Billionaire Clive Palmer is rumoured to have bought himself a yacht.

Margin Call reckons it’s the luxury cruiser Vegas offloaded recently by the Melbourne property developer and NBL owner Larry Kestelman.

Palmer apparently paid around $8.4m for the 37m Sunseeker.

Palmer sold the family’s previous yacht, Maximus II, in 2017 for £5m, having bought it at a 2009 receivers’ auction by administrators selling off the assets of fallen Gold Coast IT tycoon Daniel Tzvetkoff.

Vegas has three decks containing multiple areas for entertaining guests, including lounges and bars.

The sundeck has a covered dining area, jacuzzi and a “state of the art sound system” while another has a swimming platform and a garage for storing kayaks, jet skis and water skis.

Palmer, whose wealth was estimated at $4.5bn earlier this year, is extensively refurbishing the five-cabin boat which was built in 2009 in Britain and became one of the largest in Australia when bought by the Dodo founder.

It was last spotted by Margin Call cruising around Sydney Harbour over January, where everyone wanted to be out on the harbour for Australia Day, and has since made its way to the Gold Coast where it was listed for sale through Alexander Marine Australia, with buyers advised its listing was partly driven by the impact of COVID-19 border restrictions.

Locals are suggesting the purchase by Palmer was another sign that the $100m investment into the expansion of the Tony Longhurst-owned Boat Works has paid off.

It includes a super yacht marina with 10 sheds and 15 berths.

The Sunseeker had long been a luxury $180,000 a week charter, but is no longer offered on the Ahoy Club website.

It even acted as an alternative office for the Melbourne-based NBL boss who sits 179th on The List — Australia’s Richest 250 with a net worth of $630m. Two years ago when moored at Melbourne’s Docklands, Kestelman held a secret meeting on Vegas with Andrew Bogut about his joining the NBL after leaving the NBA.

Meanwhile Palmer continues to be the subject of satirical taunts on The West Australian newspaper’s front pages. The latest instalment, the fourth in a week, has Palmer’s head on the body of a chook with the headline “Chicken Palmer” as the paper asks whether the Queensland billionaire is running scared in a war of words with Premier Mark McGowan over his $27.75bn damages claim over the Balmoral South iron ore project.

Cash splash at JB Hi-Fi

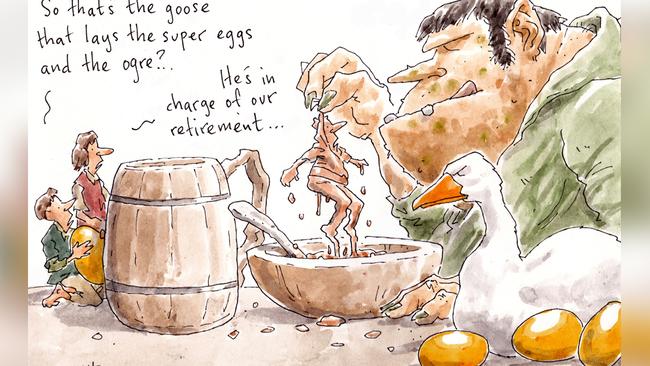

Fee-fi-fo-fum. We all know the Jack and the Beanstalk fairytale.

Young Jack swaps his boring but income-producing cow for some magic beans which sees Jack rewarded with riches and glory.

It first appeared as the story of Jack Spriggins and the Enchanted Bean in the 1734 publication, Round About Our Coal-Fire, and as Benjamin Tabart’s moralised The History of Jack and the Beanstalk in 1807.

Macquarie Wealth stockbroking analysis of Richard Murray’s JB Hi-Fi reckons the fairytale is now being repeated.

Their update on the modern fairytale follows Monday’s annual results of the retailer, suggestimg young Australians are swapping “boring but income-producing superannuation for magic coffee bean machines”.

Macquarie referenced research from advisory firm AlphaBeta-Illion showing that many people dipping into their retirement nest eggs had increased spending on lifestyle items, rather than using the cash as a lifeline.

Much of it was spent in the first fortnight after getting it from the superannuation fund under the early release scheme during the pandemic.

The retailer is happy, but Macquarie’s neutral share recommendation is premised on seeing the upside risk to sales.

“With a quarter of the economy in lockdown, we remain cautious on discretionary retailers until underlying economic reality matches current levels of spending,” Macquarie noted.

Unlike the fairytale which saw Jack prevail over the ogre and become rich, cashing in one’s super to buy kitchen gadgets seems unlikely to end well for the consumer.

Toothpaste trauma

There will be no white-coated dentist showing his face in the legal battle between Procter & Gamble and Colgate-Palmolive. The Federal Court matter has been resolved, with the lawsuit dropped by Procter & Gamble.

Procter & Gamble, the name behind the Oral B brand which makes whitening toothpaste, had alleged Colgate had breached consumer law by falsely claiming its new whitening toothpaste can remove 10 years of stains.

Colgate was prepared to get Professor Harald O. Heymann, the past-president of the American Academy of Aesthetic Dentistry, to back its case.

But the lawsuit now appears to be dropped with no settlement being secured.

The discontinuance was advised to Justice Stephen Burley in the Federal Court.

Procter had wanted damages and compensation, as well as an injunction on sales, and a statement from Colgate correcting its allegedly misleading representation.

Vale Will Bailey

Banker Will Bailey, the former ANZ boss who led the bank’s roll out of ATMs across Australia, has died.

When he retired as chief executive in 1992, one of his major legacies had been modernising the bank, introducing automation and computerisation.

He took over in 1984, replacing managing director John Milne. Bailey was succeeded eight years later by Don Mercer.

Bailey joined the Oakleigh branch of the English, Scottish and Australian Bank in January 1950, having been born Willoughby James Bailey in March 1933.

In 1970 ES&A merged with ANZ, which was headquartered in London until 1977.

Banking meant hand-written ledgers and manual processes, but the ANZ Bluenotes website noted in 1985, under Bailey’s stewardship, ANZ opened Australia’s first “electronic branch”.

The Balwyn branch had a drive-through facility, an ATM and inquiry terminals.

Bailey, who died last week, is survived by wife Dorothy, their daughters Alison, Robyn and Merryn, eight grandchildren and five great grandchildren.

Back to the well

Investors don’t need to have long memories when its comes to the coal miner Coronado Global Resources, which is now on a debt-tackling equity raising.

Coronado raised $774m in late 2018, the ASX’s largest coal float in history, with the IPO priced at $4 a share.

By early 2019 it announced a US6c a share final dividend and a special dividend of US25c, which its managing director Gerry Spindler said reflected the company’s confidence in its outlook, cashflows and balance sheet.

The dividend reflected a 21.5 per cent yield.

Fast forward and Coronado is now in need of cash, with its market value at $807m and net debt of $US404m. Coronado is raising $250m through Citi, Bell Potter, Credit Suisse and GoldmanSachs at 60c per CHESS depositary interest. It seeks to secure $145m through the placement and a further $105m through a non-renounceable entitlement offer, where shareholders will secure two new chess depositary interests for every 11 held.

The stock last traded at 82c, its lowest level since listing.

The biggest shareholder, American resources giant Energy & Minerals, is set to see its holding diluted to 65 per cent from 80 per cent as part of the raising.

Coronado’s assets are located in two prolific coal-producing regions in the world, Queensland’s Bowen Basin and the central Appalachian region in the US.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout