, Mermaid Beach beachfront was bought through estate agent Tony Velissariou from Peter Mitchell and wife Dee, who made their fortune drilling water bores for Kingaroy peanut farmers.

Mermaid Beach’s latest home sale came when the property developer Tony Smith sold his home with 40m beach frontage to the Melbourne-based businessman Dean Pask for around $25m last month, the highest price on the Gold Coast in a decade.

Smith’s 2112sq m Heron Ave holding was sold by Harry Kakavas, of Prestige Property Sales, the former high-roller gambler who’s shown extraordinary salesmanship on the strip since he arrived from Melbourne in 1999.

Meanwhile Village last month entered into formal discussions with private equity firm BGH, which has offered $468m for its movie studios, cinemas and theme parks.

Jacket racket

It seems everyone had a story this week about being tricked by the so-called marketing director for Versace who sold fake leather jackets.

No less than Ross Greenwood, the Nine Network finance editor who’s on a gap year, golfing, podcasting and briefly growing a beard, declared himself a victim.

Of course the scam has been going on for decades, so it’s not all been the alleged work of the 54-year-old Five Dock man who was charged by NSW Police mid-week. Indeed Ciro Gallo had only arrived in Australia from Italy in February. Here on a tourist visa, Gallo will remain behind bars until he next fronts Liverpool Local Court on June 11. Greenwood was leaving the Signorelli family’s Doltone House 50th anniversary dinner last October when he fell for the fakery.

“I’m leaving there and a bloke in a car with a very attractive female accomplice pulled me over, asked me for directions to the airport,” Greenwood told Nine Radio.

Greenwood was then shown samples of leather jackets.

“He said he couldn’t take it home, they’re all samples — did I wanna have them?

“I’ve never heard of this scam in my life before, so he’s eased me of 200 bucks,” the Reservoir-born finance reporting veteran said. He got his reality check on phoning his wife Tanya to tell her he’d bought her a new leather jacket.

“She knew about the con but I didn’t. A magnificent jacket, but not leather. It is PVC.”

Margin Call assumes it wasn’t packed when the downsizing couple moved from their recently sold six-bedroom $5m Northbridge home into a three-bedroom $1100-a-week Milsons Point high-rise rental, which will be a quick walk to work next year after Nine moves into their new North Sydney office tower.

Holden test track

Holden’s Lang Lang test track on the southeastern outskirts of Melbourne is nearing a sale by the US car giant General Motors.

The Vietnamese automotive start-up Vinfast, which wants to tap into Australia’s engineering expertise to fast-track its vehicle development, seemingly sits in pole position.

Vinfast, run by one of Vietnam’s richest billionaires, Pham Nhat Vuong, is especially interested in the emissions laboratory that sits on the 877 hectare offering.

It has a 44km network of roads, including a 4.7km four-lane high-speed oval.

There are estimates that somewhere between $15m and $20m will secure the site, which is being vacated around September ahead of the Holden brand being retired.

Local interest could possibly come from transport magnate Lindsay Fox, since itwould sit nicely with the nearby Phillip Island Raceway, and his 1141-hectare Anglesea vehicle assessment facility bought in 1991 from International Harvester.

Living in luxury

Some 18 months after its $50m sale, the Point Piper waterfront Routala is just days off seeing its new owner move in.

David Wilkenfeld Fox, co-owner of the leading global dance wear company, Bloch International, and his fashion designer wife Gazette Hazzouri are its mystery buyers, with plans to return from St Helier, Jersey, in the Channel Islands.

They bought it from Rubicon Asset Management founder Gordon Fell and his wife Philippa just before Christmas 2018 through estate agent Brad Pillinger.

Fell, who was chairman of Opera Australia in his heyday, paid a national record $28.75m in 2007 when buying the Wunulla Road home from horse breeder and Guess fashionwear importer Warwick Miller. The harbourside mansion was bought just before the GFC, when Fell’s Rubicon business was sold to the late David Coe’s finance group Allco for $331m, with it all then collapsing under its debt burden.

Fell’s recent endeavour has been the luxury Six Senses resort on Fiji’s Malolo Island, which is co-owned by investment banker and former SurfAid CEO Andrew Griffiths. After its opening it was listed in Time’s “World’s Greatest Places 2018”, and the Financial Times How to Spend It magazine noted its mandate for health and wellbeing. Its executive chef Ihaka Peri oversaw its gluten-free bakery and a bottling plant for probiotic soda. Apparently the partnership has soured with court proceedings under way, The Fiji Sun reported.