Capital at stake so Anz’s Smith reckons a Toorak do will do

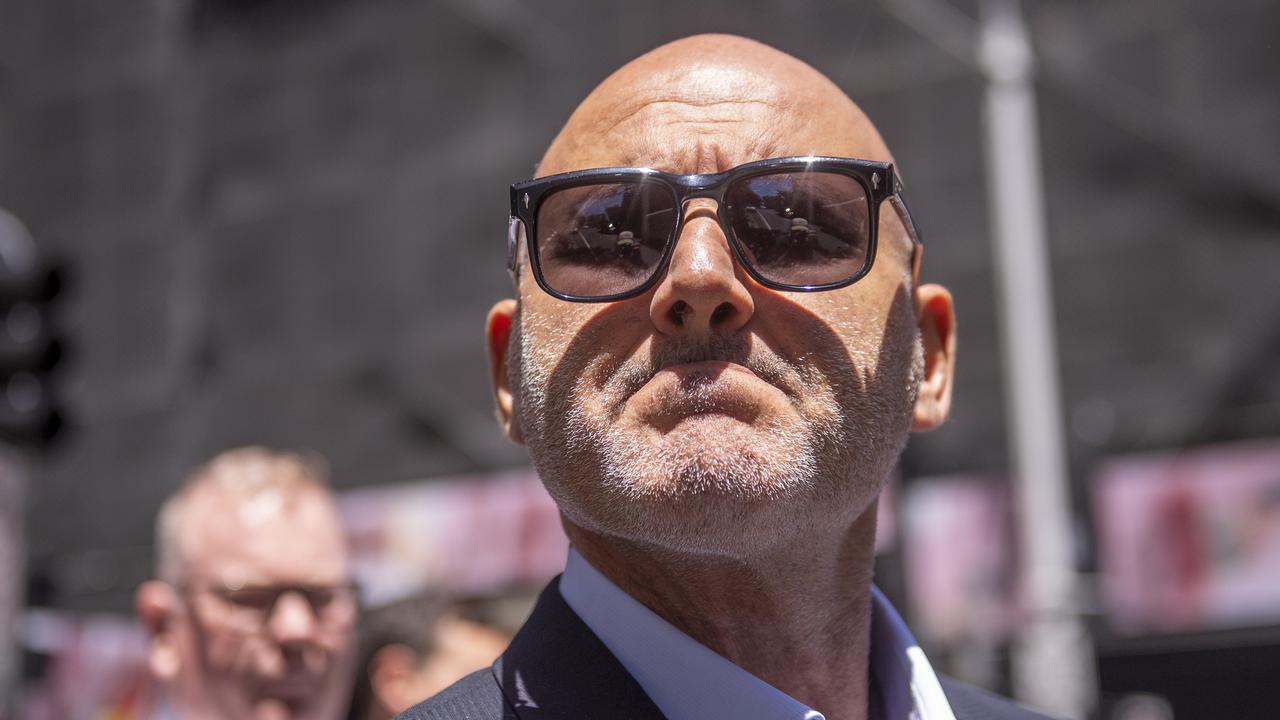

ANZ’s international man of mystery, Mike Smith, has been spotted making a rare trip to the bank’s headquarters in Melbourne.

In a move that no doubt saves ANZ money — every penny counts when capital requirements are on the rise — the banker’s banker has been entertaining clients and executives at his mansion in leafy Toorak. Sources by the drawing room-table say Smith whacked up a marquee in the back yard, pressing the flesh with corporate clients last Thursday night and bank execs the following night.

What, no invitation to the Smith family’s coastal country pile, Spray Farm, which he bought from Black Caviar breeder Rick Jamieson for $10 million earlier this year?

Big bank’s small bonus

CAN’T you just feel the generosity oozing from every pore at JPMorgan Chase, the biggest bank in the US? In an annual act of beneficence to employees, it offers a “special award” bonus every year, cash, “to recognise the commitment and contributions of our employees at every level in the organisation”.

Emails announcing the shower of dollars went out to employees around the globe, including in Australia, yesterday.

And yet, there appear to be a couple of catches. First, the bonus is capped at $US600. Second, it’s only available to employees who are paid less than $US60,000 a year.

That would be a lot of tellers at US retail bank Chase, but not many of the IB types in the Aussie office. Does not the humble miner bringing home low six figures by working the pits of M&A also deserve a little Christmas cheer? Perhaps JPMorgan is scrimping for its new capital requirements: the US Federal Reserve reckons it needs an extra $US20 billion tucked away by 2019.

No ‘rap session’ please

AT least the lawyers are getting some gravy out of the collapse of Pie Face, with battles erupting in New York’s courts over the hasty retreat beaten by the franchisee pie empire. The stoush between Pie Face and landlords trying to collect the crumbs of rent they claim to be owed has also brought to light some of the odder terms included in your standard New York City commercial lease.

Pie Face was forbidden from using its shops for a dizzying array of “obscene or pornographic purposes”, including as a “commercial sex establishment”. Specifically not on: the use of premises for “obscene, nude or semi-nude performances”, “nude modelling, rap sessions or (use) as a so-called ‘rubber goods’ shop, or as a sex club of any sort, or as a ‘massage parlour’.”

Margin Call has a fair idea why “rubber goods” and “massage parlour” are in scare quotes, but rap session? What if Jay-Z wanted to walk in and freestyle over some baked goods? It turns out that besides its innocent meanings, “rap session” is a euphemism for a situation where an establishment provides space for a chitchat between a man and a woman and if he pays her for sex that’s totally nothing to do with them. Unrelated to pies, then.

The dead can sue

MORE from the Apple Isle, where Attorney General and enemy of free speech Vanessa Goodwin is determined to set back business reporting by allowing companies to sue for defamation (Margin Call, December 8). This was something thought long dead, killed by uniform defo law adopted by all states and territories back in 2005.

If successful, the move would be a boon for Tasmania’s tourism industry, encouraging lawyers to pile in to the state’s Supreme Court with cases about companies from all around the country (and then eat at one of Hobart’s fine restaurants).

But it turns out that company defamation is not the only secret of the grave to be unearthed in Tassie. While in 2005 every other state and territory made it clear that the dead can’t sue for defo, Tassie simply left that bit of the act out, leaving it up in the air as to whether they or their families can sue.

When Goodwin comes to her senses over corporate defo, she should fix that too.

bbutler@theaustralian.com.au