Catherine Brenner’s trail of unexploded bombs for AMP board

Catherine Brenner has left at least two unexploded bombs that could destroy further billions of shareholder value at endangered financial shop AMP.

Potentially years of litigation loom. It’s not clear the joint will survive in its current form.

No wonder swarms of lawyers are buzzing around AMP like flies around a kangaroo carcass.

More immediately, Margin Call advises anxious AMP shareholders, big and small, to keep their powder dry ahead of the stricken wealth business’s annual general meeting in eight business days.

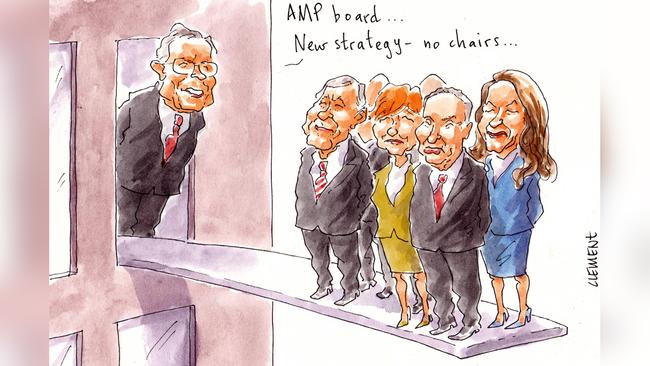

Just appointed AMP executive chairman Mike Wilkins, the best of a mostly uninspiring bunch, was on the phone yesterday trying to convince his biggest investors that his appointment heralded a new era of stability and governance at the $11-and-a-bit-billion group. To his credit, a late-day “Wilkins bounce” had the stock finish up 0.8 per cent at $4.04, ending a 11-day losing streak.

But danger lurks.

AMP yesterday told the market it was satisfied now-ex chairwoman Brenner and her board, including ousted boss Craig Meller, “did not act inappropriately in relation to the preparation of the Clayton Utz report”.

That’s the much-doctored, not-at-all-independent Clutz report that considered the group’s seven-year-long fees-for-no-service scandal and was presented by AMP to Greg Medcraft’s ASIC in October last year.

In yesterday’s ASX statement, the board said it was “unaware and disappointed about the number of drafts and the extent of the Group General Counsel’s interaction with Clayton Utz during the preparation of the report”.

The man they fingered was the best man at Medcraft’s wedding, Brian Salter, who on the statement’s release at 7.45am yesterday became the former general-counsel at AMP. Salter — who was not present at AMP’s Sunday night crisis board meeting — said he learned by the press release that he had been fired.

The board delivered its damning judgment on Salter after a Sunday night presentation by AMP’s hired royal commission lawyers: barristers Philip Crutchfield and Tamieka Spencer Bruce and King & Wood Mallesons partner Tim Bednall, whose Sinophile firm will later this week lodge AMP’s response to the latest revelations in the royal commission.

Salter, 62, promptly let it be known he disagreed with the AMP board’s version of history.

“I have not engaged in any wrongdoing,” Salter said in a statement delivered by his own recently hired crisis manager.

Salter said the report by Clayton Utz, where he was a longstanding partner until he joined AMP in 2008, was only ever “independent of management of the AMP Advice business”. In his interpretation, it wasn’t independent of the wider group.

Salter said the report was produced “under the instruction of the AMP board”. The AMP board Brenner led.

So what does Kenneth Hayne’s banking commission make of this radically different view?

Here’s a clue.

On Friday, just before lunch and ahead of counsel assisting Rowena “Shock And” Orr’s closing statement in which she said it was open to the commission to find AMP senior executives committed crimes by misleading ASIC about the independence of the Clayton Utz report, the senior barrister spent nearly 10 minutes tendering a fresh block of documents into evidence.

To Margin Call’s ears, they could be explosive.

Orr told Hayne the fresh docos “may be relevant to the AMP fees-for-no-service case study”, adding the material had been provided to Hayne’s commission by AMP days before the group’s head of advice Jack Regan detonated the business’s existential crisis with his evidence.

Documents of doom

So what is in Orr’s newly lodged combustible binder?

The bundle comprises a series of emails sent last September and October between variously AMP, Clayton Utz and ASIC. They include an October 4 email from Clutz partner Nicholas Mavrakis to Salter concerning a revised draft of the report, which had an attachment containing the report incorporating mark-ups to the doco made after discussions with, wait for it, Catherine Brenner.

You read that right: changes made after discussions with the chairwoman.

There’s also an email on October 16 from Salter to members of the AMP board with an update on the Clutz report and an attachment of updated pages of the report, with changes highlighted.

Yes, changes to the document were highlighted for Brenner’s board.

Also tabled by Orr were minutes from a subsequent AMP meeting on December 16 after Brenner, Meller and Salter had presented the “independent” report to ASIC’s Medcraft and Peter Kell.

Investors will be interested in the boardroom contributions made by AMP’s three directors struggling to be re-elected: Auckland lawyer Andrew Harmos, consultant Vanessa Wallace and retail expert Holly Kramer.

The documents should be there for all to see on Hayne’s website later this week.

Plenty of time for further Shock and Orr before next week’s AGM at Melbourne’s Grand Hyatt.

But wait, there’s more

Here’s bomb No 2. And, as the Americans would say, it’s a Fat Man.

AMP is still to appoint the “retired judge or equivalent independent expert” prescribed in its April 20 release to the ASX, back when Brenner came up with the novel scheme to elongate her chairmanship: executing then CEO Meller, who was already on death row.

The retired judge was to take an “immediate, comprehensive review of AMP’s regulatory reporting and governance processes”.

Clearly, “immediate” has a different definition over in AMP land.

Margin Call can reveal no one has yet been appointed. Ten days on and Brenner’s “immediate, comprehensive review” still hasn’t started.

It’s not hard to see why Brenner, Michael Wilkins and the rest of the hapless board might be nervous about lighting that fuse.

The independent expert may not agree with the AMP board, which on Sunday night excused Brenner, Meller and themselves from acting “inappropriately in relation to the preparation of the Clayton Utz report”.

Will the independent expert be as forgiving of the board’s apparent ignorance about the seven-year-long theft from AMP’s customers?

And what will the independent expert make of the AMP board’s behaviour with corporate regulator ASIC?

Will the independent expert also come to the extraordinary conclusion that this was just a case of a lone, rogue general counsel?

Whether or not it ultimately survives, AMP looks set to explode a few more times yet.

Shareholders, keep your hard hats on.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout