Catherine Brenner in no threat of Coca-Cola Amatil spill

Not long now until former AMP chair Catherine Brenner emerges from her self-protection program.

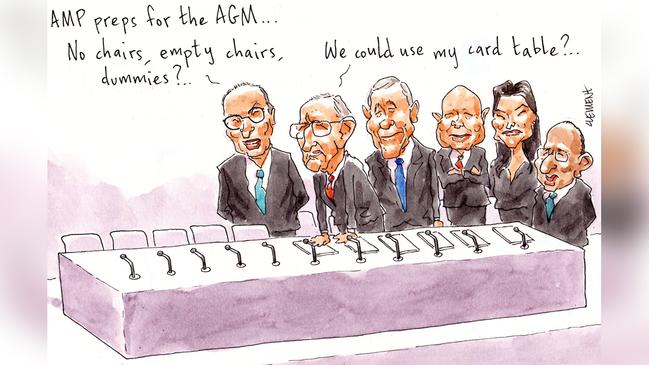

The 47-year-old former investment banker will today keep away from Melbourne’s Grand Hyatt, site of AMP’s combustible annual meeting.

But Brenner, resident of Sydney’s Centennial Park, will step out next Wednesday at the annual general meeting of Coca-Cola Amatil, the beverage company chaired by Ilana Atlas, a less high-profile protegee of David Gonski.

Brenner has been on the Coke board since Gonski invited her into the fold in April 2008 — more than a decade ago — and will not face re-election at the meeting in North Sydney. Phew.

Brenner is not without ongoing interest in the now Mike Wilkins-chaired AMP.

She still has $153,000 worth of AMP shares. That’s a slim one-quarter of her former chairman’s pay of $660,000 a year.

Speaking of pay, what’s the man temporarily in the hot seat on? Investors still don’t know how much Wilkins, who gets about $400,000 a year for his various AMP board duties, is being paid for steering AMP’s now $12 billion ship until he and incoming chair David Murray can find a replacement for sacked boss Craig Meller.

Margin Call understands a final amount is yet to be set.

That’s a different approach to that taken by Garry “Old Fashioned” Hounsell after Hounsell sacked Myer’s CEO Richard Umbers in mid-February and took over as executive chair.

Hounsell was quick in revealing he was paying himself $1 million a year for the interim gig, which will continue until Peter Dutton’s Immigration department issues incoming CEO John King’s visa.

Margin Call hears Wilkins won’t be getting a typical CEO package. There will be no bonus, no long-term or short-term incentives, just a reasonable fixed fee for his work for the period until a new CEO starts. At least that’s one thing AMP investors can be happy about.

Poised to strike

AMP’s furious shareholders today will lodge a “first strike” against the $40.7m that Mike Wilkins’ AMP board wants to give its scandal-entangled executive team.

Margin Call understands proxies lodged ahead of today’s fiery annual meeting show AMP’s remuneration report will receive a formal protest from shareholders.

If more than 25 per cent of voters oppose a rem report, a formal strike is recorded by corporate regulator ASIC.

We understand more than 30 per cent of votes received ahead of the wealth and insurance group’s meeting have ticked “no”.

A second strike against the remuneration report at AMP’s next AGM would set the scene for a full spill of the soon-to-be David Murray-chaired board. They’re on notice.

Murray, the 69-year-old former Commonwealth Bank boss and Future Fund chair, takes the helm from the 60-year-old former IAG boss Wilkins on July 1.

Margin Call also understands that based on proxies already lodged, the single up-for-election director, Andrew Harmos, the Auckland lawyer who joined the AMP board in June last year (but has been a director of subsidiary AMP Life since August 2013), will be returned. Although more than 30 per cent of voters will oppose him. Yikes!

The showdown with shareholders follows the departures of chair Catherine Brenner and directors retail expert Holly Kramer and business consultant Vanessa Wallace.

After the Kenneth Hayne-triggered killing season only six directors remain on Wilkins’ board. One of those six, Patty Akopiantz,announced on Tuesday she would leave at the end of the year. That will leave five men around the kitchen table, so no one will be able to blame the company’s decades-long mismanagement on its female directors.

ScoMo’s mojo

Third time around and budgeter Scott Morrison has hit his stride. It’s a bit weird having a confident and competent federal treasurer — it’s been so long.

Treasurer ScoMo was in commanding form defending his new tax cuts at his post-budget luncheon address yesterday in Parliament House’s Great Hall.

“Anyone who thinks that sort of tax relief is meaningless must be hopelessly out of touch — caught up in some sort of almond latte fog,” said ScoMo to big laughs from the hundreds of lobbyists, corporates and members of the Turnbull ministry gathered in the room.

As well as humanising the budget papers (it was a plan “for Mark and Nicole” and “for Lucky Steve”), the Treasurer generously praised his colleagues.

Morrison applauded Foreign Minister Julie Bishop (“J Bish” in ScoMo parlance) and superannuation rort buster Kelly O’Dwyer. Well-deserved acknowledgment went to ScoMo’s principal budget co-author, Finance Minister Mathias Cormann,and the government’s other key Senate leaders: Education Minister Simon Birmingham and Communications Minister Mitch Fifield (“They’re pretty good at this,” ScoMo reminded the crowd of the pair’s track record of successful negotiation in the red house).

Also singled out for praise was UBS bigwig turned Canberra mandarin John Fraser, ScoMo’s Treasury secretary.

Fraser, who has a love of anecdote to rival his boss Morrison, sat next to Business Council of Australia chief Jennifer Westacott on the same table as the PM’s chief mandarin Martin Parkinson and Parky’s lunchmate Anna Bligh of the recently rebadged Australian Banking Association. (Until earlier in the year it was named the Australian Bankers’ Association — which was decided to be a less-than-ideal name for a cashed-up industry with a reputation for being more absorbed with the bonuses of its pinstriped members than its customers, dead or alive.)

While Westpac was the lunch’s main sponsor, its CEO Brian Hartzer was elsewhere spruiking the big four’s latest $4.3bn profit. Representing Hartzer was his direct report Gary Thursby, Westpac’s head of strategy.

Also in the cavernous room from the royal commission-battered industry: ANZ director Jane Halton and AMP’s long-serving head of government relations, Alastair Kinloch.

If your day isn’t going well, think of Kinloch. Things could be worse.

Up, up and away

To happier things like billionaire Lindsay Fox, the star of yesterday’s Aussies crowd.

What was the brown sweater-wearing trucking-airport-and-property mogul doing in the Parliament House cafe scrum?

“I’m here for the milkshakes,” Fox told us. “I had vanilla. It was excellent.”

The ebullient Fox, who celebrated his 81st birthday a fortnight ago and is valued at almost $3bn on the Stensholt Index, had a good budget.

Thanks to some persuasive advocacy by the Fox Group and Sarah Henderson, the Liberal member for Corangamite, the Fox family’s Avalon Airport got $20m from Treasurer ScoMo to help build an international terminal.

Between that and the vanilla milkshake, it’s no wonder Fox was in such a good mood.