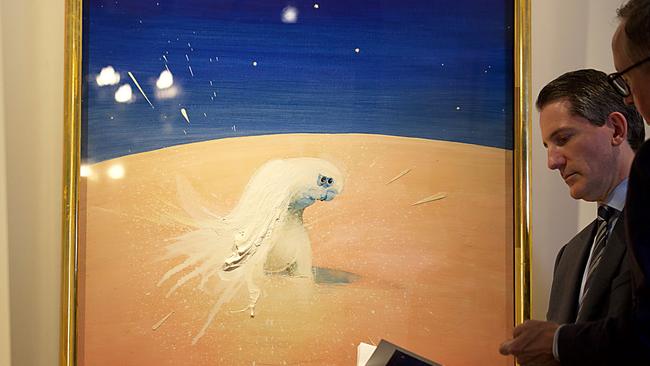

A 1987 Brett Whiteley painting, White Corella, was the biggest drawcard at this week’s Smith & Singer art auction. It found a new home at its low estimate of $600,000, having been estimated to sell for between $600,000 and $800,000.

It was the painting caught up in an embarrassing provenance issue, with the auction house having to retract its advisory that it was once owned by golfing champion Greg Norman.

Geoffrey Smith, the Smith & Singer chairman, had initially suggested that Norman had bought the painting at the VIP opening of Whiteley’s 1988 Birds exhibition at the artist’s Surry Hills, Sydney studio and then hung it in his Florida home.

It had actually been bought by sports management agent James Erskine, Norman’s manager in the 1980s, and hung on the walls of Erskine’s longtime home in Vaucluse.

The painting, which Erskine sold many years ago, depicts a galah bathing in a waterhole on the top of Uluru, although for some its looks like a milk bottle exploding.

“The work is one of the most exuberant, joyous and irreverent of all Whiteley’s avian subjects,” Smith & Singer suggested.

The burgeoning art market resulted in the auction securing $6.3m across the 48 lots that sold, representing 149 per cent sold by value and 87 per cent sold by volume.

Stuart Davies, estate agent and chief auctioneer of Sotheby’s International Realty, stood in for the locked-down Melbourne-based Smith & Singer head auctioneer Martin Gallon.

One of the few passed in was a Del Kathryn Barton, Weird Seed, 2017, listed with $180,000 hopes.

An Elioth Gruner sold for an artist record of $393,750, including buyer’s commission. It was A Land of Wide Horizons, Michelago circa 1922. And Ethel Carrick’s In Sydney Botanical Gardens that sold in 2018 for $65,000 fetched $150,000.

Observers noted all the big sales of the traditional works were to private buyers, since the institutions are crying short of money.

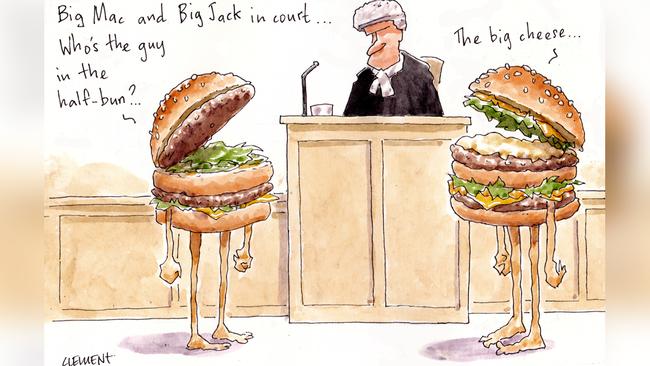

Big bun fight

McDonald’s has sued Jack Cowin’sHungry Jack’s over its new Big Jack burger.

The trademark infringement Federal Court papers were lodged late last month accusing Hungry Jack’s of violating its legendary Big Mac trademark.

The lawsuit alleges the new Big Jack and Mega Jack burgers, which were launched in July, infringe McDonald’s Big Mac and Mega Mac trademarks.

McDonald’s has sold Big Macs in Australia since 1971, opening at Yagoona, in Sydney’s west, with 49c Big Mac hamburgers.

It alleges the Big Jack and Mega Jack trademarks are “deceptively similar” to its trademarks, and consumers would be deceived into thinking there was a connection between its burger and the rival product.

McDonald’s is being represented by Spruson & Ferguson Lawyers.

Hungry Jack’s has HWL Ebsworth as its lawyers, who have yet to file their defence.

Maybe not fair

The antics of Mayfair 101 founder James Mawhinney have not impressed Victorian Supreme Court Justice Ross Robson, who has noted Mayfair investors were rightfully “very, very concerned”.

The hearing concerns wind-up attempts of investment entities in the Mawhinney empire.

ASIC’s barrister, Jonathan Moore QC, advised that the regulator was concerned at Mawhinney’s contact with investors, saying it appeared the Mayfair boss was trying to replace the current trustee and get hold of trust assets.

“ASIC is concerned that there is a prospect that if this matter is adjourned or even if the companies are wound up … that the trust assets would remain in jeopardy because Mr Mawhinney is seeking through his proposal to convince enough unitholders to replace the trustee and replace the trust assets to a new company that Mr Mawhinney wants to nominate,” Moore said, as reported by the Lawyerly website.

Justice Robson suggested “the investors may have been misled and I think it’s important that the investors are reassured that there’s someone who can look at their interests independently”. The parties will seek to appoint a contradictor before the matter returns to court on September 16.

Moss passes baton

Bill Moss, founder and chairman of the FSHD Global Research Foundation, has announced he’s to conclude his chairmanship of the charitable board. He will be succeeded by his daughter, the foundation’s managing director Natalie Cooney.

The long-time Macquarie Group executive director, who was diagnosed with facioscapulohumeral dystrophy when he was 28, set up the foundation in 2007. It has since raised more than $11m, funding 54 medical research grants across 10 countries.

It was named the Australian charity of the year for 2017.

Cooney has been involved with the foundation for more than a decade.

“Natalie is the only person that has the prerequisite skills and experience to take on this role,” Moss told Margin Call.

Cooney ran a successful events and PR agency for six years after university, before joining the organisation.

“It is my mission to use innovative philanthropy to fight for treatments and a cure within my lifetime,” Cooney said.

Moss’s personal investment into new and unproven techniques to stop the muscle disease through his personal biotech ventures will continue into the future.

Moss will be remaining on the board and its medical research advisory committee.

McGrath chief exits

Chief executive Geoff Lucas departed the McGrath estate agency last week, thwarted in his visionary expansionary desire, with the announcement advising the appointment of Eddie Law, former ANZ global head of institutional property, as his replacement.

Lucas advised he left with a “heavy heart” and 9.4 million forfeited options.

A major shareholder, Shane Smollen, one of the smartest operators in real estate, joined the board on Thursday, having obviously decided he’ll spend less time on fast cars, boats and travel and more on business.

Smollen’s stake in the ASX-listed agency sits at 7.94 per cent, now worth $3.5m based on its reduced $45m market cap, which kicked off on its perfectly timed 2015 float at $272m.

Something appears to be at play within the mostly ultra-cautious agency which, buoyed by $2.2m in JobKeeper payments, posted a $700,000 net profit, against a net loss of $9.7m in the prior year.

Meanwhile its hitherto bitter rival The Agency, with $1.08m in government assistance, heads towards a September 30 deadline on its $12.5m debt repayment to Macquarie Group.

West Australian businessman Bob Peters, the prominent Perth horse owner and breeder, came to the aid in May, with a $1m injection, and has first rights to take a bigger stake.

The Agency was frank in its Monday unaudited annual results that it was “active in pursuing a range of strategic partnership and joint venture opportunities”.

The first whispers of potential ties-up came last September, when The Sunday Telegraph reported it and McGrath were “contemplating mutual solutions”.

It prompted The Agency managing director Paul Niardone to advise shareholders “if we receive approaches that make strategic sense and provide value for our shareholders, agents and staff, we are duty bound to review them”.

Realistically it could only be a takeover of the Matt Lahood-led agency, not a merger with two brands and different commission structures.

Much will depend on how founder and biggest shareholder John McGrath feels the group needs to evolve. The rising share price will give it the flexibility to grow strategically with $17m available in cash.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout