Charlie Aitken finally gets his dosh

Want an idea of how tough it is out there in funds management land?

Celebrity money man Charlie Aitken has just sold a bit under 40 per cent of his operation to billionaire Kerry Stokes and investment banker-at-large Rob Rankin for less than $1 million. What a bargain.

Based on the sale price, Aitken’s high-profile Aitken Investment Management is valued at just under $2.5m, with Aitken and his fund manager wife Ellie Aitken’s combined 55 per cent stake in the business worth about $1.37m.

Peering behind the shiny headlines, it has been a dramatic few years since the famously bullish Aitken launched his fund in 2015 with widely publicised plans about having $300m in funds under management.

That was built on a $150m commitment from Stokes into the fund that — despite the headlines — proved to be illusory.

Finally, last month, the Stokes family came through with some money.

The Stokes clan, along with Rankin and — apparently — even Rankin’s old boss James Packer of Bora Bora have committed what we hear is a combined $50m to Aitken’s Global High Conviction Fund.

When the final instalment arrives, it’s expected to take total funds under management to about $150m.

That’ll be double the $75m in funds under management Aitken told this column were under management last year. Getting there.

Aitken company documents reveal Rankin and Stokes have paid $2.50 apiece for their 199,990 shares (just under 20 per cent) in Aitken’s business for an equity investment of just under $500,000 each.

The other AIM shareholder is Christopher Nasser, an investor from a publican family, who owns the outstanding 5 per cent.

Charlie’s coup

A closer inspection of Charlie Aitken’s coup in luring Ryan and Kerry Stokes and former investment banker Rob Rankin as shareholders and clients of his Aitken Investment Management (AIM) has exposed the severing of another tie between Rankin and his former boss and billionaire buddy James Packer.

The two had been business partners in a Caribbean registered investment company, Pacific Point Partners, which Rankin now appears to control solo.

The Hong Kong-based Rankin has invested in Aitken’s business via PPP, which appears to use a Singapore-based business services company as its point of communication.

Rankin will also chair AIM.

Mid-last year Packer and Rankin used PPP to invest

$13m to back a management buyout of listed investment company Contango Asset Management, which at the same time was launched on to the local stock exchange via a backdoor listing.

Aitken is a Contango director.

That investment gave PPP a 20 per cent stake, with Consolidated Press’s group head of strategy Patricia Toh taking up a seat on the board.

One year on, Toh is still a non-executive director, but it’s unclear whether Packer is still backing the group, now that it appears Rankin — who left the Crown board quietly last month — is going it alone at PPP.

Taming the beast

This year’s Archibald portraiture finalists will be selected today at chairman David Gonski’s Art Gallery of NSW.

Could Outsider Mark Latham soon be moving inside Gonski’s prestigious gallery?

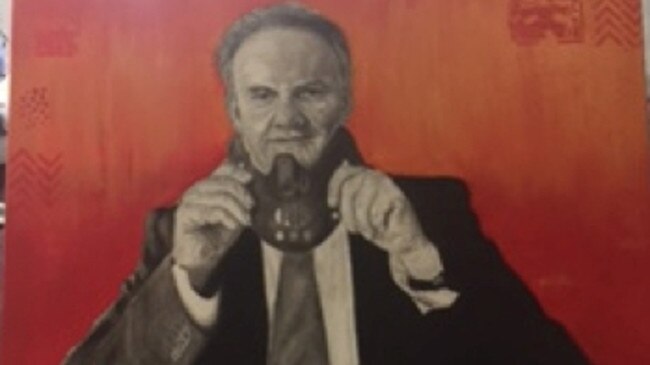

Sydney street artist Knack has painted “The Unsilencing of the Latham” in his first attempt at the nation’s premier portraiture prize.

The charcoal and graphite portrait on an oil background was inspired by the 1991 film The Silence of the Lambs, with Latham pulling down a Hannibal Lecter mask.

“He was happy and amused to go along with it,” the self-taught artist told us of his prop-themed sitting with Latham.

The former Labor leader turned media personality, a famously hard marker, told us he was very happy with it.

“Love Knack,” Latham said.

We’ll find out soon if the judges agree.

Toothy tale

It seems that even while brushing his teeth or doing the shopping, top lawyer John Atanaskovic is always available to look after the interests of his Bermudian billionaire client Bruce Gordon.

The man his opponents call John “Antagonistic” took the opportunity to detail his lifestyle in lengthy emails sent to legal “Mr Fixit” Leon Zwier over the weekend, which have been released by the Federal Court.

Atanaskovic was looking out for his client’s interests as a guarantor — alongside Lachlan Murdoch and James Packer — of a $200m line of credit Ian Narev’s CBA provided to the embattled Ten Network.

Zwier, meanwhile, was defending the honour of Ten’s administrators, Mark Korda’s KordaMentha, against allegations it looked like the firm had a conflict of interest.

In one email, Atanaskovic complains he only got time to look at one of Zwier’s missives at 9pm on Friday.

“I was very tired then, having risen very early on Friday, so after sending you my email on Friday night and brushing my teeth, I went directly to bed,” he explained.

Glad that’s been cleared up.

Another A to Z email, sent on Sunday afternoon begins: “Leon, just listening to my mobile phone’s voicemail messages, before going off to do the weekend grocery shopping (which my wife Felicity just reminded me it was my turn to do, having missed out on performing my ‘duty’ for 3 weeks, apparently), I heard your lunchtime Saturday message again.”

What’s with this guy?

Zwier, proving he too has an idiosyncratic approach to communication, chose all caps to respond to issues raised by Atanaskovic. “JOHN I HAVE NO REGRETS ENGAGING IN EMAIL COMMUNICATIONS WITH YOU,” Zwier wrote, confidently.

Zwier often acts for KordaMentha but hasn’t been working on the main Ten game because he himself has a conflict, acting for a potential buyer (believed to be Oaktree Capital Management).

However, he has been acting for free for KordaMentha on this conflict of interest issue, hoping for an opportunity to get judicial support for his idea that early engagement of insolvency practitioners can help rescue an enterprise.

One of the other things Atanaskovic complained about was that the court proceeding was in Melbourne — a location convenient for the other players.

A Melbourne legal identity who was not physically in the room was former Federal Court judge Ray Finkelstein, but his presence was felt nonetheless.

Not only were his rulings frequently cited but the Fink has been helping Zwier out in the background.

Completing the circle, the judge hearing the case, David O’Callaghan, did his readings with his mentor, Finkelstein, while a baby barrister.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout